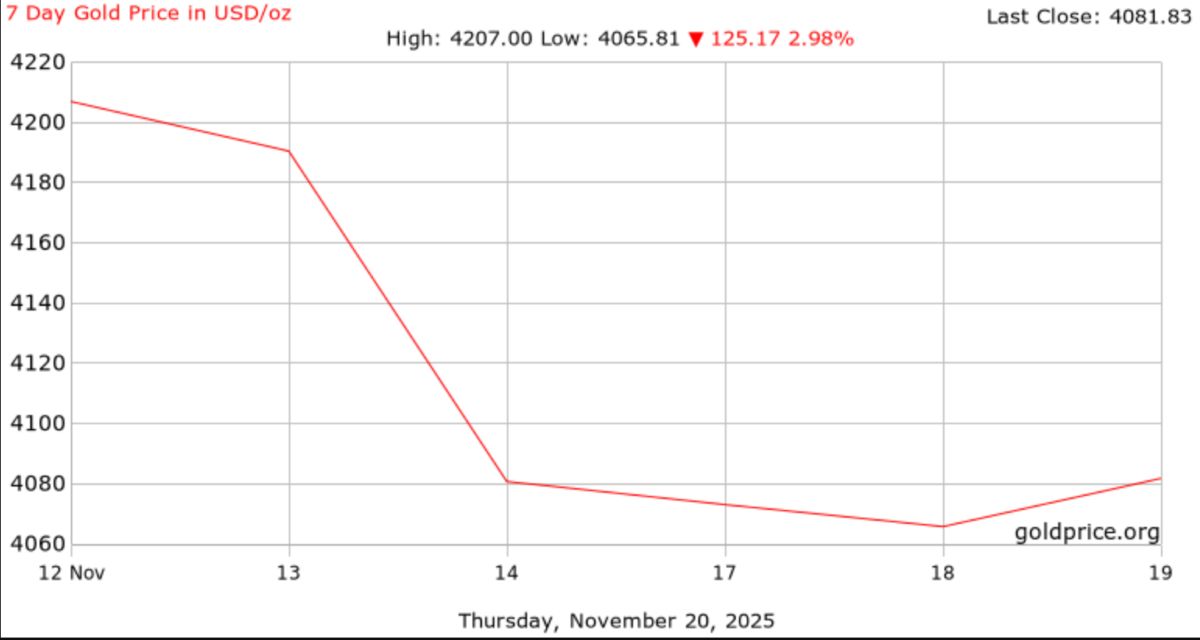

World gold prices opened last week with a remarkable increase, when spot gold increased by 1.1% to 4,112.50 USD/ounce, while December gold futures also increased similarly to 4,112.90 USD/ounce.

This increase comes amid increased sentiment ahead of a series of important economic data being released.

Global investors are watching the minutes of the Fed's October meeting and the September employment report being delayed. The survey shows that the US economy is likely to create only about 50,000 more jobs in the past month, a signal that could strongly impact interest rate expectations.

According to FXTM expert Lukman Otunuga, gold has recoveryed spectacularly from the psychological level of 4,000 USD, and if economic data leans towards a rate cut scenario, gold prices could well move up to 4,130-4.200 USD/ounce.

However, if Fed officials give a tougher view and data is positive, gold prices are expected to be pulled back around $4,000/ounce as the market adjusts expectations.

Newly released data shows that the number of unemployment benefits recipients in the US has increased to a 2-month high as of mid-October, while the minutes of the Fed meeting are expected to reveal internal debate on how to handle slowly proceeding inflation.

The CME FedWatch tool recorded that the percentage of Fed rates in December decreased to just over 46%, compared to 63% last week. This is proof that the market is increasingly cautious as the Fed signals that it cannot be eased too soon.

The minutes of last month's Fed meeting showed that deep within the central bank, there is still a big difference in the timing of interest rate cuts.

Chairman Jerome Powell affirmed that the interest rate cut at the meeting on December 9 is not certain, although he did not rule out the possibility that the Fed could still act if the data supported.

Gold - a non-profit asset - often benefits in low interest rate environments or when the economy is unstable. According to OANDA expert Zain Vawda, if labor data weakens, gold could continue to rise. But in the opposite scenario, the market could see a fall below $4,000/ounce, the most important psychological support level in December.

Notably, the USD has clearly strengthened, as the Dollar Index returns above 100. Normally, a strong USD will put great pressure on gold.

The world gold price as of 6:52 p.m. on November 20, Vietnam time, was trading at 4,058.47 USD/ounce, down 23.36 USD, equivalent to a decrease of 0.57%.

Regarding domestic gold prices, SJC gold bar prices are trading around 148.8 - 150.3 million VND/tael (buy - sell).

The price of 9999 Bao Tin Minh Chau gold rings is trading around 147.8 - 150.8 million VND/tael (buy - sell).