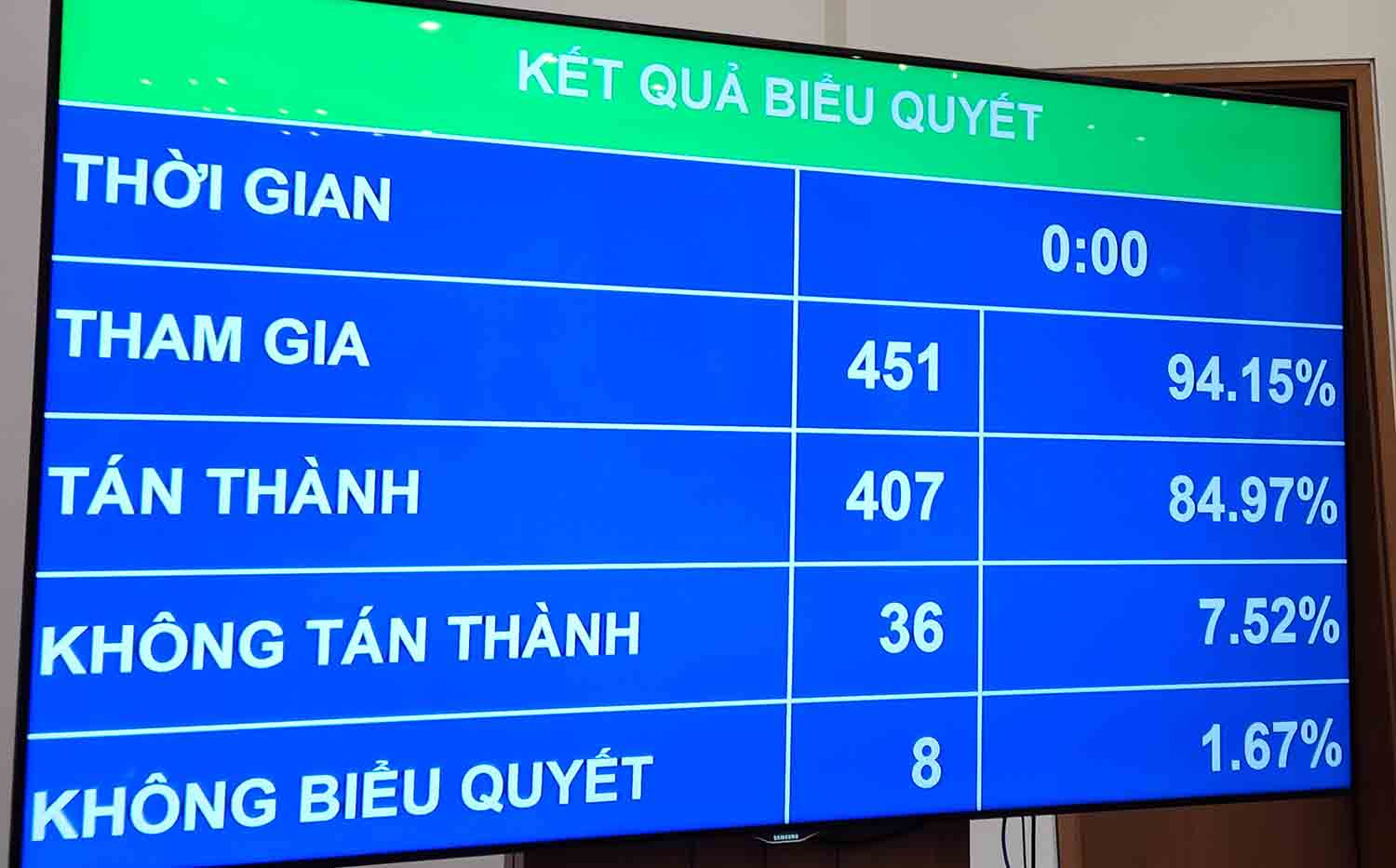

Accordingly, the National Assembly passed the new Law on Value Added Tax (VAT) with 407/451 delegates in favor.

Before voting, the National Assembly listened to Chairman of the Finance and Budget Committee Le Quang Manh briefly report on the explanation, acceptance and revision of this draft Law.

According to the Chairman of the Finance and Budget Committee, many opinions agree with the proposal to apply a 5% tax rate on fertilizers. Some opinions suggest keeping it as the current regulations; some opinions suggest applying a 0%, 1%, or 2% tax rate.

Regarding the proposal to apply 0% VAT rate (or 1%, 2%), the Chairman of the Finance and Budget Committee said exactly as the delegate said, if the regulation applies 0% tax rate to fertilizer, it will ensure benefits for both domestic fertilizer production enterprises and importing enterprises because they will be refunded the input VAT paid and will not have to pay output VAT.

However, in this case, the State will have to spend its budget every year to refund taxes to businesses. In addition to the disadvantage for the State budget, applying a 0% tax rate to fertilizers is contrary to the principles and practices of VAT, which is that a 0% tax rate only applies to exported goods and services, not to domestic consumption.

“Applying in this direction will break the neutrality of tax policy, create a bad precedent and be unfair to other manufacturing industries. According to the explanation of the drafting agency, the regulation of adding a 2% tax rate will require restructuring the VAT Law such as designing a separate section on tax rates, adding regulations on VAT refunds for this case,” said Mr. Le Quang Manh.

In addition, the regulation of a 1% or 2% tax rate on fertilizers is also inconsistent with the goal of VAT reform, which is to reduce the number of tax rates, not to increase the number of tax rates compared to current regulations, as explained to National Assembly deputies.

Based on the opinions of the National Assembly deputies, in Report No. 1035/BC-UBTVQH15 dated October 28, 2024, the National Assembly Standing Committee explained and reported on the impact of changing fertilizer products from non-taxable to 5% taxable. The Government also issued Official Dispatch No. 692/CP-PL to supplement the explanation and provide specific supporting data.

To properly express the National Assembly's viewpoint in handling the above issue, on November 26, 2024, the Secretary General of the National Assembly sent a request for the National Assembly deputies' opinions on two options. One is to apply a 5% tax rate, the other is to keep it as current regulations.

Through the synthesis of opinions, it is shown that 72.67% of the total number of National Assembly deputies agreed with the proposal of the National Assembly Standing Committee and the Government to stipulate a tax rate of 5% for fertilizers, machinery, specialized equipment for agricultural production, and fishing vessels. This content is shown in Clause 2, Article 9 of the draft Law.

This Law comes into force from July 1, 2025, except for some other cases.