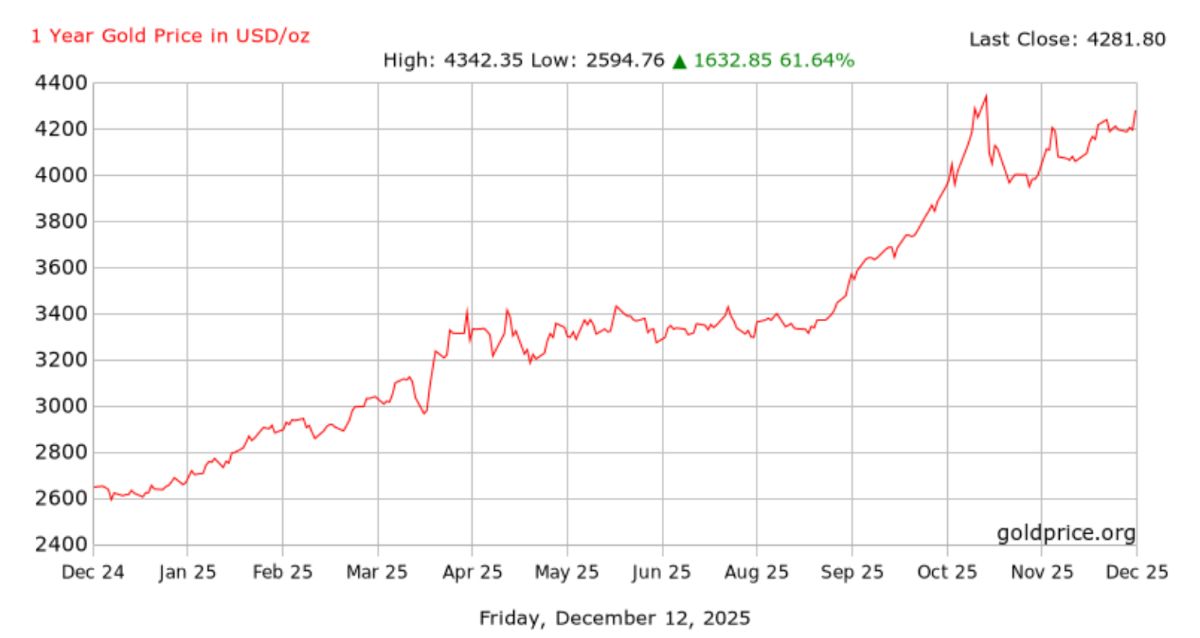

2025 is not over yet, but gold investors have a reason to celebrate early. The precious metal is on track for a full-year gain of around 60%, its best performance since the late 1970s.

The strong increase has helped gold outperform both stocks and bonds, strengthening its position as a safe haven asset in the context of widespread geopolitical instability and loose fiscal policy.

According to Mr. Rajat Bhattacharya - senior investment strategist at Standard Chartered, this is the second consecutive year that gold has defeated both traditional investment channels, while maintaining a 10-year streak of superiority over bonds.

Major organizations are still leaning towards the scenario of gold prices going up in 2026, but the expectation of "profit doubling" as in the recent period is said to be unlikely to repeat.

Standard Chartered forecasts gold prices will remain flat for the next 12 months, reflecting its growing role in asset allocation strategy. The bank said that although gold has become more expensive in some measurements, strategic and cycological factors still support a positive trend.

However, the increase is expected to be only moderate, making it difficult to repeat the fierce breakthrough of 2025. Standard Chartered forecasts gold prices to average $4,500/ounce in the next 12 months.

Many other financial institutions predict that the world gold price could reach 5,000 USD/ounce next year, equivalent to an increase of 16%, significantly slower than the price increase of up to 60% this year and the increase of 27% recorded in 2024.

Commerzbank said that gold prices have doubled in less than 2 years, a speed that is difficult to maintain in the long term. According to analysts, the market is entering the necessary technical adjustment to absorb the large profit that has been formed.

However, many experts still maintain an optimistic attitude about the medium and long term. Chantelle Schieven - Research Director of Capitalight Research - said that gold may have approached the "hot" zone, but that does not mean a strong reversal next year. The global financial market is witnessing a structural shift, in which gold is more favored thanks to not bringing political risks from third parties.

State Street Investment Management said that the popular scenario for 2026 is that gold prices move sideways within a high range, with the risk of increasing more than decreasing.

An important pillar of this trend comes from the demand of central banks. Over the past 3 years, more than 3,000 tons of gold have been added to global official gold reserves.

According to Bank of America, gold currently accounts for about 15% of total central bank reserves, while the optimal level could be nearly double. This shows that the demand for platforms still has room to increase, helping to create a solid "crush" for the market.

After a series of rare hot increases, gold prices in 2026 may no longer have a "shocking increase". But with a foundation supported by geopolitics, monetary policy and reserve demand, this precious metal is still considered an irreplaceable investment channel in the uncertain global financial picture.

World gold prices closed last week's session at 4,300.000 USD/ounce, up 18.60 USD, equivalent to an increase of 0.43%.

Regarding domestic gold prices, SJC gold bar prices are trading around 154.3 - 156.3 million VND/tael (buy - sell).

The price of 9999 Bao Tin Minh Chau gold rings is trading around 152.3 - 155.3 million VND/tael (buy - sell).