Domestic pepper prices: Sideways in the first session of the week

As of 11:30 AM today (February 2nd), domestic pepper prices remained unchanged in the first session of the week, averaging 150,400 VND/kg. Currently, key areas are trading in the range of 149,000 - 152,000 VND/kg.

The first trading session of the week recorded a sideways price range, currently the pepper price list for specific regions is as follows:

Dong Nai is anchored at the threshold of 150,000 VND/kg.

Gia Lai and Lam Dong respectively put them on the market in the price range of 149,000-151,000 VND/kg. Among them, Gia Lai is the province with the lowest price.

Ho Chi Minh City and Dak Lak still maintain the price threshold of 150,000-152,000 VND/kg.

Compared to the first week of January, the average pepper price decreased slightly by 200 VND/kg. Although there were times when pepper prices skyrocketed, climbing to an average of 151,500 VND/kg, they quickly reversed to below the 150,000 VND/kg mark.

World pepper prices: In the same direction

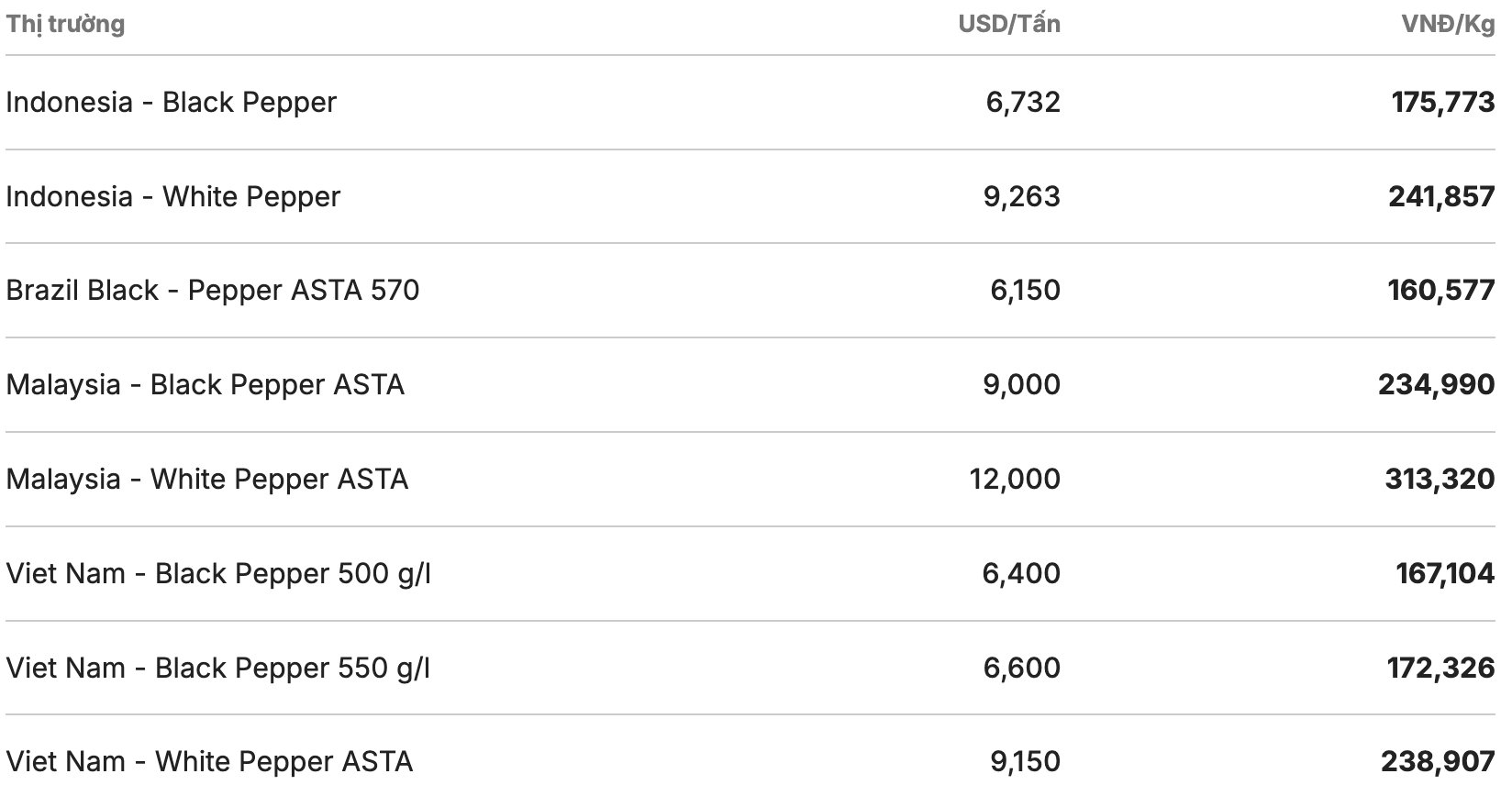

In the world market, pepper prices do not have much fluctuation. The Indonesian exchange alone - one of the most active markets - is sideways. These two items are traded in the range of 6,732 - 9,263 USD/ton (equivalent to 175,773 VND/kg - 241,857 VND/kg).

Meanwhile, the Brazilian market maintained its upward momentum, trading at 6,150 USD/ton (about 160,577 VND/kg). Black and white pepper continued to remain unchanged, trading at 12,000 USD/ton and 9,000 USD/ton.

Notably, in Vietnam's pepper export market, the price of black peppers of 500 g/l and 550 g/l is maintained at the threshold of 6,400 - 6,600 USD/ton. ASTA white pepper price continues to be offered for sale at 9,150 USD/ton (equivalent to 238,907 VND/kg).

Assessments and forecasts

According to experts, although trading is sluggish due to bonded warehouses and agents temporarily stopping importing goods for Tet holiday, the price above 150,000 VND/kg is a good psychological support.

Garden owners are currently not under pressure to sell at any price, while forecasting that global supply in 2026 will continue to be in deficit makes the expectation of price increases after Tet even clearer.