World gold prices have just experienced an unprecedented week of fluctuations. After a gain of more than 50% since the beginning of the year and hitting a historic peak of nearly $4,400/ounce, the precious metal suddenly plummeted by 6% on October 21 alone - the biggest decline since 2015. Although investors took the opportunity to buy at the bottom, gold still closed the week down 3.5%, causing the market to question whether the price increase cycle had ended?

However, Goldman Sachs - one of the most influential banks on Wall Street - has appeared calm. In its latest report to customers, the bank said it had reviewed its gold price forecast for 2026 and continued to maintain a "super optimistic" view.

According to Goldman Sachs, the recent adjustment is a " strong one" after a period of strong capital inflows. Since the beginning of the third quarter of 2025, ETFs have bought up to 268 tons of gold, equivalent to 33 billion USD, contributing to pushing prices to the top.

Such a decline is necessary to cool the market down, not to change the bullish outlook for many years to come, the report said.

Goldman Sachs forecasts that gold demand will remain high thanks to three main drivers:

Global central banks plan to buy 760 tonnes of gold per year in 2025-2026, much higher than the average of 400-500 tonnes before 2022.

ETF capital flows remained active, strengthening safe-haven sentiment.

The US Federal Reserve (Fed) is expected to continue cutting interest rates 3 times in the first half of 2026, causing bond yields to decrease and the USD to weaken.

Meanwhile, current US economic factors further strengthen the prospect of gold price increase.

The unemployment rate has risen to 4.3%, the highest since 2021; inflation has increased to 3% due to the impact of new tariffs from the Trump administration.

The economy is in a dilemma, weak jobs force the Fed to ease, while high inflation reduces market confidence. In addition to the huge mountain of public debt and the risk of foreign investors turning their backs on US bonds, capital flows are seeking shelter, and gold once again becomes a "bright star".

10-year Treasury bonds have reduced yields from 4.77% at the beginning of the year to 4%, while the USD Index fell from 109 to 99. These are all "golden" signals for... gold, as the weak greenback makes the precious metal cheaper for international buyers.

Goldman Sachs believes gold could test the support around $4,000 an ounce in the short term, but will increase back to $4,440 in the first quarter of 2026 and surpass $5,000 an ounce by the end of next year.

According to bank experts, short-term profit-taking will soon be compensated by the buying demand of central banks and physical investors. All adjustments are temporary.

If this scenario occurs, 2026 could become a "golden year" for gold, continuing the impressive price increase streak: 2020: +24%; 2022: +1.4%; 2023: ++12.2%, 2024: +27.4%, 2025: +55.3%.

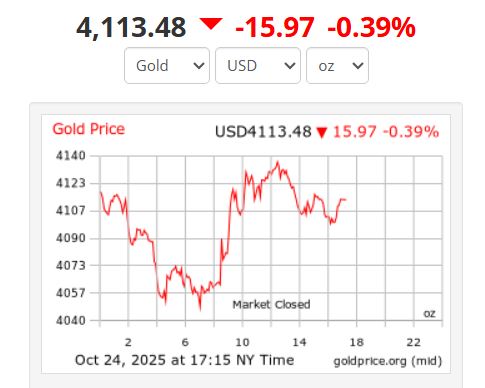

World gold prices closed the weekend session at 4:15 (Vietnam time) on October 25 at 4,113.48 USD/ounce.

Regarding domestic gold prices, as of 9:00 a.m. on October 26, the price of SJC gold bars was listed at around 148.2 - 149.2 million VND/tael (buy - sell).

The price of 9999 Bao Tin Minh Chau gold rings is listed at around 150 - 153 million VND/tael (buy - sell).

Gold investors need to be cautious about risk factors

According to some domestic gold trading enterprises, world gold prices recovered slightly last weekend thanks to the "hunting for cheap goods" mentality of investors after strong selling pressure in previous days. However, gold investors still need to be cautious about risk factors such as fluctuations in the USD, bond yields and upcoming economic data.