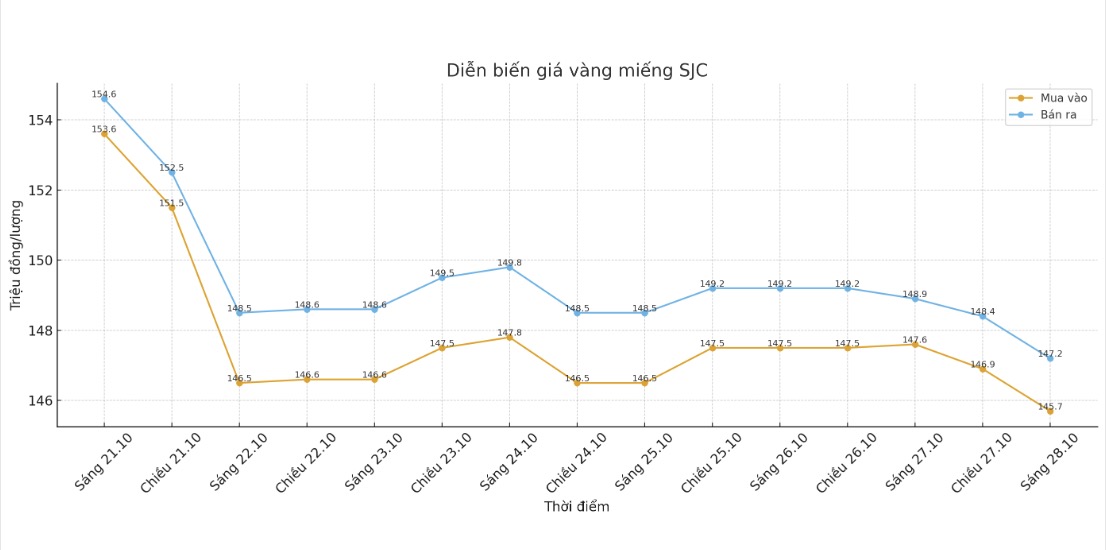

Updated SJC gold price

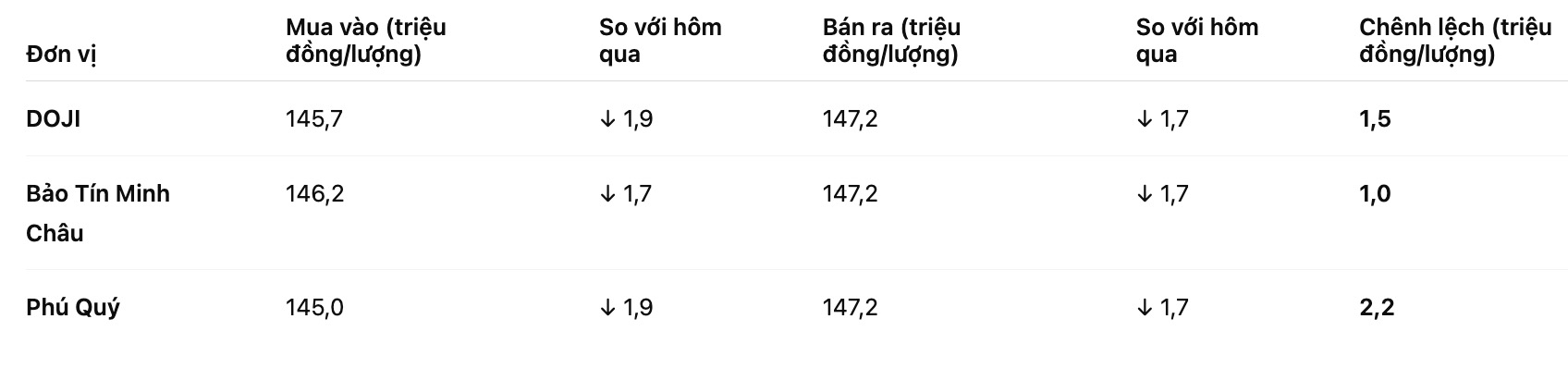

As of 9:40 a.m., DOJI Group listed the price of SJC gold bars at 145.77.2 million VND/tael (buy - sell), down 1.9 million VND/tael for buying and down 1.7 million VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146.2-147.2 million VND/tael (buy in - sell out), down 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 145-147.2 million VND/tael (buy - sell), down 1.9 million VND/tael for buying and down 1.7 million VND/tael for selling. The difference between buying and selling prices is at 2.2 million VND/tael.

