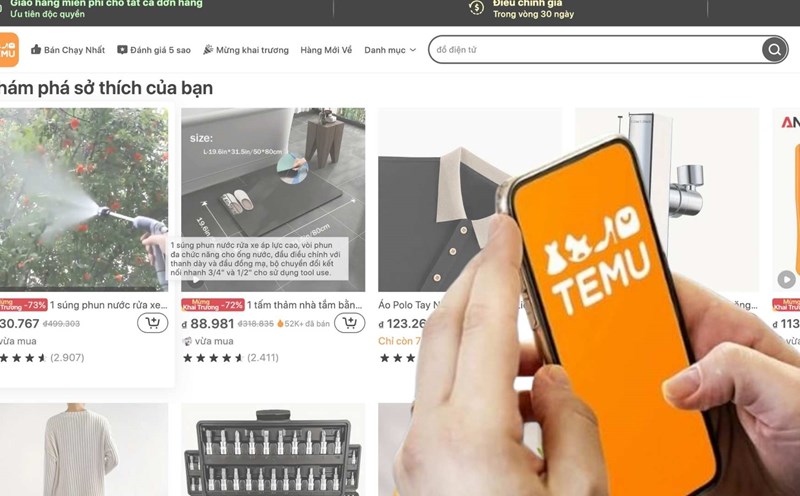

On the afternoon of November 9, at the regular Government press conference in October 2024, the press asked the leaders of the Ministry of Industry and Trade and the General Department of Taxation about the agencies' management of the e-commerce platforms Temu and Shein.

Responding to this content, Deputy Minister of Industry and Trade Nguyen Hoang Long said that regarding cross-border e-commerce platforms, the Ministry of Industry and Trade has worked with the legal agencies of Temu and Shein platforms.

In particular, it is required to urgently register operations with the Ministry of Industry and Trade according to Vietnamese law in November 2024. During the registration period, it is necessary to notify consumers that the registration procedure is being carried out.

According to Deputy Minister Nguyen Hoang Long, Temu and Shein must stop all commercial and advertising activities that violate Vietnamese law to protect consumers.

The Ministry of Industry and Trade also requested these platforms to urgently study other laws related to e-commerce such as customs and taxes.

“Shein and Temu are working closely with the Ministry of Industry and Trade and in November 2024, these two exchanges will register to operate in Vietnam,” said Mr. Nguyen Hoang Long.

The Deputy Minister of Industry and Trade affirmed that after the announcement, if these exchanges do not comply, the Ministry of Industry and Trade will coordinate with competent authorities to implement technical measures such as blocking applications and blocking domain names.

“We will continue to carry out inspections, checks, and warn consumers about risks with unlicensed e-commerce platforms,” said the Deputy Minister of Industry and Trade.

In addition, the Deputy Minister of Industry and Trade affirmed that he will promote the communication of the movement of Vietnamese people giving priority to using Vietnamese goods. The Ministry of Industry and Trade will review relevant regulations and make recommendations to the Government on management frameworks for cross-border e-commerce platforms that are receiving public attention.

Previously, providing more information about this content, Mr. Mai Son - Deputy General Director of the General Department of Taxation affirmed that the business activities of Vietnamese e-commerce platforms are business activities that must be licensed and subject to State management by the Ministry of Industry and Trade.

Regarding the field of State management of domestic revenues, including revenues from e-commerce business activities, based on the provisions of the Law on Tax Administration and Circular No. 80/2021, e-commerce platform managers such as Temu, Shein Amazon... are responsible for registering, self-calculating, self-declaring, and self-paying taxes directly through the Electronic Information Portal (TTDT) of the General Department of Taxation.

“If a foreign supplier is found to have declared incorrect revenue, the tax authority will compare data to determine revenue, thereby requesting the foreign supplier to fulfill its obligations and conducting inspections and checks according to regulations if there are signs of fraud or tax evasion,” said Mr. Mai Son.

According to the Deputy Director General of the General Department of Taxation, up to now, 116 foreign suppliers have registered, declared and paid taxes via the Electronic Portal for foreign suppliers.

Regarding Temu, the leader of the General Department of Taxation said that on September 4, 2024, Elementary Innovation Pte. Ltd - the owner and operator of the Temu platform in Vietnam - registered for tax through the General Department of Taxation's Foreign Supplier Portal and was granted tax code 9000001289.

According to Circular No. 80, foreign suppliers must declare and pay taxes quarterly.