Domestic pepper prices: Continue to stand still

As of 1:30 PM today (January 20), domestic pepper prices remained unchanged in all regions, averaging at 148,100 VND/kg. Currently, key areas are trading in the range of 147,500 - 148,500 VND/kg.

Maintaining a price lower than 4,000 VND/kg compared to the previous week, the pepper price list for specific regions is currently as follows:

Ho Chi Minh City and Gia Lai listed at 148,000 VND/kg.

Dong Nai province is the purchasing area with the lowest price of 147,500 VND/kg.

Dak Lak and Lam Dong are still the two provinces with the highest prices. Currently, these 2 areas are put on the market at 148,500 VND/kg.

World pepper prices: Fluctuations

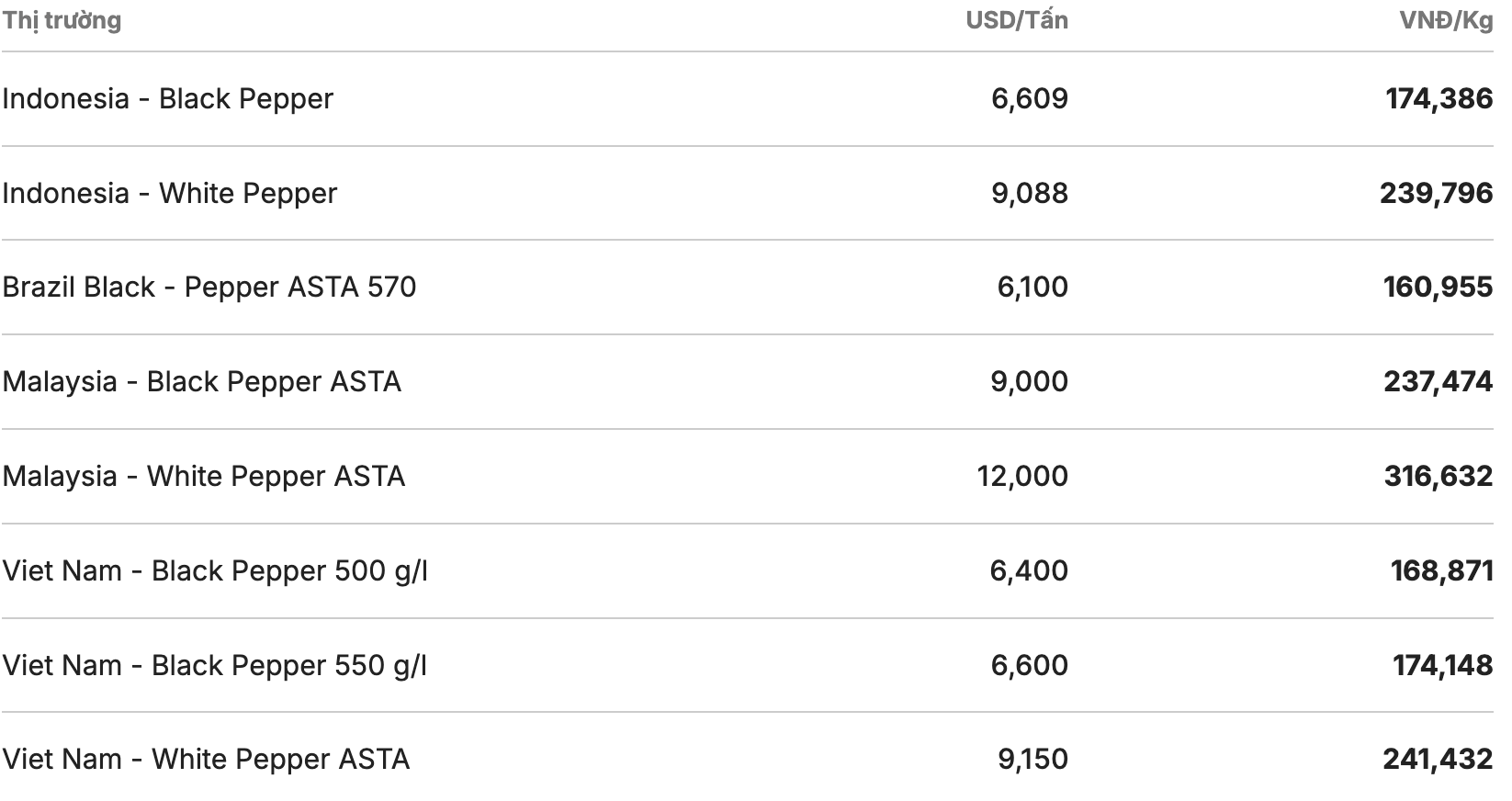

In the world market, pepper prices reversed in some countries. The Indonesian exchange - one of the most vibrant markets is no exception. These two commodities traded in the range of 6,609 - 9,088 USD/ton (equivalent to 174,386 VND/kg - 239,796 VND/kg), increasing by 46 USD/ton and 30 USD/ton respectively.

Meanwhile, the Brazilian market stood at 6,100 USD/ton (about 160,955 VND/kg). In the opposite direction, black and white pepper continued to remain unchanged, trading at 12,000 USD/ton and 9,000 USD/ton.

Notably, in Vietnam's pepper export market, black pepper prices of 500 g/l and 550 g/l remained at the threshold of 6,400 - 6,600 USD/ton. In the same direction, ASTA white pepper prices continued to maintain a decrease of 200 USD/ton, offering for sale at a price of 9,150 USD/ton (equivalent to 241,432 VND/kg).

Perspectives and forecasts

According to statistics from the Vietnam Pepper and Spice Plant Association (VPSA), in 2025, Vietnam exported about 247,482 tons of pepper, with a turnover of over 1.6 billion USD, an increase of more than 26% compared to 2024. This is the highest turnover ever of the pepper industry.

This result shows a clear change in the growth structure of the industry, when export prices become a decisive factor, instead of output as in previous periods.

Despite achieving positive results in 2025, businesses in the industry believe that entering 2026, Vietnamese pepper will face many challenges, mainly from the industry's internal situation. First of all, there is the risk of a shortage of domestic raw materials due to the continued shrinking of the area and pepper growers limiting investment due to high input costs. This may increase purchasing competition, pushing up the costs of export businesses.