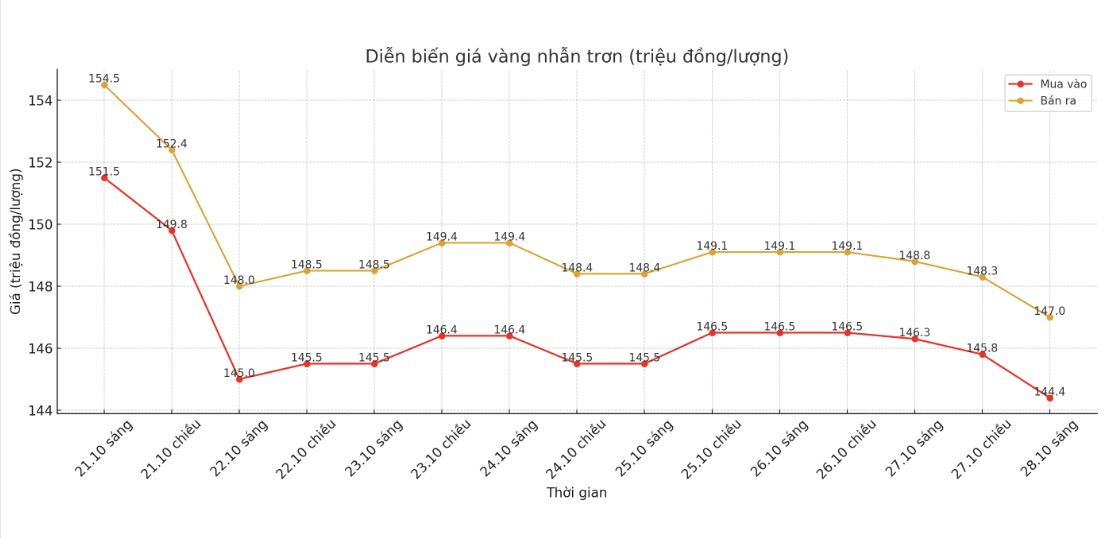

9999 round gold ring price

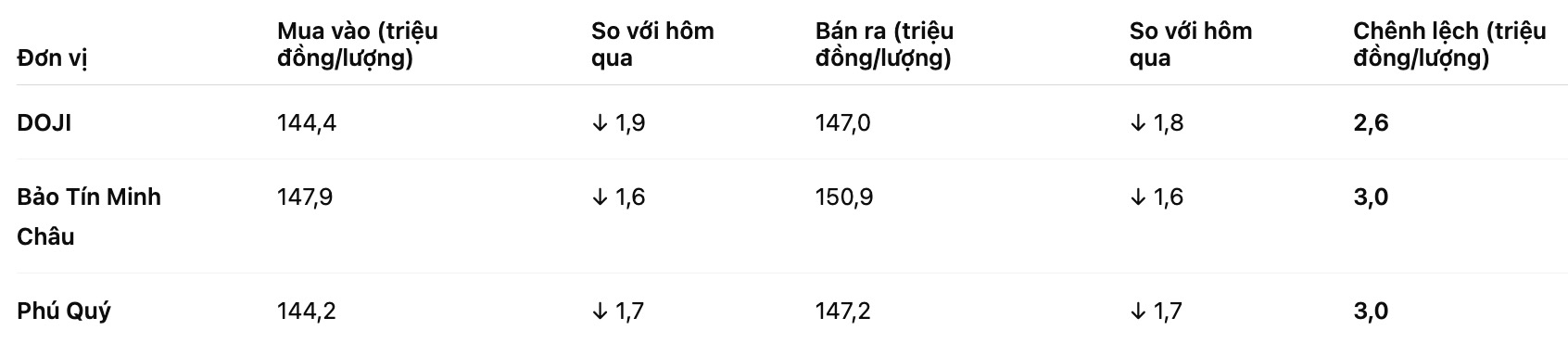

As of 9:40 a.m., DOJI Group listed the price of gold rings at 144.4-147 million VND/tael (buy - sell), down 1.9 million VND/tael for buying and down 1.8 million VND/tael for selling. The difference between buying and selling is 2.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 147.9-150.9 million VND/tael (buy - sell), down 1.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 144.2-147.2 million VND/tael (buy in - sell out), down 1.7 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

