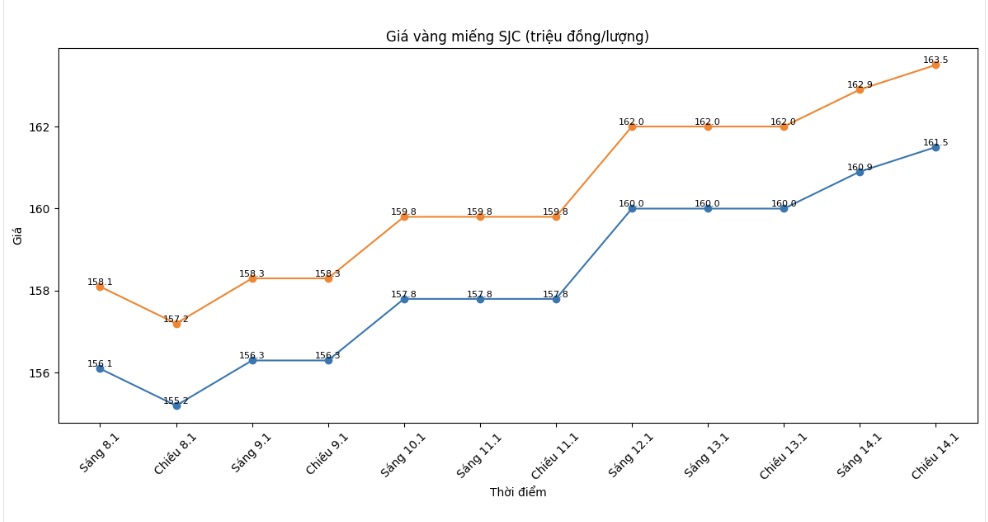

SJC gold bar price

As of 6:00 AM on January 15, SJC gold bar prices were listed by DOJI Group at the threshold of 161.5-163.5 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 161.5-163.5 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 161-163.5 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

