On the afternoon of October 27 (US time), world gold prices fell 2.7% to $4,002.29/ounce, at times reaching a bottom of $3,970.81/ounce - the lowest since October 10.

December gold futures on the Comex floor fell 2.9%, closing at $4,019,70/ounce.

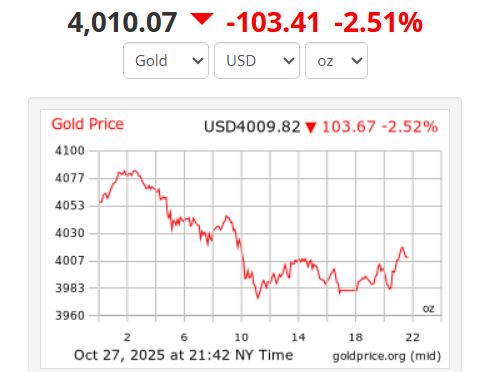

At 8:42 a.m. on October 28, Vietnam time, the world gold price was trading at 4,010.07 USD/ounce, down 2.51%.

According to David Meger, Director of Metals Trading at High Ridge Futures, the possibility of reaching a trade deal between the US and China has caused demand for safe-haven assets such as gold to drop significantly.

Just a week before, gold prices had set a record of $4,381.21/ounce (October 20), amid escalating tariff tensions. However, the recent agreement between the two world's largest economies to temporarily suspend US tax increases and extend control of China's rare earth exports has softened the market.

The White House confirmed that President Donald Trump and President Xi Jinping are expected to meet this week to complete a preliminary trade deal.

This information immediately triggered a wave of sell-offs of gold - an asset considered a "hiding paradise" in the crisis.

Mr. Jeffrey Christian, CEO of the precious metals research group CPM Group, commented that gold prices are under double pressure: both due to technical selling and the excitement of reduced trade risks. This development has all but erased gold's $600/ounce gain in the first three weeks of October.

Despite the sharp decline in gold, investors are still paying attention to the meeting of the US Federal Reserve (Fed) on October 30. The market is now betting on a 97% chance of a further 0.25 percentage point rate cut.

Normally, gold - a non-yielding asset - will benefit in a low interest rate environment. However, the current decline shows that market sentiment has shifted to more risky channels, such as stocks and currency.

Although some investors still believe that gold could reach 5,000 USD/ounce in the coming cycle, many experts are starting to show caution.

Capital Economics recently lowered its gold price forecast to $3,500/ounce by the end of 2026, saying that the 25% increase in just the past 3 months is difficult to explain compared to previous increases in the same cycle.

Along with gold, silver prices fell 3.6% to $46.85/ounce, platinum lost 0.4% to $1,592.03/ounce, and palladium lost 1.8% to $1,402.98/ounce.

Regarding domestic gold prices, at 8:37 a.m. on October 28, the price of SJC gold bars was trading at VND145.7 - 147.2 million/tael (buy - sell).

Bao Tin Minh Chau 9999 gold ring price is trading around 149 - 152 million VND/tael (buy - sell).