The gold market continues to attract strong attention from investors as spot gold prices have jumped around 4,670 USD/ounce, getting closer than ever to the psychological milestone of 5,000 USD/ounce.

The main driving force does not come from short-term technical factors, but originates from an increasingly gloomy global picture.

According to the Global Risk Report 2026 released by the World Economic Forum (WEF) ahead of the annual conference in Davos, "geo-economic confrontation" is assessed by leaders and experts as the biggest risk of the year, surpassing conflicts between countries, extreme weather, social polarization and misinformation.

The report shows that anxiety is spreading. About 50% of WEF members predict that the world in the next 2 years will fall into a state of "agitation or storm", a sharp increase compared to the previous year.

Looking beyond 10 years, 57% believe that instability will become the dominant trend, while only 1% expect a peaceful world. These figures are strengthening the role of gold as the last refuge of faith.

Global tensions are further heightened when US President Donald Trump recently opened a new "front" in the trade war. His threat to impose tariffs from 10% to 25% on a series of European allies to put pressure around the Greenland issue immediately faced strong reactions from the EU.

The European Parliament announced the freeze of the ratification process of the trade agreement with the US, making the risk of escalating economic confrontation clearer.

In that context, many commodity analysts predict that gold prices hit or exceed 5,000 USD/ounce in the first half of the year is no longer too far-fetched a scenario.

Mr. Aakash Doshi, Head of Gold Strategy at State Street Investment Management, said that geopolitical risks today are no longer just "shocking news", but have become a structural threat, strong enough to support gold prices in the long term.

According to Mr. Doshi, although the price of gold looks high on the surface, in relation to other risky assets, this precious metal has not yet been overvalued.

The fact that the US stock market continuously hits new peaks makes gold even more attractive as a hedging tool when unexpected fluctuations occur.

Sharing the same view, Ms. Linh Tran, a senior market analyst at XS.com, said that the current upward momentum of gold is no longer speculative. The fact that prices continuously set new peaks shows that investors' belief in the strategic role of gold in the global financial system is changing.

According to her, gold is gradually transforming from a "defensive asset" to a core asset in risk management, as confidence in legal tender is challenged by unpredictable policies and prolonged conflicts. If there is an adjustment, it is likely only a technical rhythm, not a trend reversal.

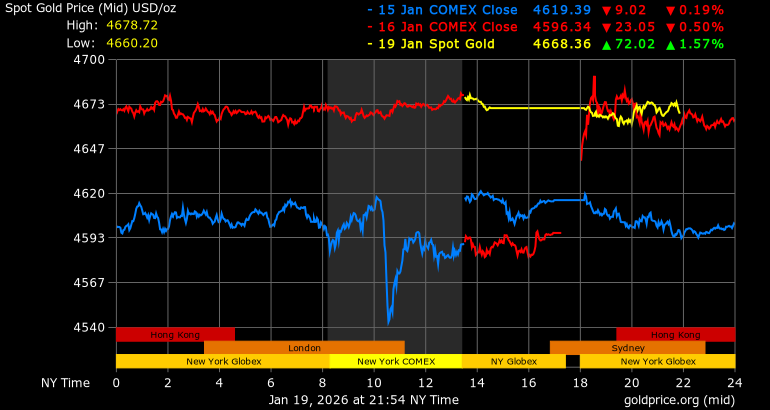

World gold prices at 9:41 am on January 20, Vietnam time, traded at 4,673.56 USD/ounce, up 77.22 USD, equivalent to an increase of 1.68%.

Regarding domestic gold prices, SJC gold bar prices at 9:20 am on January 20 traded around 163 - 165 million VND/tael (buying - selling).

The price of 9999 Bao Tin Minh Chau gold rings is trading around 161.8 - 164.8 million VND/tael (buying - selling).