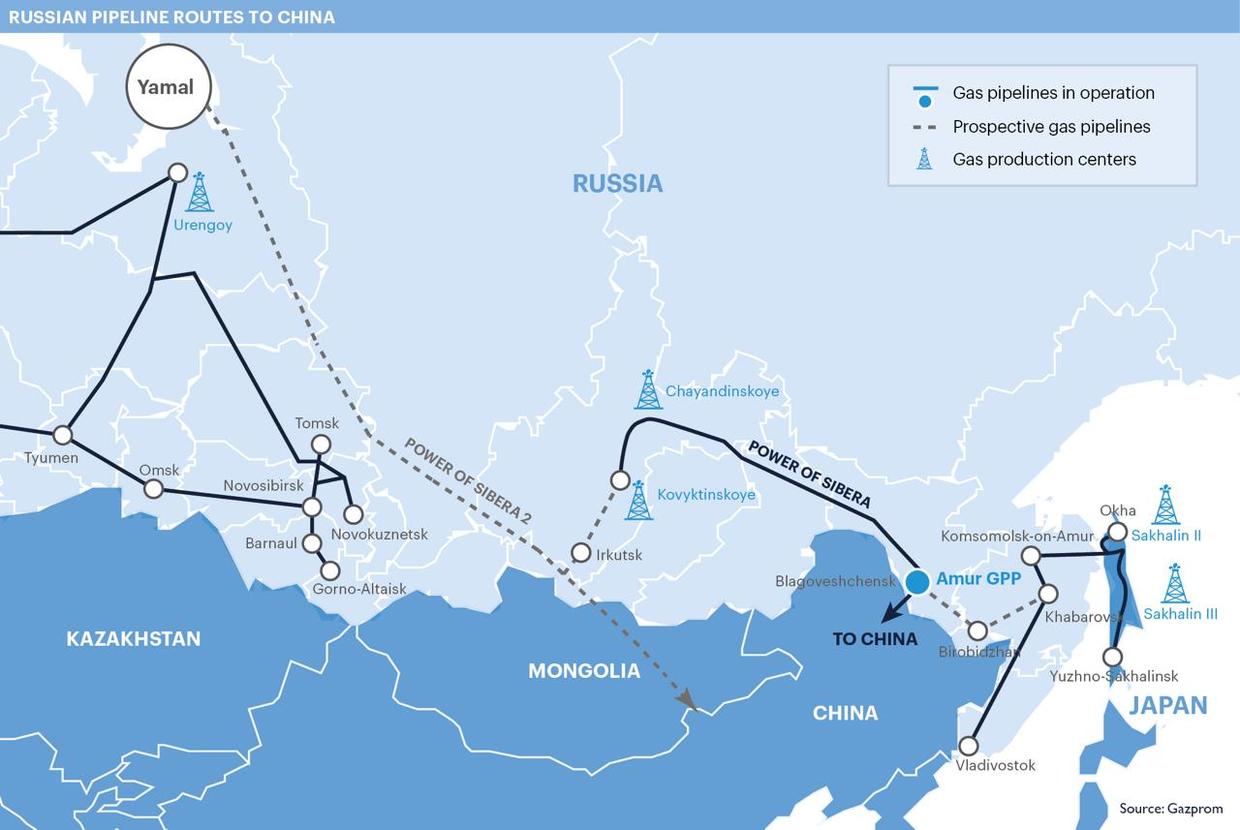

On September 2, Russia, China and Mongolia signed a memorandum of understanding on legal binding for the construction of the Power of Siberia 2 gas pipeline ( Power of Siberia 2).

The $13.6 billion Power of Siberia 2 project is expected to transport 50 billion cubic meters of natural gas per year from Russia's Arctic mines through Mongolia to northern China, marking an unprecedented turning point on the global energy map.

For decades, gas from Yamal fields in the Arctic has been the driving force for German and Western European industry, transported directly via the Nord Stream 1 gas pipeline and the Yamal-European pipeline. Now, that supply will turn to the East.

If Power of Siberia 1 has been in operation since 2019 with gas exploited in the Russian Far East to serve Northeast China, the new route will exploit directly from mines that once harbored Europe.

This new pipeline not only brings transit revenue to Mongolia but also ends the era of "cheap gas feeding European factories".

The scale of the pipeline also says many things. With a length of about 2,600km and an estimated capacity of 50 billion cubic meters per year, the Power of Siberia 2 was roughly equivalent to Nord Stream 1 before the pipeline was destroyed.

By adding the Power of Siberia 1 and the Sakhalin route, the total Russian gas supplies to China could exceed 100 billion cubic meters per year, almost the same as those Europe bought during its golden period.

For the European Union (EU), the price to pay is clear. After 2022, when deciding to cut Russian gas, countries in the bloc will have to switch to importing LNG from the US and the Middle East at prices many times higher. As a result, the energy crisis has increased production costs, while the German economy - the locomotive of the old continent - has fallen into recession.

With a new deal between Moscow, Beijing and Ulaanbaatar, the door to connecting Russian supplies to Europe is considered closed.

As for China, the global context has changed calculations. Beijing has previously feared over-reliance on Russian supplies, but the Russia-EU confrontation has made Western energy unreliable.

At the same time, US President Donald Trump's warning about the risk of China having difficulty accessing international LNG and tensions in the Middle East has shaken confidence in shipping routes.

Meanwhile, a trans Mongolian pipeline, beyond the reach of the US Navy's intervention, has become the optimal choice.

The Power of Siberia 2 is therefore not just a simple commercial contract. It is a statement that Russia has found a long-term outlet for the huge resources in the Arctic and has completely escaped dependence on the European market.

China has while strengthening its position as a number one customer, while Europe has lost its "infrastructure" that has maintained post-war growth and now has to accept living with expensive energy.