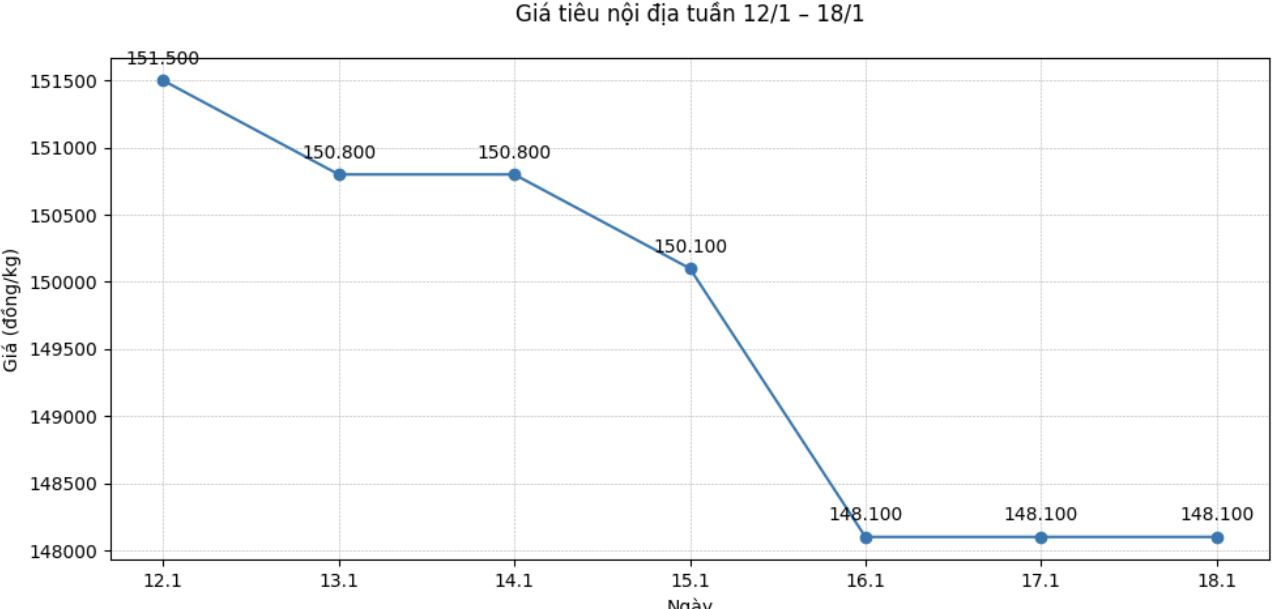

Domestic pepper prices: Weekly "turn around" to reduce prices

Today (January 18), domestic pepper prices traded in the range of 147,000 - 148,500 VND/kg, down 4,000 VND/kg in all regions compared to the previous week.

At the end of last week, pepper prices in Dong Nai, Dak Lak and Lam Dong recorded a sharp decrease of 3,500 VND/kg, falling to 147,500 VND/kg and 148,500 VND/kg respectively.

Similarly, pepper prices in Ho Chi Minh City decreased by 3,500 VND/kg, trading at 148,000 VND/kg.

Pepper prices in Gia Lai are in the same direction, currently being purchased at 148,000 VND/kg, down 2,000 VND/kg.

World pepper prices: Price drop

According to the International Pepper Corporation (IPC), world pepper prices simultaneously decreased.

Indonesian black pepper price decreased by 154 USD/ton compared to the previous week, down to 6,563 USD/ton. At the same time as the survey, Indonesian white pepper price decreased by 25 USD/ton compared to the previous week, reaching 9,118 USD/ton.

Brazilian black pepper ASTA 570 reversed to a decrease of 50 USD/ton, down to 6,100 USD/ton. Meanwhile, the price of black and white ASTA Malaysia pepper remained unchanged, selling at 9,000 USD/ton and 12,000 USD/ton respectively.

In Vietnam, black pepper export prices simultaneously slipped by 200 USD/ton compared to the closing price last week, at 6,400-6,600 USD/ton for 500 g/l and 550 g/l types. At the same decrease, ASTA white pepper price is currently at 9,150 USD/ton.

Perspectives and forecasts

In complete contrast to the dien bien of the previous week when domestic pepper prices increased sharply on a large scale, this week the item has adjusted to below the threshold of 150,000 VND/kg.

Although red is still present on the weekly chart, the price did not decrease further in the last 2 days of the week, showing that profit-taking selling pressure has been somewhat absorbed.

The supply to the market is currently not too large because farmers still maintain the psychology of expecting the recovery of pepper prices in the context of production forecast to decrease significantly due to the impact of weather phenomena from 2025.

Besides supply and demand factors, the dien bien of the USD index anchored at a high level is also a barrier to the breakthrough of agricultural products priced in greenback.