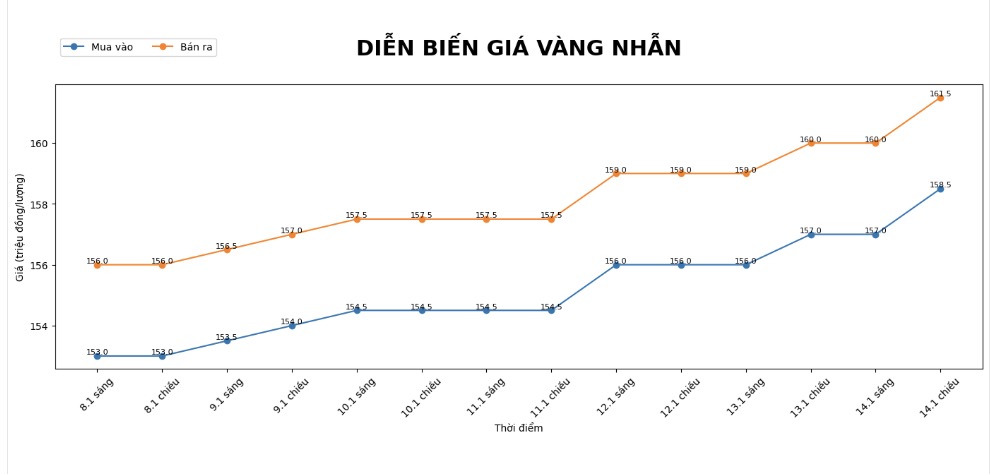

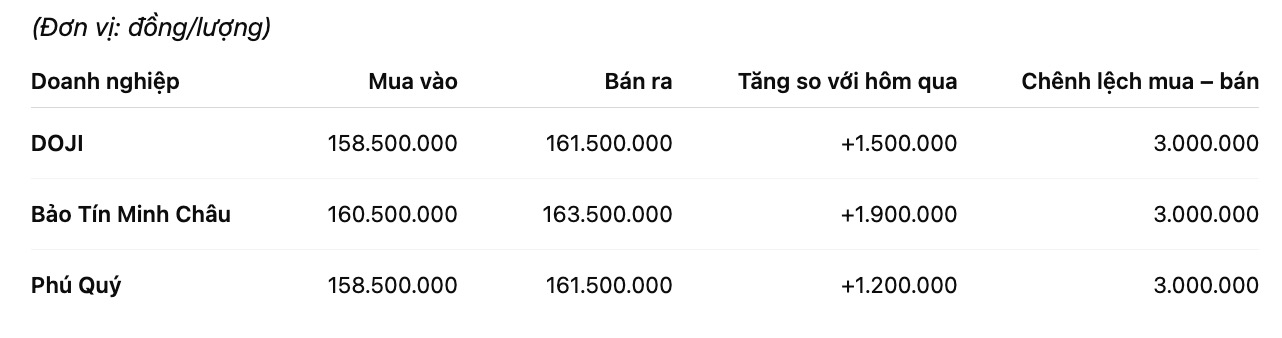

9999 gold ring price

As of 6:00 AM on January 15, DOJI Group listed the price of plain gold rings at 158.5-161.5 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 160.5-163.5 million VND/tael (buying - selling), an increase of 1.9 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 158.5-161.5 million VND/tael (buying - selling), an increase of 1.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

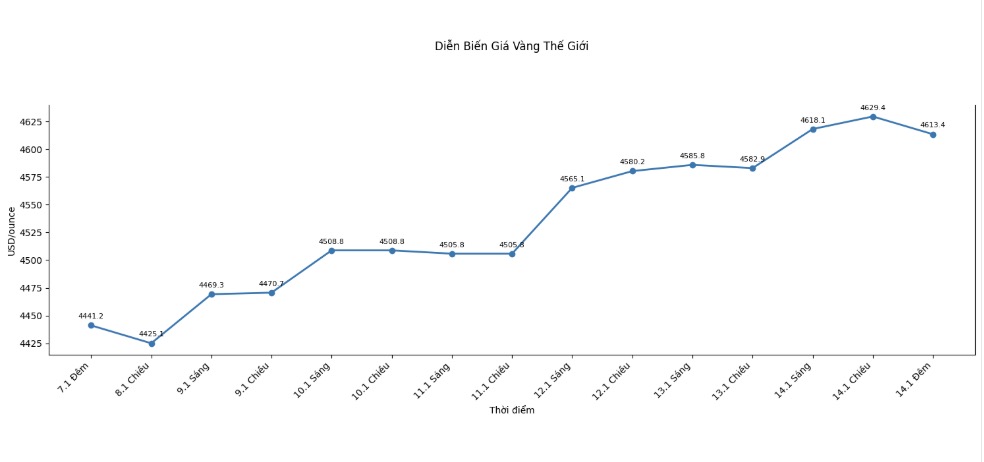

World gold price

World spot gold price listed at 23:41 on January 14 at the threshold of 4,613.4 USD/ounce.

Gold price forecast

Gold and silver prices continued to break through strongly as both precious metals simultaneously set new record highs. The increase reflects the defensive sentiment of investors in the context of a still volatile global financial environment.

Notably, silver is moving very close to the 100 USD/ounce mark - a symbolic price that has never appeared in trading history.

Gold futures for February delivery increased by 45.9 USD, to 4,645.30 USD/ounce. Silver for March delivery increased by nearly 5 USD, to 91.305 USD/ounce, extending the very strong increase streak from the end of last year to now.

The upward momentum of precious metals takes place in the context of the market waiting for the latest US production inflation figures. According to TradingEconomics' forecast, the producer price index (PPI) in November is expected to increase by 0.2% compared to the previous month, lower than the 0.3% increase recorded in September.

The core PPI index, excluding food and energy, is also forecast to increase by 0.2%. Compared to the same period last year, total manufacturing inflation is expected to remain at 2.7%, while core inflation may slightly increase to 2.7%.

Along with gold and silver, the global metal market is experiencing a rare boom period. According to Bloomberg, the prices of copper, tin and many other industrial metals have also continuously hit new peaks thanks to expectations that the US Federal Reserve will continue to cut interest rates to support economic growth, thereby stimulating production demand.

In addition, the recovery of high-tech sectors, especially artificial intelligence, is also creating more momentum for metal demand.

Technically, the trend of gold is still assessed as very positive. According to analysts, the next target of the buying side is to push gold prices above the strong resistance level of 4,750 USD/ounce. Meanwhile, the important support zone lies around the 4,400 USD area. Assessing on the Wyckoff scale, the gold market currently reaches 8.5 points, reflecting the upward trend that is clearly dominant.

On the financial market, the USD index fell slightly while crude oil prices rose to around 62 USD/barrel. The yield on US 10-year government bonds is currently at 4.18%. The Japanese Yen continues to weaken against the USD, falling to its lowest level in 18 months, showing that pressure on Asian currencies is still high.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...