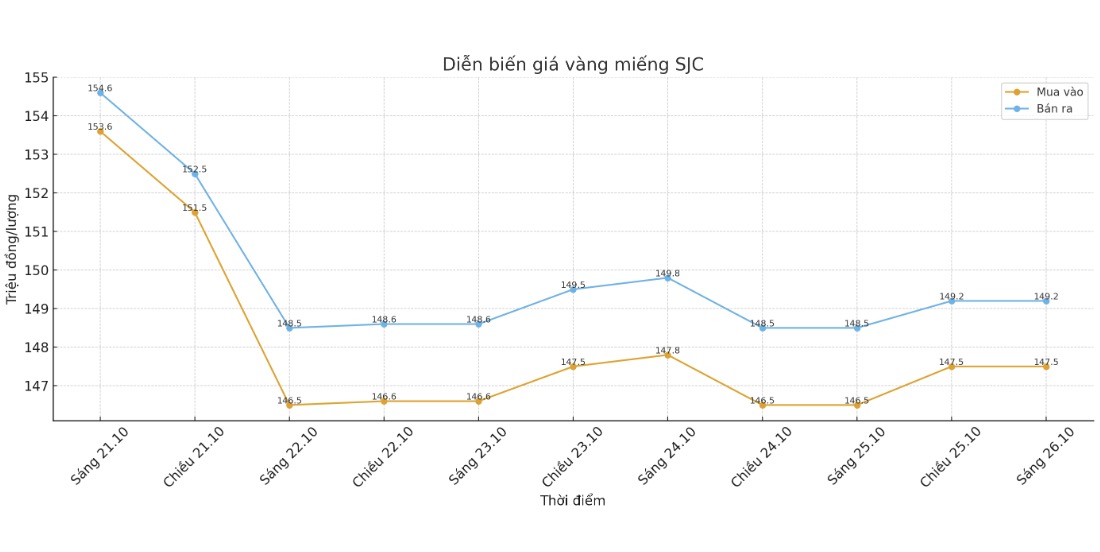

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 147.2-149.2 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (October 19, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC decreased by 2.3 million VND/tael for buying and decreased by 1.8 million VND/tael for selling. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 148.2-149.2 million VND/tael (buy in - sell out).

Compared to a week ago, the price of SJC gold bars was reduced by 2.3 million VND/tael for buying by Bao Tin Minh Chau and 1.8 million VND/tael for selling. The difference between the buying and selling prices of SJC gold at Bao Tin Minh Chau is at 1 million VND/tael.

If buying SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau in the session of October 19 and selling it in today's session (October 26), buyers will lose VND3.8 million and VND2.8 million/tael, respectively.

