The Ministry of Home Affairs has issued Circular 002/2025 on amendments and supplements of a number of articles of the Circular 01/2025 dated January 17, 2025 of the Minister of Home Affairs.

Circular 002 stated that cadres, civil servants, officials and employees specified in Article 2 of Circular 01 (amended and supplemented in Clause 2, Article 1 of this Circular) is eligible and decided by the competent authority for retirement before the age of retirement prescribed in Appendix I or Appendix II together with Decree No. 135/2020/ND-CP, which is entitled to pension with the rules of social insurance. retirement due to retirement before age;

At the same time, they are entitled to retirement allowances once; The allowance for the number of years of early break and allowance is allowed by time to pay compulsory social insurance provisions specified in Article 7, Article 7a and Article 7B of Decree No. 178/2024 (amended and supplemented in Clauses 6, 7 and 8, Article 1 of Decree No. 67/2025).

According to the Ministry of the Interior, in the case of an age of over 5 years to 10 years to retirement age prescribed at Point b, Clause 2, Article 7 of Decree No. 178/2024/ND-CP, entitled to the following 3 allowances:

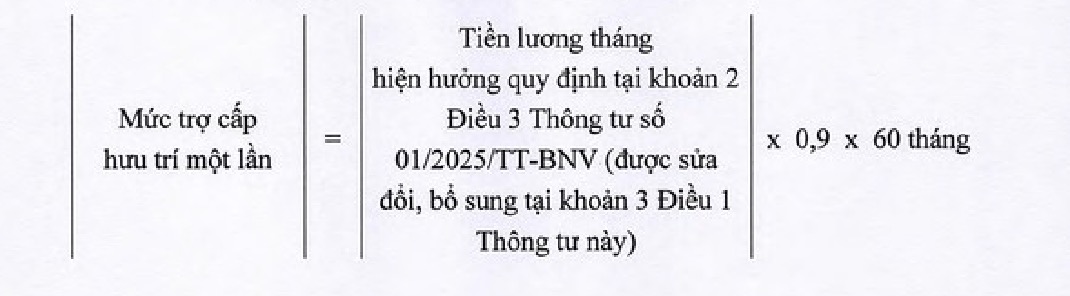

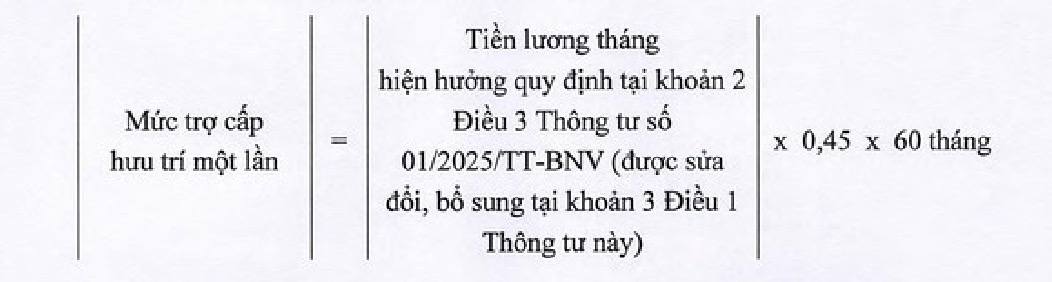

One-time pension for months of early retirement

For those who retire within the first 12 months:

For those who retire from the 13th month onwards:

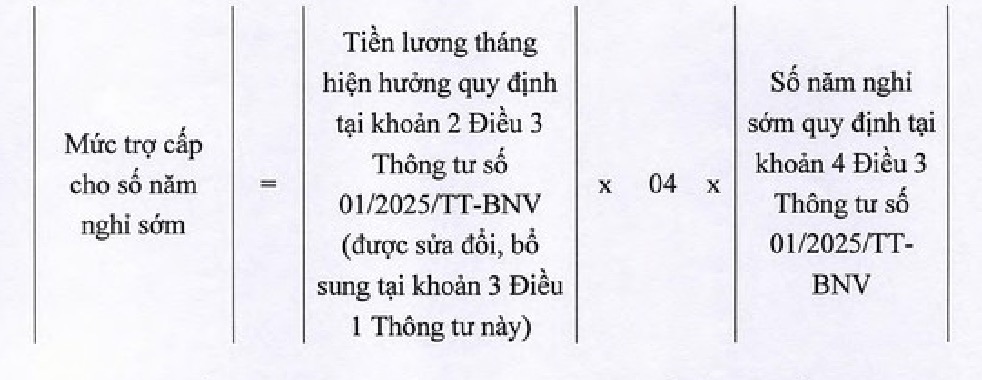

Allowance for the number of years of vacation early

Each year off early (full 12 months) is entitled to 4 months of salary currently enjoyed.

