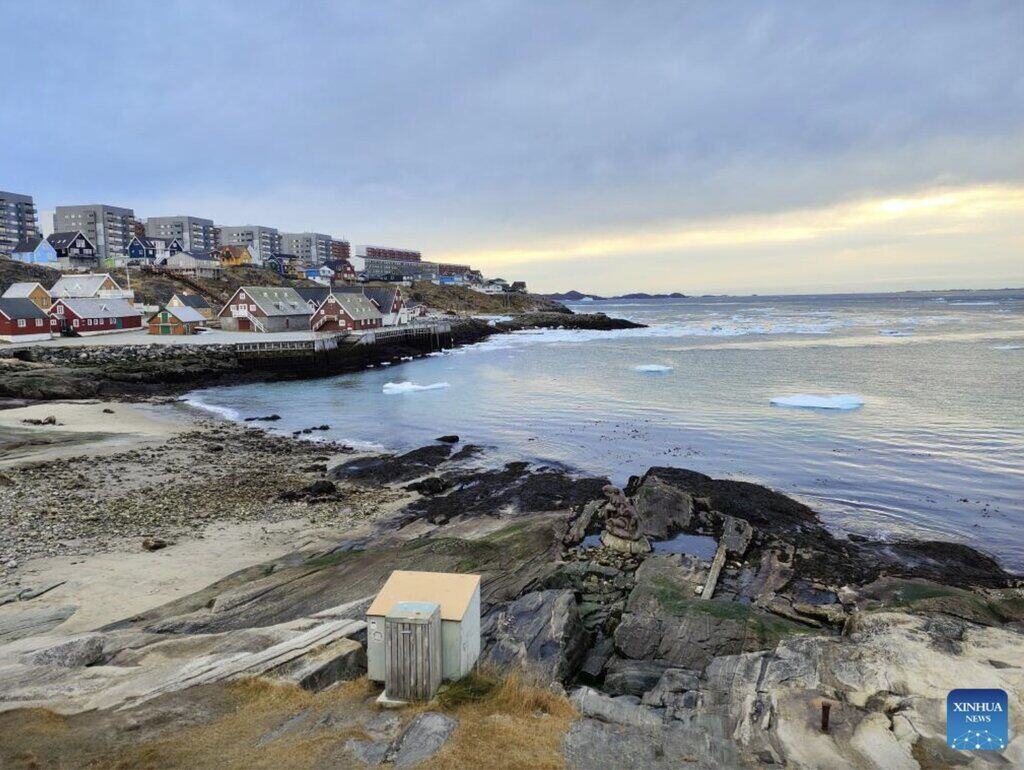

President-elect Donald Trump has made headlines in recent weeks for publicly announcing his intention to buy Greenland. Trump has said that the main reason for buying Greenland is for US national security as countries compete for control of the Arctic.

Although the Danish government has declared that the territory is not for sale, real estate experts are still assessing Greenland's real value.

Real estate developer David Barker told The New York Times that Greenland's true value depends on many factors and compares it to some of the real estate deals the United States has made over the past century, including Alaska and the U.S. Virgin Islands.

The US bought Alaska in 1867 for less than 2 cents per 10,000 square feet. In 2025 dollars, that deal would be worth more than $150 million. Meanwhile, the US bought the Virgin Islands, formerly known as the Danish West Indies, from Denmark in 1917 for $25 million (about $657 million in today's dollars).

Using the Virgin Islands as the lowest valuation, Barker said Denmark’s GDP has grown 500-fold since 1917, so Greenland would be worth $12.5 billion. If the equivalent territory were converted to Alaska and using the current U.S. GDP as a guide, Greenland’s value would rise to $77 billion.

Real estate expert Barker admits that no comparison is ideal. "The feeling many people had when they bought Alaska was that the US had overpaid, but they didn't have the same mindset when they bought the Danish West Indies," he says.

Greenland is rich in rare earth metals, such as copper and lithium, which are important for the future, especially in artificial intelligence and electric vehicles. If mining these metals is a key consideration when buying Greenland, prices will rise.

"If Greenland really helps us defend the United States, then the value of the island will increase with the size of the U.S. economy. If Greenland's only value is its minerals, then the size of the U.S. economy will not have much impact on the price," said Barker.

According to The Financial Times, Greenland's mineral resources are worth up to $1,000 billion, but real estate expert Barker noted an important point: "The US government will not receive the full benefit from resource exploitation. They will sell drilling and exploitation rights to companies that bid to ensure costs and profits."