In a new report released on November 13, the World Gold Council (WGC) said that the outlook for gold prices in 2026 depends mainly on two factors: US tariff developments and interest rate policy of the US Federal Reserve (Fed).

Mr. Shaokai Fan - Director of the Asia - Pacific region (except China) and Global Director in charge of the central bank of the WGC - said that world gold prices will enter a sensitive period when a series of major variables from the US are activated. Gold prices could remain more stable if tariff disputes between the US and its partners are resolved peacefully.

He commented: "If trade tax issues are resolved, market risks will be reduced, thereby limiting the negative impact on gold prices".

In addition to the tax story, Mr. Shaokai emphasized that the Fed will be the second factor shaping the gold price trend next year. Currently, the market is betting on a 67% chance of the Fed cutting interest rates in December.

I believe there is a high probability that gold prices will react positively if the Fed adjusts interest rates, he said.

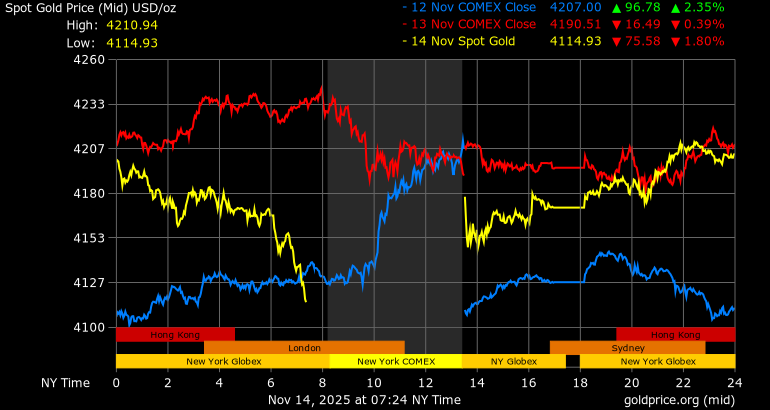

Gold prices rebounded this week after last month's correction, causing many investors to expect the precious metal to continue to rise in the coming time.

The main driver for the rally comes from the US government reopening after 43 days. The end of the closure will help important data on the US economy be released soon, making it easier for investors and the Fed to predict upcoming monetary policy.

Major financial institutions continue to maintain a positive outlook for gold through 2026, with many forecasts suggesting that gold prices could increase by about 20% compared to current levels, approaching or exceeding the 5,000 USD/ounce mark.

JP Morgan forecasts gold prices to reach $5,055/ounce by the fourth quarter of 2026, with a long-term target of $6,000/ounce by 2028.

Goldman Sachs expects gold prices to reach $5,055/ounce by the end of 2026, thanks to strong ETF inflows and continuous central bank purchases.

The Bank of America also raised its forecast for 2026 to $5,000/ounce, stressing that increased investment demand could push gold above this threshold.

World gold prices are currently trading around $4,126.73/ounce.

Regarding domestic gold prices, SJC gold bar prices are trading around 151.2 - 153.2 million VND/tael (buy - sell).

The price of 9999 Bao Tin Minh Chau gold rings is trading around 150 - 153 million VND/tael (buy - sell).