Periods by time working with compulsory social insurance premium

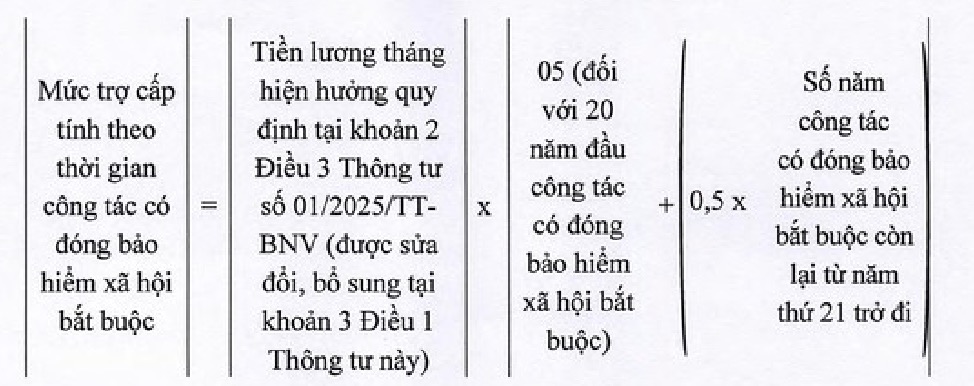

For those who leave before the Law on Social Insurance in 2024, take effect (except for female cadres and civil servants), the allowance level is calculated as follows: The first 20 years of the work with compulsory social insurance premium is allowed to receive a 5 -month salary of the current salary; For the remaining years (from the 21st year onwards), each year is allowed to provide 0.5 months of salary.

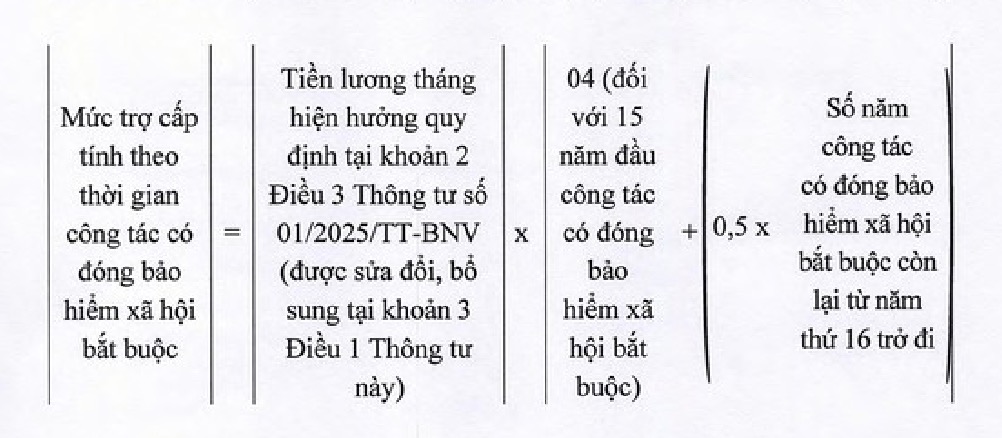

For female cadres and civil servants from the commune level from January 1, 2025 onwards and those who leave from the Law on Social Insurance in 2024 take effect, the allowance level is calculated as follows: The first 15 years of work with compulsory social insurance premium is allowed to be granted 4 months of current salary; For the remaining years (from the 16th year onwards), each year is allowed to provide 0.5 months of salary.

Point b, Clause 2, Article 7 of Decree No. 178/2024/ND-CP states:

b) In case of being over 5 years old to 10 years to retirement age prescribed in Appendix I issued together with Decree No. 135/2020/ND-CP and has enough time to pay compulsory social insurance to enjoy pension in accordance with the law on social insurance, in addition to enjoying the retirement regime in accordance with the law on social insurance, it is also entitled to the following regimes:

Not deducted pension ratio due to retirement before age;

Get a 4-month salary level for each retirement year before the retirement age prescribed in Appendix I issued together with Decree No. 135/2020/ND-CP;

Get a 5 -month salary allowance for the first 20 years of work with compulsory social insurance premium. From the 21st year onwards, every year the work has compulsory social insurance premiums are allowed to grant 0.5 months of salary.