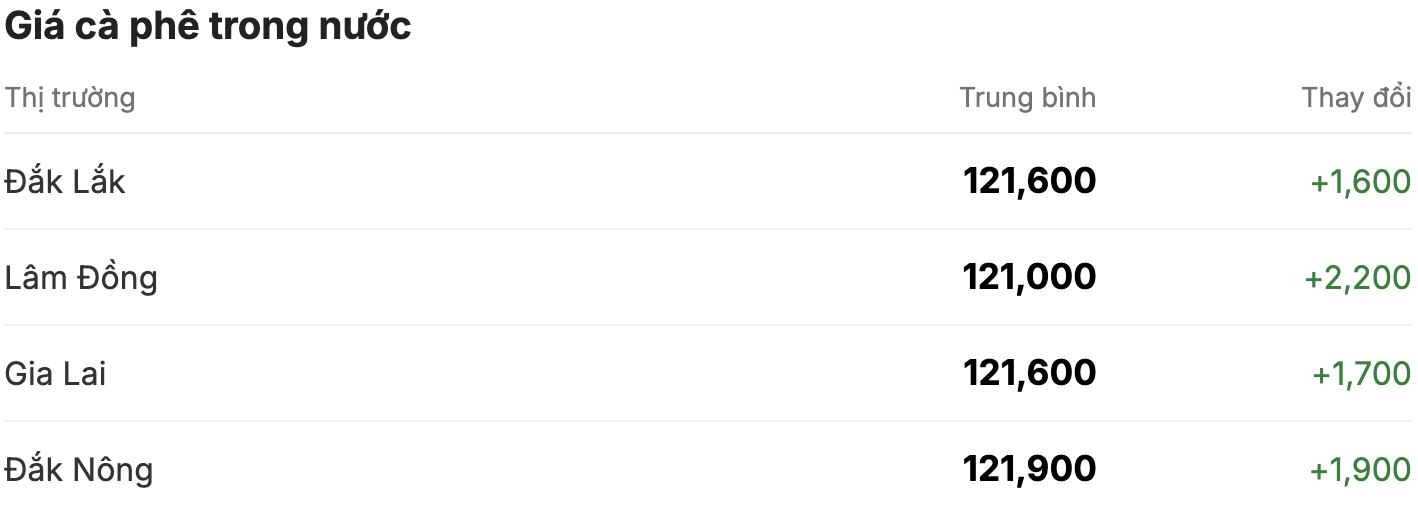

As of 11:30 a.m. today (November 26), the domestic coffee market continued to break out, increasing by an average of VND1,700/kg, causing prices to fluctuate between VND121,000 - VND121,900/kg. The average coffee purchase price in the Central Highlands provinces is VND121,700/kg.

Lam Dong is still the province with the lowest coffee purchasing price in the Central Highlands. Compared to yesterday's closing price, coffee prices in this region stood at 121,000 VND/kg, although the strongest increase was up to 2,000 VND/kg.

In the same direction, coffee purchasing prices in Gia Lai and Dak Lak provinces today increased by 1,700 VND/kg and 1,600 VND/kg respectively, listed at 121,600 VND/kg.

Dak Nong province maintains its position with the highest coffee purchase price in the country, increasing by 1,900 VND/kg, setting the mark at 121,900 VND/kg.

A week ago, domestic coffee prices hovered around VND114,800 - 115,300/kg. After a week of continuous upward adjustments, the coffee purchase price has increased to VND6,400/kg, setting a new peak.

