Gold price increases, silver is not out of the picture

According to Kitco, gold is still a safe haven asset favored by investors in the context of increasing economic and geopolitical instability. For many analysts, gold reaching $3,000/ounce is just a matter of time, or even a small milestone in a larger rally.

In the latest report, Bank of America (BoA) said that if investment demand increases by 10%, gold prices could completely reach 3,500 USD/ounce. This is not a far-fetched prospect, especially when capital flows from ETFs have just begun to return, still much lower than the peak in 2020.

China continues to be an important driver for gold prices. Last weekend, the Chinese government launched a pilot program, allowing the country's top 10 insurance companies - including its two largest - to invest up to 1% of their assets in gold.

According to the BoA, this could help the gold market receive an additional $28 billion, equivalent to about 300 tons of gold, accounting for 6.5% of annual physical gold demand. See more...

Laundry demand is booming, the number of customers increases during the wet season

Yen breaks strongly, towards a record

The Japanese Yen (JPY) is on a three-day streak of consecutive price increases, heading towards its highest level since December 2024, thanks to expectations that the Bank of Japan (BoJ) will continue to raise interest rates. The main reason is that strong GDP data just released this morning, February 17, shows that the Japanese economy is growing steadily.

Not only that, optimism about the possibility of delaying US President Donald Trump's counterpart tariffs and the narrowing of the US-Japan interest rate gap are also boosting demand for the Yen, a safe-haven asset.

In addition, the USD is under selling pressure, causing the USD/JPY pair to fall to a one-week low, fluctuating around 151.00. However, investors are still cautious about the potential impacts of Trump's policies. In addition, the possibility of the Fed continuing to maintain a "hawl" stance could support the USD and limit the decline of this currency pair. See more...

Coffee prices rebound, waiting for a breakthrough

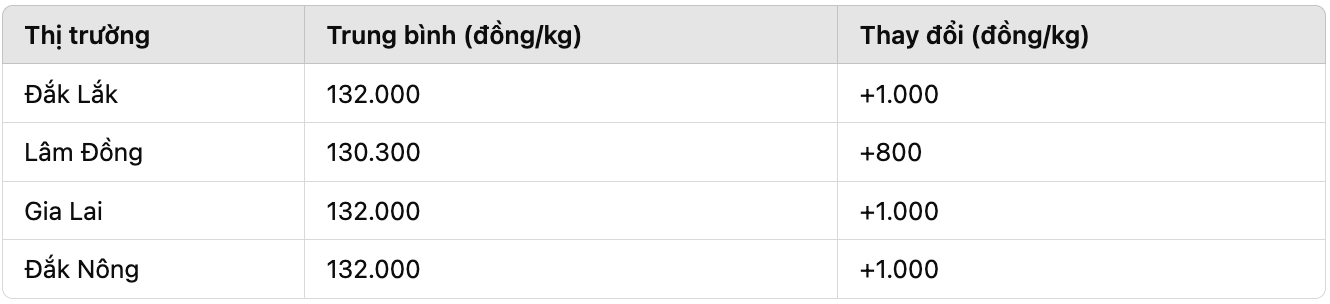

According to records on February 17, domestic coffee prices in key areas such as Dak Lak, Gia Lai, Dak Nong all reached 132,000 VND/kg, an increase of 1,000 VND/kg compared to the previous session. Lam Dong alone is currently trading at 130,300 VND/kg, up 800 VND/kg.

On the London Stock Exchange, Robusta prices for delivery in March 2025 remained unchanged at 5,735 USD/ton. Longer terms have slight adjustments. Meanwhile, Arabica prices on the New York exchange also did not have strong fluctuations after the trading session at the end of the week. See more...