World gold prices have increased by more than 265% since 2020, sparking a large-scale buying wave by central banks.

While many emerging economies and even Asian and Eastern European powers are accelerating stockpiling, some countries are quietly selling out, creating a clear differentiated picture on the global gold reserve map.

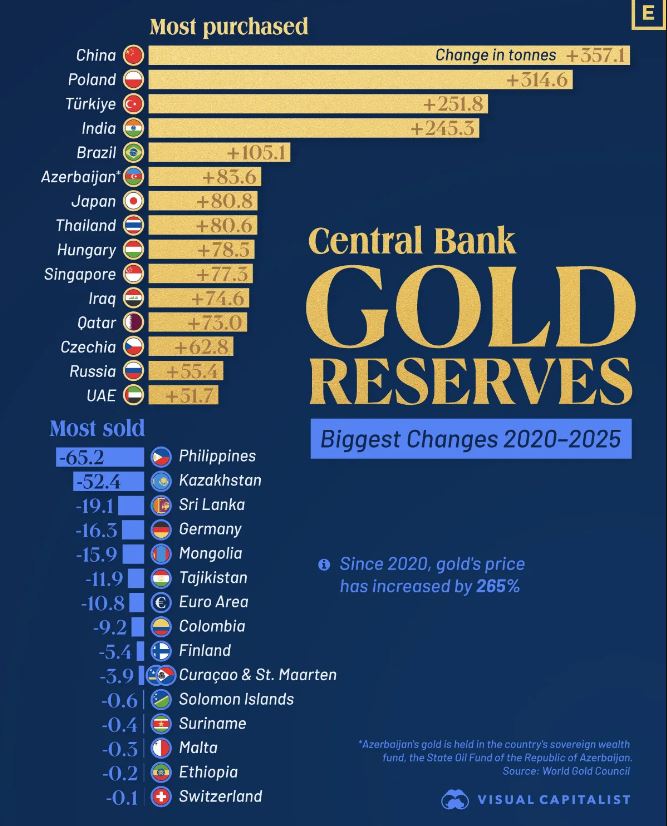

In the past 5 years, gold has not only been a simple risk hedging asset but has become a "strategic anchor" in foreign exchange reserves of many countries. World Gold Council data shows that the 15 largest net buyers have added nearly 2,000 tons of gold to reserves in the period 2020-2025, one of the largest gold hoarding waves in modern times.

China leads the stockpiling race

Leading the ranking is China with a net purchase of 357.1 tons of gold in the period 2020-2025. This move is in line with Beijing's long-term strategy to diversify reserves, reduce dependence on the USD and limit risks from the Western financial system.

In the context of increasing geopolitical tensions and global currency volatility, gold is considered a politically neutral asset, less affected by sanctions.

Poland closely follows behind by adding 314.6 tons of gold. Warsaw has for many years pursued a strategy to strengthen monetary security, making gold a pillar in the national reserves.

Turkey and India ranked third and fourth respectively, with net purchases of 251.8 tons and 245.3 tons. Both economies faced inflationary pressure and prolonged exchange rate fluctuations, making gold an effective hedging tool in the reserve structure.

The next positions in the strong buying group include Brazil (105.1 tons), Azerbaijan (83.6 tons), Japan (80.8 tons), Thailand (80.6 tons), Hungary (78.5 tons) and Singapore (77.3 tons). Notably, Azerbaijan increased gold through the National Oil Fund, showing a trend of using national asset funds to restructure reserves.

Iraq, Qatar, Czech Republic, Russia and the United Arab Emirates (UAE) are also in the top 15 largest net buyers, consolidating the trend of shifting to tangible assets amidst uncertainty.

Emerging markets accelerate gold buying

Not only major economies, many emerging markets are also stepping up stockpiling. Brazil surpassed the 100-ton mark in 5 years. Eastern European and Middle Eastern countries increased purchases amid concerns about geopolitical risks and the desire for diversification away from the USD.

The fact that Japan, Thailand or Singapore are expanding gold reserves shows that gold is being seen as a stable asset in a volatile global interest rate and growth environment.

Who is selling?

Contrary to the strong buying trend, some countries narrowed their gold reserves. The Philippines topped the list of net selling when it decreased by 65.2 tons in the period 2020-2025. Kazakhstan decreased by 52.4 tons, and Sri Lanka decreased by 19.1 tons.

Experts believe that selling often reflects domestic liquidity pressure or the need to restructure reserves when the economy is facing difficulties.

Germany decreased by 16.3 tons, Mongolia decreased by 15.9 tons, Tajikistan decreased by 11.9 tons. The Eurozone averaged a decrease of 10.8 tons. Colombia, Finland, Curaçao & St. Maarten also recorded slight cuts.

Switzerland almost maintained its status when it only reduced by 0.1 tons, showing a more stable and cautious approach compared to many other countries.

After a period of gold prices increasing by more than 230% since 2020, gold is not only a market story but also reflects the power and financial security strategies of each country. And this restructuring of reserves may just begin.