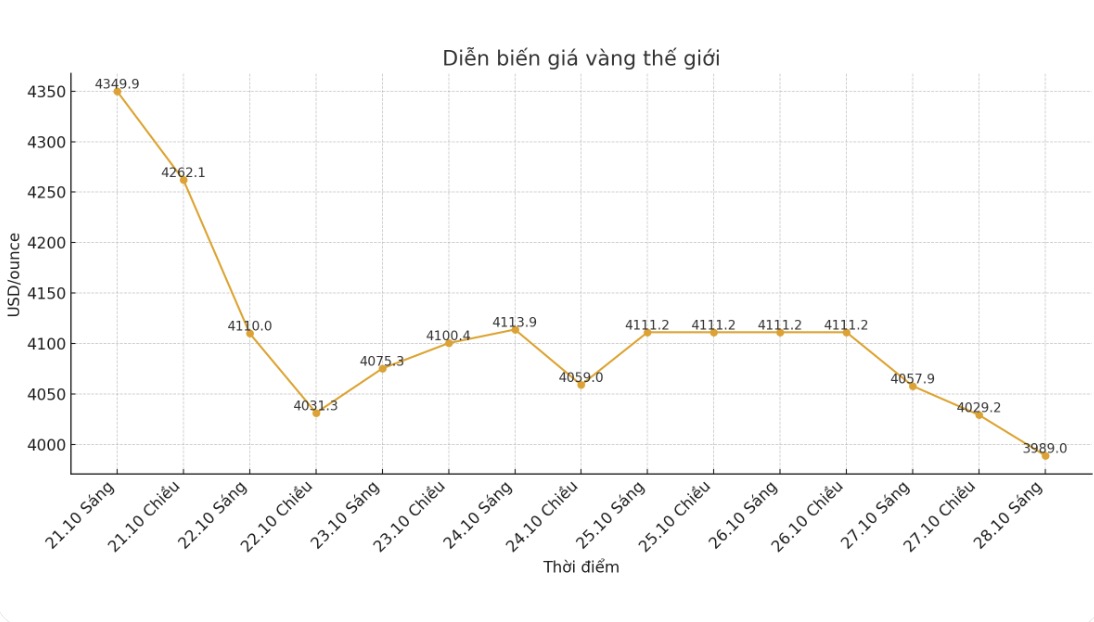

World gold price

At 9:40 a.m., the world gold price was listed around 3,989 USD/ounce, down 68.9 USD. In just two trading sessions, world gold prices have fallen by more than $120/ounce.

Gold price forecast

Gold prices fell sharply after the US and China were close to a major trade deal over the weekend. Increased risk-off sentiment has prompted the global stock market to bounce strongly, with US stock indexes forecast to open at a new record level.

The heads of the China-US negotiation delegations last weekend said they had reached consensus on many key issues, paving the way for the leaders of the two countries to sign an agreement at this weekend's meeting.

US Treasury Secretary Bessent told CBS News that the risk of a 100% tax on Chinese goods is seen as being lifted, while Beijing plans to increase soybean purchases and expand control of rare earths.

He said a broader deal could extend the tariff war, address TikTok and maintain a rare earth magnet supply chain.

The leaders of the two countries are also expected to discuss a global peace plan, after Mr. Trump publicly expressed his hope that China will help resolve the Russia-Ukraine conflict. They want a deal and so do we, Trump said. This positive sentiment has pushed up global stock prices and put safe-haven assets such as gold and silver under strong selling pressure.

President Trump also said the US is getting closer to a series of trade deals with Southeast Asian countries such as Thailand, Cambodia, Malaysia, etc. The deals aim to increase access to strategic minerals and the US agricultural market, while exempting some export tariffs, which could be implemented in the next few weeks.

In another development, the US Federal Reserve (FED) plans to cut interest rates by another 0.25 percentage points at its meeting this Wednesday to support the labor market. However, the Fed is divided internally as some members are concerned about the risk of inflation.

Data released at the end of the week showed that US consumer inflation increased the slowest in three months in September, strengthening the possibility of the Fed taking action.

Although gold prices have not held the key support zone of $4,000/ounce, research firm Metals Focus predicts that the precious metal will continue to increase.

Metals Focus forecasts that the average gold price in 2026 will be around 4,560 USD/ounce, up 40% compared to the average since the beginning of the year.

According to the report, this positive outlook reflects the fact that the proportion of gold allocation in investors' portfolios is still much lower than the period after the 2008 financial crisis, showing that there is still a large room for cash flow into gold - especially in the medium and long term vision.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...