Profit in the fourth quarter of 2024 broke out strongly

According to the consolidated financial statements for the fourth quarter of 2024, TPBank recorded pre-tax profit of more than VND 2,136 billion, 3.4 times higher than the same period last year. This is an impressive growth rate, in which:

Service income increased by 42%, reaching nearly VND 909 billion, thanks to the strategy of developing a digital financial ecosystem.

Interest rates from investment stocks increased dramatically to VND724 billion, nearly 23 times higher than the same period, becoming the main driving force for profit.

Credit risk provision costs decreased by 40%, to only VND 1,190 billion, helping TPBank optimize business efficiency.

In the whole year of 2024, TPBank recorded VND 7,599 billion in pre-tax profit, up 36% compared to 2023 and exceeding the set VND 7,500 billion plan.

Notably, in the context of the financial market facing many challenges, TPBank still maintains a credit growth rate of 18%, total assets reached VND 418,028 billion, up 17% over the beginning of the year.

TPB stock price developments

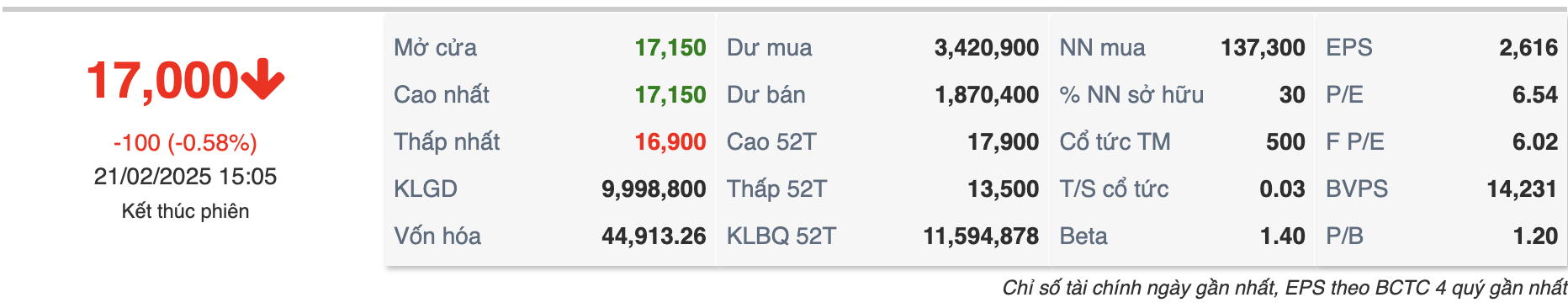

During the week from February 17 to February 21, 2025, TPB shares traded in a narrow range, ranging from VND 16,850 - 17,100/share.

At the end of the session on February 21, 2025, TPB closed at VND17,000/share, down slightly by 0.58% compared to the previous session.

Liquidity remains high, with nearly 10 million shares traded per session, showing stable interest from investors.

Although TPBank announced outstanding profits, TPB's stock price has not had a strong breakthrough. This could be a sign that the market is cautious, or this stock has not been valued at its growth potential.

Valuation and growth potential

As of February 21, 2025, TPB shares are being traded with the following financial indicators:

P/E (Price to Earnings Ratio): 6.54 times, reflecting the stock price vs. profit per share.

P/B (Price to Book Ratio): 1.20 times, showing that the market price of TPB shares is trading close to the book value.

EPS (Earnings Per share): VND 2,616, calculated according to the financial statements of the last 4 quarters.

BVPS (Book Value Per share): 14,231 VND, reflecting the bank's stable financial foundation.

ROE (Return on Equity) in 2024: 17.27%, showing the ability to make a profit on equity.

ROA (Return on Assets) in 2024: 1.57%, showing the profit on total assets of TPBank.

Compared to the industry average, TPB's P/E is at a reasonable level, reflecting investors' expectations of relatively stable profits. The P/B at 1.20 times shows that the trading stock price is close to the book value, not valued too high compared to equity. In general, financial indicators show that TPB has a solid foundation to continue growing, but current stock prices have not yet fully reflected the bank's potential.

*Note: The above indicators are for reference only and may change according to market developments. Investors need to check the latest information from official sources before making an investment decision.

Recommendations from financial institutions

According to a reporter's survey, securities companies gave a rather positive view of TPB shares:

MB Securities (MBS): "QuAN best results" recommendation, target price of VND 21,800/share, based on expectations of net profit increasing by 22,2% in 2025.

SSI Research: Provided a target price of VND 19,800/ part, up 19.3% compared to present, emphasizing TPB's growth potential.

VietinBank Securities (CTS): Recommend "MUA" with a target price of VND 17,400/share, expected profit of 8.5-11.8% in the short term.

This article aims to provide information on the financial situation and price movements of TPB shares, not as investment advice. Investors need to carefully consider risk factors, market developments and consult financial experts before making a decision.