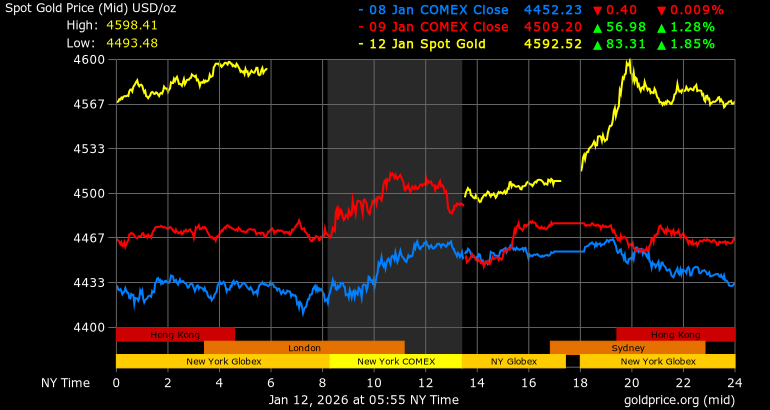

In the first trading session of the week on January 12, spot world gold prices at one point increased by nearly 2%, reaching 4,600 USD/ounce before falling slightly.

Since the beginning of 2026, gold prices have increased by about 6%, extending the strong increase streak after a volatile 2025. The main driving force comes from the combination of geopolitical instability and disruptions in US monetary policy.

A particularly noteworthy factor is the risks surrounding the US Federal Reserve (Fed). The opening of an investigation related to Fed Chairman Jerome Powell, along with speculation about the possibility of changing Fed leaders, has increased concerns about the stability of monetary policy.

According to analysts, the scenario of the Fed shifting to a stronger easing stance, if it happens, will continue to be an important driving force for gold.

In parallel with that, geopolitical tensions also returned to the focus. The US airstrikes Syria, signaling consideration of intervention options in the face of instability in Iran, while earlier this year the US launched a military campaign in Venezuela, arresting President Nicolas Maduro.

These developments reinforce defensive sentiment in the financial market, making gold stand out as the top choice. According to Standard Chartered, the current uncertain environment is the reason why gold is ranked as the most reliable asset group this year.

From a technical perspective, gold surpassing the previous historical peak is seen as a confirmation sign of a new upward trend. Many analysts believe that the $5,000/ounce mark is becoming the next symbolic target.

Technical analysis models, including the Fibonacci method, show that the $5,000 zone coincides with important expansion milestones, often playing a "attraction" role in the price discovery phase.

This assessment also coincides with the forecasts of many major financial institutions. Goldman Sachs forecasts that gold prices may approach 4,900 USD/ounce by the end of 2026, thanks to persistent buying pressure from central banks and the prospect of the Fed cutting interest rates.

JP Morgan Private Bank is more optimistic, forecasting the average gold price in Q4/2026 at around 5,055 USD/ounce, with the possibility of short-term peaks reaching 5,200-5,300 USD/ounce if safe deposits increase sharply.

Deutsche Bank and Bank of America are more cautious, but still raise the 2026 average forecast to around 4,450-4,538 USD/ounce.

In a more extreme scenario, some experts warn that if there are geopolitical shocks of a "breaking order" nature, gold prices could completely exceed the 5,000 USD/ounce mark.

Concerns related to conflicts between major powers, or the erosion of traditional alliances, are seen as factors that could push gold to unprecedented levels.

However, analysts also emphasized that after breaking the 4,600 USD/ounce mark, gold prices will hardly avoid strong corrections. In the context of geopolitical and policy instability remaining dominant, the long-term trend of gold is still assessed to be upwards, with the 5,000 USD/ounce mark increasingly considered the "new standard" of the market.

World gold prices at 5:43 PM on January 12, Vietnam time, traded at 4,592.96 USD/ounce, up 83.46 USD, equivalent to 1.85%.

Regarding domestic gold prices, SJC gold bar prices are traded around 160 - 162 million VND/tael (buying - selling). 9999 Bao Tin Minh Chau gold ring prices are traded at 158 - 161 million VND/tael (buying - selling).