Domestic pepper prices: Deep drop

As of 11:30 am today (January 16), domestic pepper prices have slipped in all regions, averaging at 148,100 VND/kg. Currently, key areas are trading in the range of 147,500 - 148,500 VND/kg.

Continuing the series of days of price reduction, the pepper price list for specific areas is as follows:

Ho Chi Minh City and Gia Lai both decreased by 2,000 VND/kg, listed at 148,000 VND/kg.

Dong Nai province, although decreasing by at least 1,000 VND/kg throughout the region, is currently the purchasing area with the lowest price of 147,500 VND/kg.

Dak Lak and Lam Dong are still the two provinces with the highest prices. Currently, these 2 regions put on the market at 148,500 VND/kg, down 2,500 VND/kg.

World pepper prices: Same trend

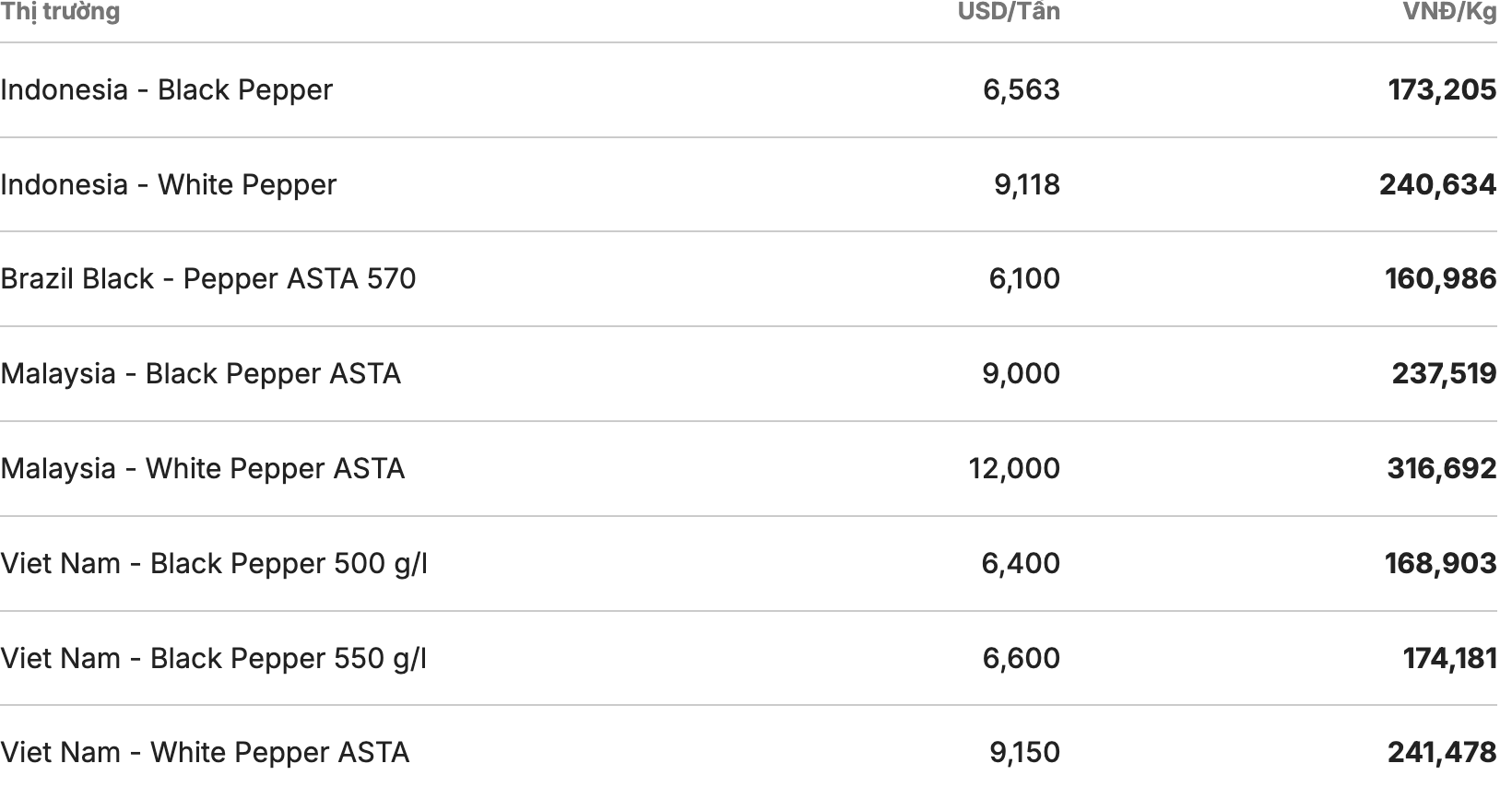

In the world market, consumer prices fluctuate in countries. The Indonesian exchange - one of the most vibrant markets - reversed downwards. These two commodities traded in the range of 6,563 - 9,118 USD/ton (equivalent to 173,205 VND/kg - 240,634 VND/kg), down 4 USD/ton and 5 USD/ton respectively.

Meanwhile, the Brazilian market stood at 6,100 USD/ton (about 160,986 VND/kg). In the opposite direction, black and white pepper continued to remain unchanged, trading at 12,000 USD/ton and 9,000 USD/ton.

Notably, in Vietnam's pepper export market, black pepper prices of 500 g/l and 550 g/l suddenly decreased to the threshold of 6,400 - 6,600 USD/ton. In the same direction, ASTA white pepper prices decreased by 200 USD/ton, offered for sale at a price of 9,150 USD/ton (equivalent to 241,478 VND/kg).

Perspectives and forecasts

A report from the International Pepper Community (IPC) shows that the global pepper market is entering a rebalancing cycle, possessing both opportunities and facing challenges. Large manufacturing countries are recommended to continue to monitor weather developments, increase investment in sustainable production and better manage risks to ensure stable supply in the coming years.

IPC estimates that global pepper production will reach 530,426 tons in 2026, although about 10,000 tons higher than the estimated production in 2025 of 520,407 tons, but about 21,000 tons lower than the adjusted production in 2024 of 551,298 tons. With a production of 530,426 tons and inventory of 205,452 tons, total consumption is expected to reach 735,878 tons in 2026.