Hopes of agreeing on a new method of funding Ukraine's military efforts have been dashed after Belgium's objections, which held much of the Russian Central Bank's money frozen in the European Union (EU).

At the EU summit in Brussels on October 23, despite an urgent call from Ukrainian President Volodymyr Zelensky, EU leaders only stopped at asking the European Commission to " present financial support plans to Ukraine" - without directly mentioning the use of Russian assets.

The EU's initial plan was to use the proceeds from 183 billion euros in frozen assets of the Russian Central Bank at the Belgian-based financial institution Euroclear - equivalent to 86% of Russia's total assets in the EU - to finance Ukraine. However, Belgian Prime Minister Bart De Wever objected, worrying that "if Russia demands its money back, who will be responsible?".

We cannot risk national finances just for an unguaranteed decision of the whole EU, De Wever said before the conference, stressing that Belgium needs to commit to sharing risks from other countries before nodding.

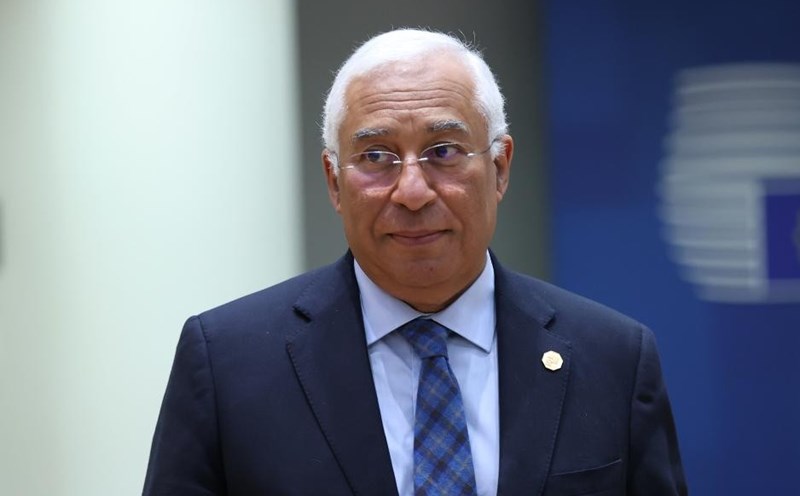

European Council President Antonio Costa said after the meeting that the EU is still committed to providing financial and defense support to Ukraine for the next two years, but there are many technical points that need to be clarified.

We have agreed on a compensation loan for Ukraine, but we still need to clarify how to do it legally, added European Commission President Ursula von der Leyen.

The plan proposed by the European Commission is to use the profits from the frozen Russian assets as a basis for a loan of 140 billion euros to support Ukraine.

Accordingly, Ukraine will receive the loan immediately, but only have to repay it when Russia pays compensation for damages - that is, when Moscow officially accepts to pay compensation for the losses caused by the conflict.

The EU believes this is a way to force Russia to pay the price for the conflict without directly confiscating assets, helping to avoid violating international law on property rights.

However, observers warned that this was a "double-edged sword". If errors occur, the European financial system could lose the trust of other countries, which are depositing foreign currency reserves in European institutions.

Speaking before the conference, President Zelensky called on EU leaders to make this major decision soon. any delay would mean limiting our defense and seriously hampering Europes progress. Now is the time to act with Russian assets, Zelensky said.

Meanwhile, Hungarian Prime Minister Viktor Orban revealed that Russian President Vladimir Putin had sent him a letter warning of retaliatory measures if the West seized Russian assets. Mr. Orban affirmed that Hungary has a clear economic advantage in not supporting this action, because many Hungarian enterprises are investing in Russia.

If the EU truly seizes Russian assets, no one in the world will trust and deposit reserves in European banks, Orban said.

Russian Foreign Ministry spokeswoman Maria Zakharova said on October 23 that "any EU initiative to seize Russian assets will have a painful and proportionate reaction."