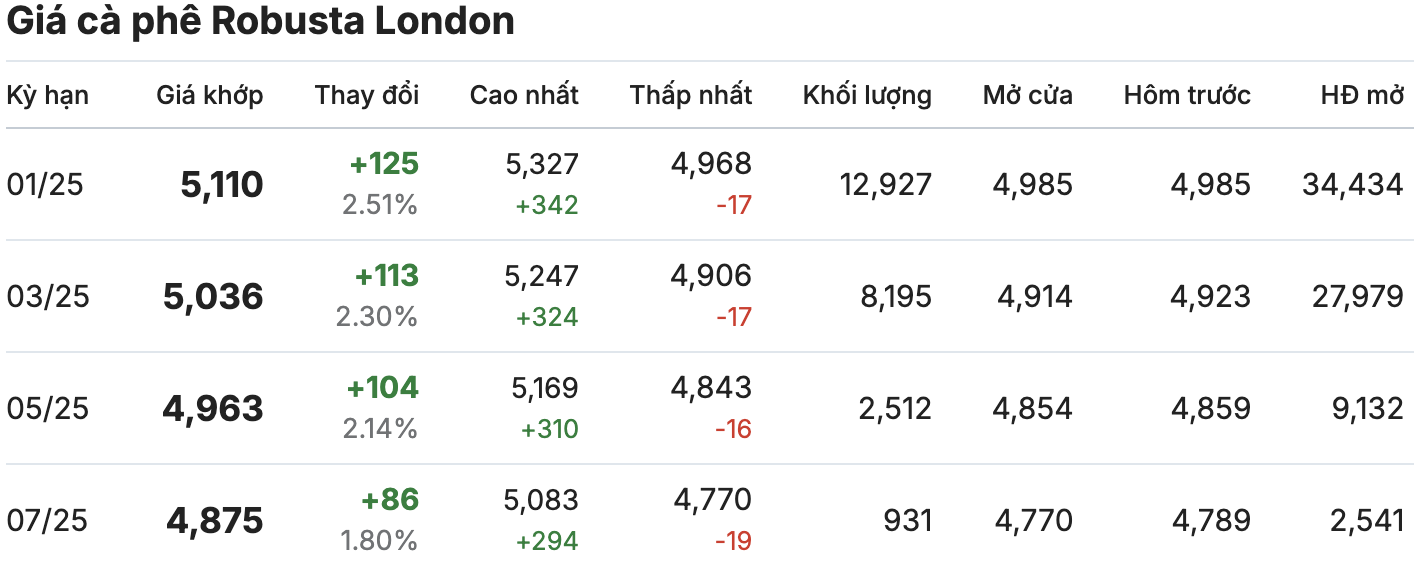

On the London and New York exchanges, the coffee market maintained the same increase compared to yesterday in all terms. The contract for delivery in January 2025 increased by more than 2% (equivalent to 125 USD/ton), standing at 5,110 USD/ton. The contract for delivery in March 2025 was listed at 5,036 USD/ton, up 2.30% (equivalent to 113 USD/ton).

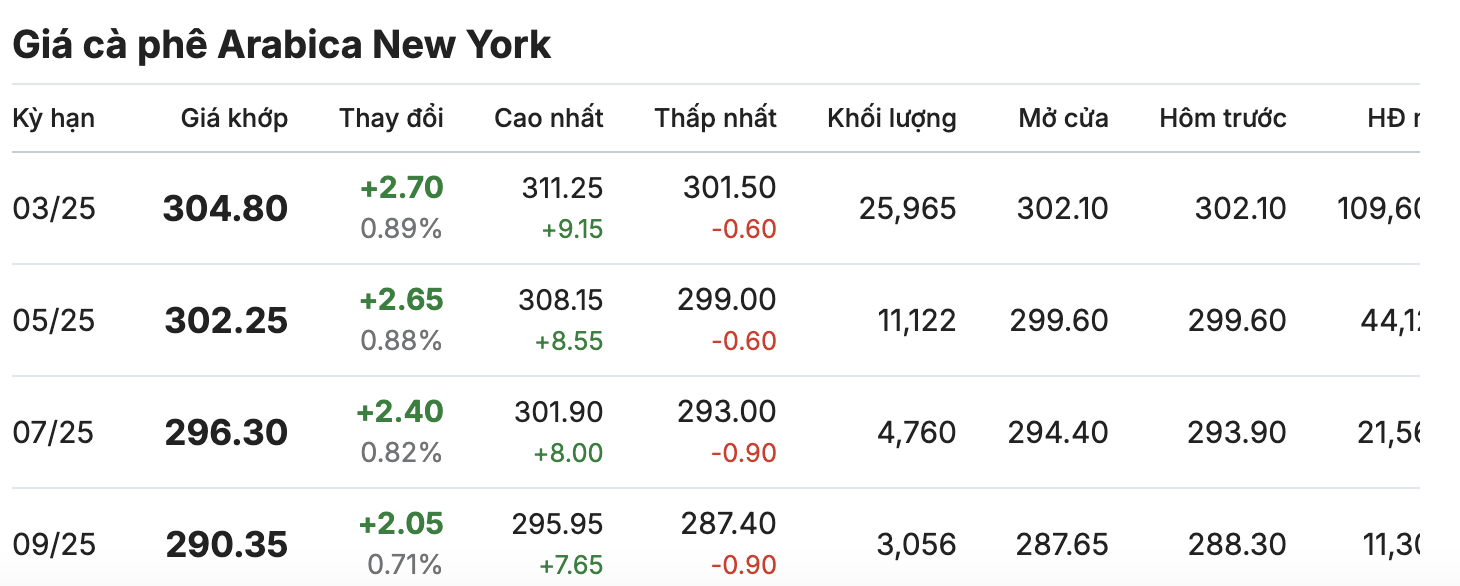

Similarly, developments in the New York Arabica coffee market for December 2024 and March 2025 delivery terms increased by over 2.50%, currently standing at 304.80 cents/lb and 302.25 cents/lb.

The reason for the recent surge is the massive supply disruptions from major coffee-producing countries like Brazil and Vietnam. The cheaper Robusta variety has also reached its highest level since the 1970s.

In addition, rising input costs are also one of the factors affecting the price trend. The third reason for the prolonged increase is that freight rates are at their peak, transporting goods at the end of the year.

Brazil’s long drought has ended, but concerns remain about supplies from the country. Production next season could be lower.

Experts say the outlook for next season’s crop has been affected by a prolonged dry spell that has hit Arabica fields. While recent rains have helped the crop flower, there is still a risk that the flowers will not attach to the branches.

Brazil's coffee inventories could reach just 1.2 million bags at the end of the current crop, down 26% from a year ago, according to the U.S. Department of Agriculture's Foreign Agricultural Service.

In Vietnam, export figures reflect a situation where coffee prices are high but output is on the decline.

A representative of the Vietnam Coffee and Cocoa Association (Vicofa) said the main reason is that the price balance between supply and demand has not been found. Buyers are waiting for prices to drop, while sellers are holding onto their goods, waiting for prices to rise before releasing them to the market.