World gold prices this year have sometimes climbed to 4,300 USD/ounce not only due to economic instability or fluctuations in interest rates. The bigger driver lies in the strategies of the superpowers - from China to the US and many other economies - buying gold at an unprecedented speed. The game now belongs to central banks, which account for more than a third of global demand and are increasingly unpredictable.

China is the focus, according to the Financial Times. Despite announcing only 1.9 tonnes of gold in 8; 1.9 tonnes in July and 2.2 tonnes in June - too small to make an impact - analysts believe the reality is many times greater.

French bank Societe Generale estimates that Beijing's total purchases this year could reach 250 tons, equivalent to more than a third of the world's central bank's gold demand.

China is buying gold as part of its de-dollarization strategy, said Jeff Currie, chief strategy officer at Carlyle Financial Group.

plenum Research, a consulting firm in Beijing, calculates that the official Chinese gold purchases will be 1,351 tonnes in 2023 and 1,382 tonnes in 2022 - more than 6 times the amount of public gold that China has purchased in those years.

Bruce Ikemizu, director of the Japan Golden bars Market Association, said that China's current gold reserves are nearly 5,000 tons, double the level the country announced.

As the US strengthens trade and financial measures under President Donald Trump, major economies are increasingly looking to diversify reserves. Gold - an un impunited, unopolitical asset - has become a safe choice.

Secrets do not only come from China. Many central banks are avoiding full reporting to the International Monetary Fund (IMF) to avoid "mental wave", or avoiding the US's reaction when buying gold - an asset often seen as a hedge against the USD.

In the third quarter of this year, only about a third of central bank gold transactions were reported publicly, down sharply from 90% 4 years ago - according to an estimate by the World Gold Council (WGC) based on Metals Focus data.

In that context, the US has also become one of the decisive factors in the direction of gold prices. The US Federal Reserve's tax, trade policies and interest rate expectations have caused demand for gold protection to increase sharply. Any signal that Washington may tighten or loosen immediately affects the buying psychology of other countries.

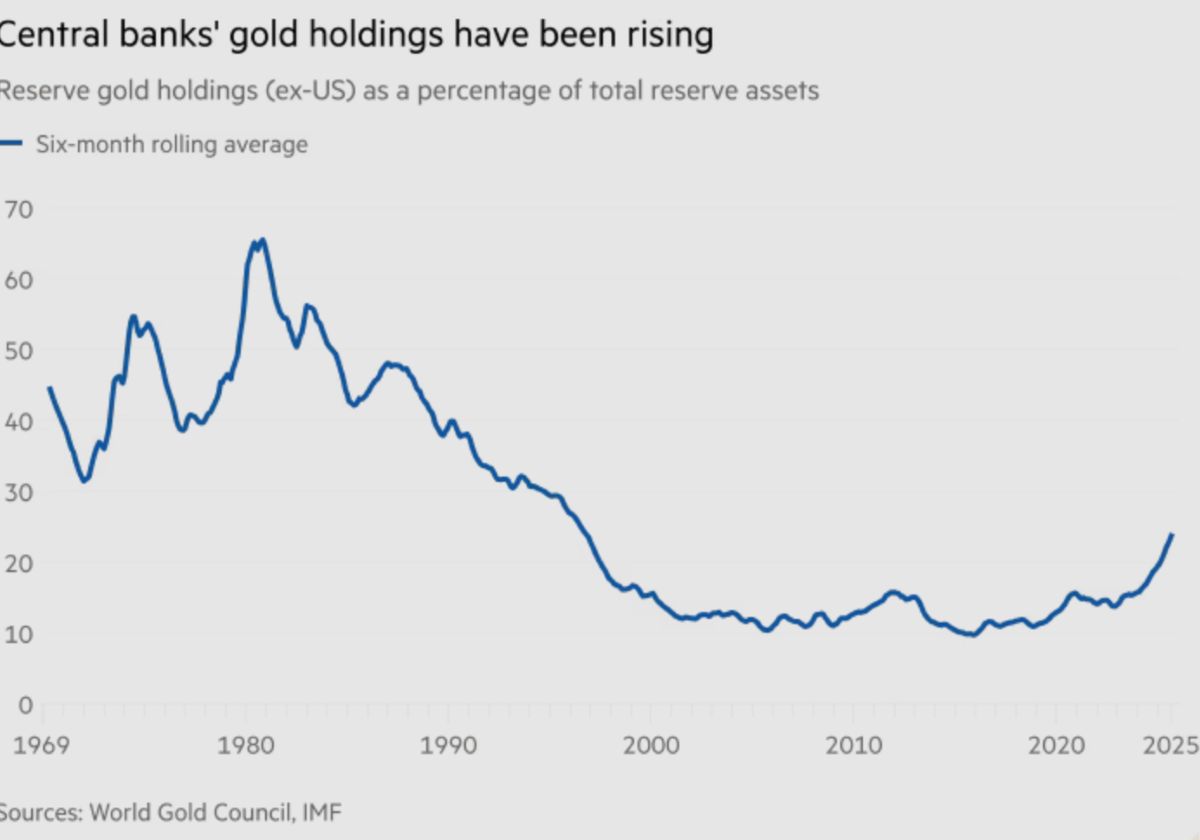

Emerging economies such as Türkiye, India, Kazakhstan and Singapore are also accelerating gold accumulation. Over the past decade, the share of gold in global reserves (excluding the US) has increased from 10% to 26%, becoming the second largest reserve asset after the US dollar.

As the superpowers quietly reshape their strategic reserves, the gold market becomes more unpredictable than ever. The race to accumulate gold is quietly deciding the future of the world's most valuable metal price.

World gold prices are currently trading around $4,080.78/ounce.

Regarding domestic gold prices, SJC gold bar prices are trading around 149-151 million VND/tael (buy in - sell out). The price of 9999 Bao Tin Minh Chau gold rings is trading around 147.8 - 150.8 million VND/tael (buy - sell).

Gold demand forecast to reach 15-year strongest level

According to UBS, gold demand this year and next year is forecast to reach its strongest level since 2011. Any significant increase in political risks and financial markets could push gold prices to the target of $4,700/ounce.

Meanwhile, Jim Wyckoff - senior analyst at Kitco Metals - commented that traders believe that upcoming economic data will show signs of weakening the US economy and this could lead the Fed to cut interest rates in December. "That is probably a factor that encourages gold buyers" - Jim Wyckoff analyzed.