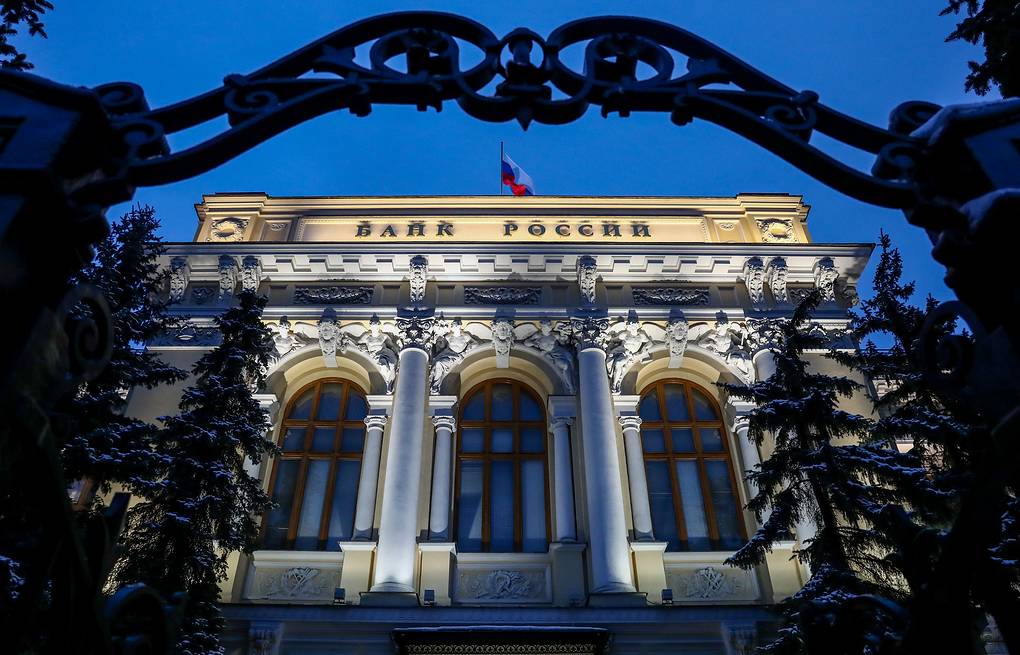

The Russian Central Bank announced on August 1 that its foreign exchange reserves reached 695.5 billion USD at the end of July - the highest level ever, despite more than 300 billion USD of which is still frozen by the West due to tensions related to the conflict in Ukraine.

Compared to the beginning of July, Russia's reserves have increased by 5.5 billion USD, officially surpassing the old record of 690 billion USD recorded on July 4. Since the beginning of 2023, Russia has accumulated more than 100 billion USD in national reserves.

According to the Russian Central Bank's definition, international reserves include strong foreign currencies, gold bars, the IMF's specialising withdrawal (SDR) and other highly liquid assets. These assets are jointly managed by the government and the Central Bank to stabilize rubles, repay foreign debt and deal with financial fluctuations.

It is noteworthy that more than $300 billion in Russian assets are still frozen in Western countries, mostly at the Brussels-based clearinghouse Euroclear. Russia has repeatedly criticized the move as a violation of international law and warned that the West is playing with fire.

President Vladimir Putin called using profits from frozen Russian assets to support Ukraine a looting act, which could have serious consequences for global confidence in the Western-controlled financial system.

He warned that any attempt to seize Russian assets would promote a shift to regional payment systems and undermine the role of Western financial institutions.

Meanwhile, the European Union (EU) continues to take advantage of cash flow from frozen assets. Last year alone, Euroclear transferred 1.5 billion (more than 1.7 billion USD) euros in profits from Russian assets to a $50 billion loan from the G7 Group to Ukraine. To date, 7 billion euros (more than 8 billion USD) out of 18.1 billion euros (nearly 21 billion USD) in benefits have been disbursed by the European Commission.

Brussels is also considering reinvesting these assets in higher-yielding tools to maximize additional revenue for Kiev, despite legal risks and strong backlash from Moscow.

Although it did not disclose details of the list of frozen assets, Russia continues to calculate them in official statistics. According to experts, Moscow's maintaining high reserves despite the sanctions shows that the Russian economy still has cash flow from energy and gold exports, while increasing reserves with assets that are not easily controlled by the West.