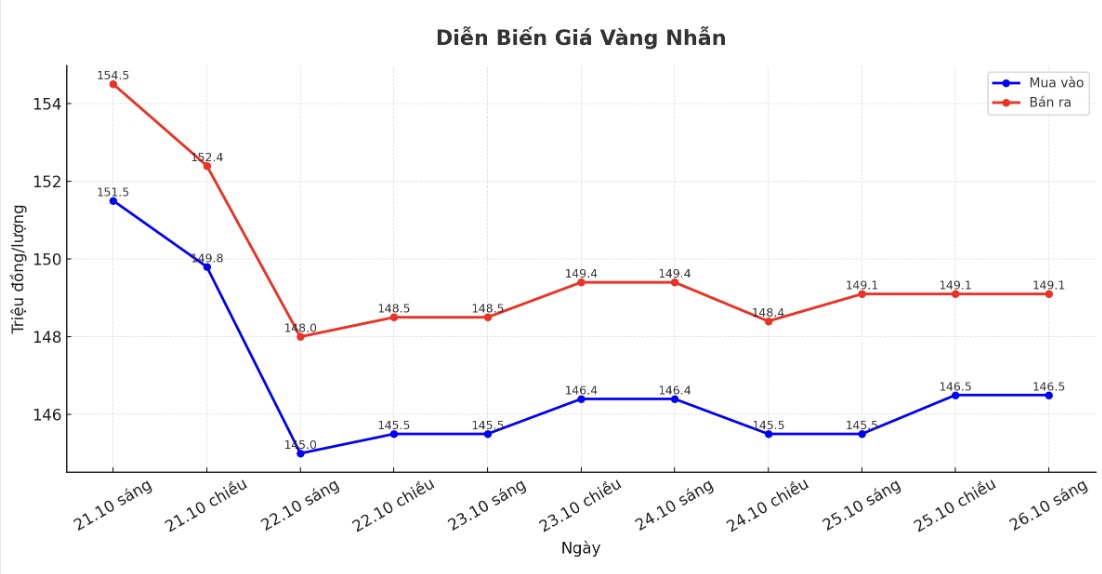

9999 gold ring price

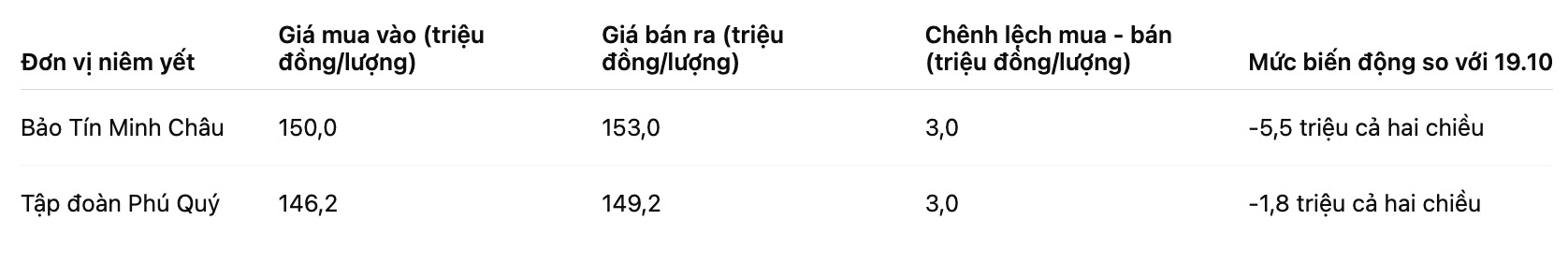

Bao Tin Minh Chau listed the price of gold rings at 150-153 million VND/tael (buy - sell); down 5.5 million VND/tael in both directions. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 146.2-149.2 million VND/tael (buy - sell), down 1.8 million VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of October 19 and selling in today's session (October 26), buyers at Bao Tin Minh Chau will lose 8.5 million VND/tael. Meanwhile, the loss when buying in Phu Quy was 4.8 million VND/tael.

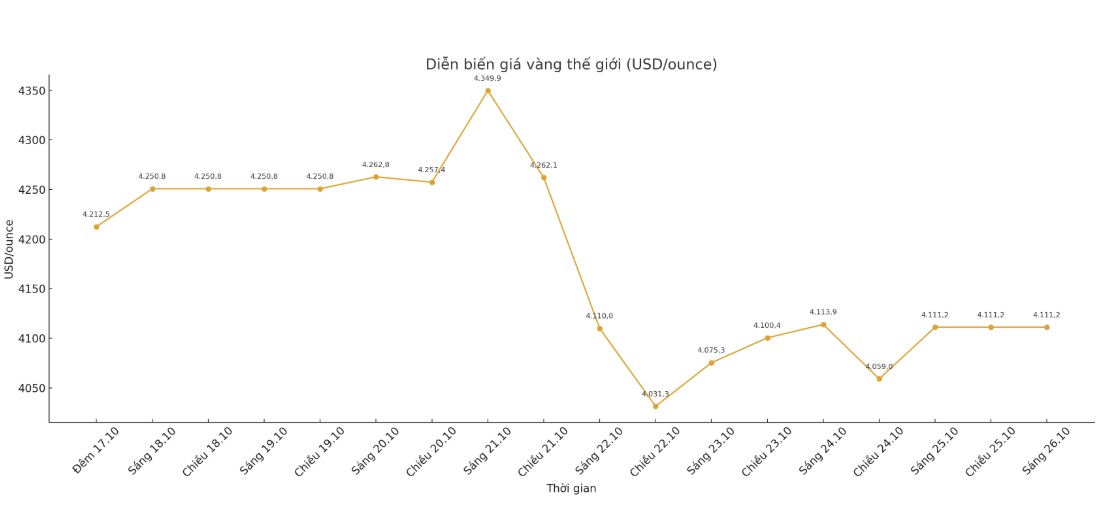

World gold price

At the end of the trading session of the week, the world gold price was listed at 4,111.2 USD/ounce, down 139.6 USD compared to a week ago.

