Gold prices are forecast to surpass the 5,000 USD/ounce mark in the first quarter of 2026, while silver prices may reach 100 USD/ounce. However, Citigroup analysts warn that this strong increase may not be sustainable, as gold prices are at risk of deep correction by the end of 2026 if global tensions cool down.

In a report released on January 13, the Citigroup strategic group led by Kenny Hu raised its gold price forecast for the first quarter of 2026 to 5,000 USD/ounce, and also raised its silver price forecast to 100 USD/ounce.

Citigroup said escalating geopolitical risks, shortages in the physical market, along with new instability related to the independence of the US Federal Reserve (Fed) are continuing to fuel safe haven demand for gold and silver.

Although both gold and silver have set new peaks since the beginning of the year, Citigroup still maintains the view that silver will have a superior increase over gold in the medium term. However, this Wall Street bank believes that in the long term, industrial metals are the dominant group.

Our long-standing assessment that silver will prevail and the precious metal market will expand to industrial metals - with industrial metals playing a central role in the same cycle - is being proven to be true," the group of strategists said.

Citigroup also emphasized the current scarcity in the physical market, especially for silver and platinum-grade metals.

According to this bank, the delay and lack of clarity in decisions related to tariffs under Section 232 for important minerals are creating "significant risks to trade flows and prices".

In the scenario of the US imposing high taxes, Citigroup warns that material shortages could become more serious as metals are strongly transported into the US market, thereby triggering sudden price increases.

However, when tariff policy becomes clear, this inventory of metals can be re-exported to the global market, easing scarcity and creating price reduction pressure.

Citigroup strategists noted that "a sharp drop in silver prices due to reverse capital flows related to Item 232 could trigger a tactical sell-off wave for other precious and base metals.

However, they emphasized that they will consider such corrections as buying opportunities, because the fundamental factors supporting the upward trend of the metal market are generally still intact.

According to Citigroup's latest baseline scenario, geopolitical tensions are likely to cool down after the first quarter of 2026, reducing safe haven demand and making gold prices the most volatile metal to fall at the end of the year.

Conversely, industrial metals - especially aluminum and copper - are expected to have more positive developments in the second half of 2026.

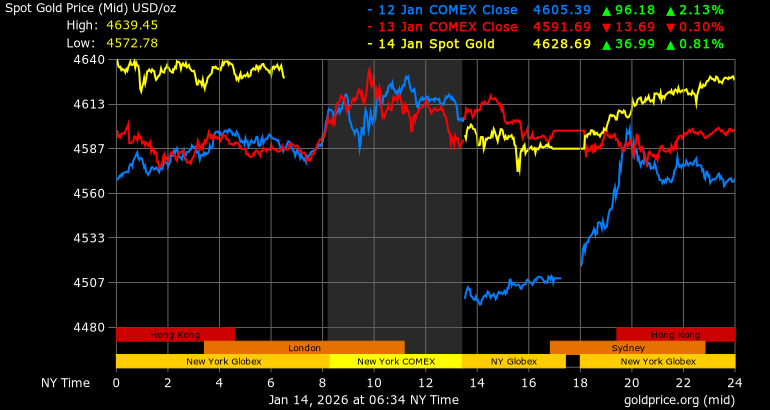

World gold price at 6:30 PM on January 14, Vietnam time, traded at 4,636.07 USD/ounce, up 44.38 USD, equivalent to an increase of 0.97%.

Regarding domestic gold prices, SJC gold bar prices are traded around 161.5 - 163.5 million VND/tael (buying - selling). 9999 Bao Tin Minh Chau gold ring prices are traded at 160.5 - 163.5 million VND/tael (buying - selling).