Gold price forecast

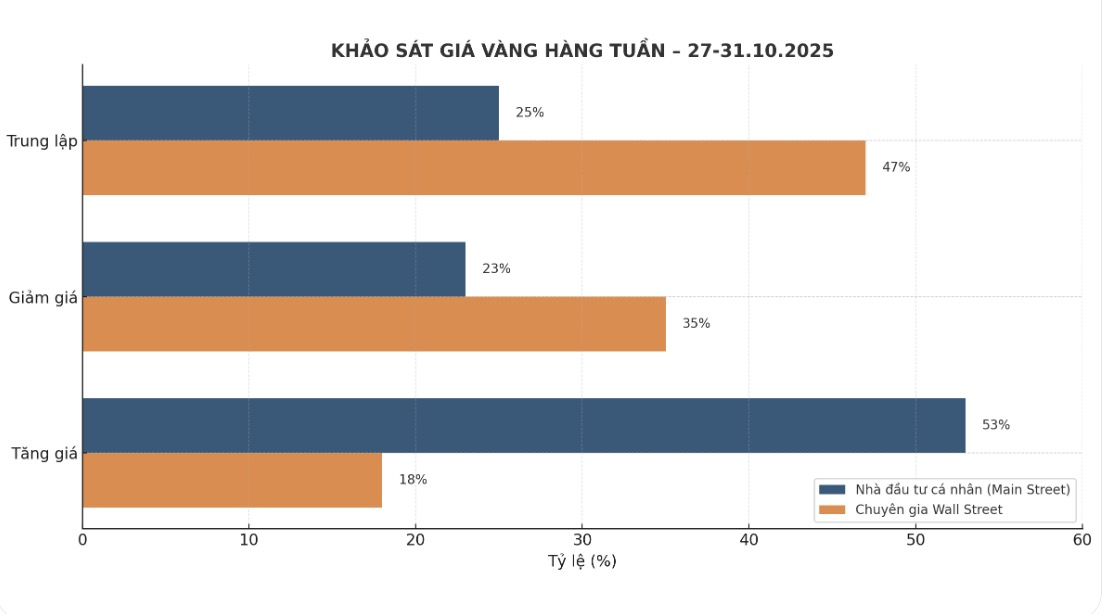

The latest weekly gold survey by an international financial information platform shows that the majority of Wall Street analysts are shifting to a pessimistic or neutral view, while retail investors are still slightly optimistic about gold.

This week, there are 17 experts participating in the survey. Less than a fifth of experts see gold prices rising. Only 3 people (18%) see gold prices rising next week, while 6 (35%) see prices falling. The remaining eight experts, or 47%, predict gold prices will move sideways.

Meanwhile, 274 participants participated in the online survey for small investors. The group's optimistic sentiment has weakened after last week's sell-off, but it still dominates. Accordingly, 144 people (53%) expect gold prices to increase next week, 62 people (23%) predict prices to decrease, and 68 people (25%) believe that prices will continue to accumulate in narrow areas.

Mr. Neil Welsh - Director of Metals at Britannia Global Markets - is neutral: "Recent fluctuations are more of a positive correction than a trend reversal. There is a feeling that the market is just taking a break to consolidate before continuing to move up.

Sharing the same view, Mr. Colin Cieszynski - Chief Strategist at SIA Wealth Management - also said that he is neutral, but not because the market will be flat but because it is difficult to predict a clear direction at this time.

He assessed the CPI report as not a major driver: CPI 3%, while the forecast is 3.1%. With the US government shut down, data could be distorted. I didn't expect much and there was actually nothing remarkable."

According to him, the recovery of gold is mainly due to technical factors: The USD is not fluctuating strongly, the digital currency is also quite quiet. The recent sell-off seems to have ended and gold is bouncing back.

He believes gold could move sideways in the $4,000-$4,300-ounce range in the near term: Gold has risen too fast. Now the market is waiting for a new signal. Recent news has reflected enough in prices.

He added: The positive thing is that the $4,000/ounce mark remains strong. Gold's long-term upward momentum has not been broken. The market needs to rest to absorb the recent strong increase, completely in accordance with technical rules".

He also noted the psychological factor associated with the holiday season: "The sell-off takes place right after the Diwali festival - a rumored way of buying and selling when it is announced".

Economic data to watch next week

Tuesday: US consumer confidence.

Wednesday: Bank of Canada policy decision, US waitress data, FED policy decision, Bank of Japan policy decision.

Thursday: ECB policy decision.

See more news related to gold prices HERE...