On the afternoon of October 30, continuing the 10th Session, the National Assembly discussed in the hall the implementation of the state budget in 2025, the state budget estimate, and the central budget allocation plan for 2026.

Budget revenue increased 1.36 times, public debt is much lower than the prescribed limit

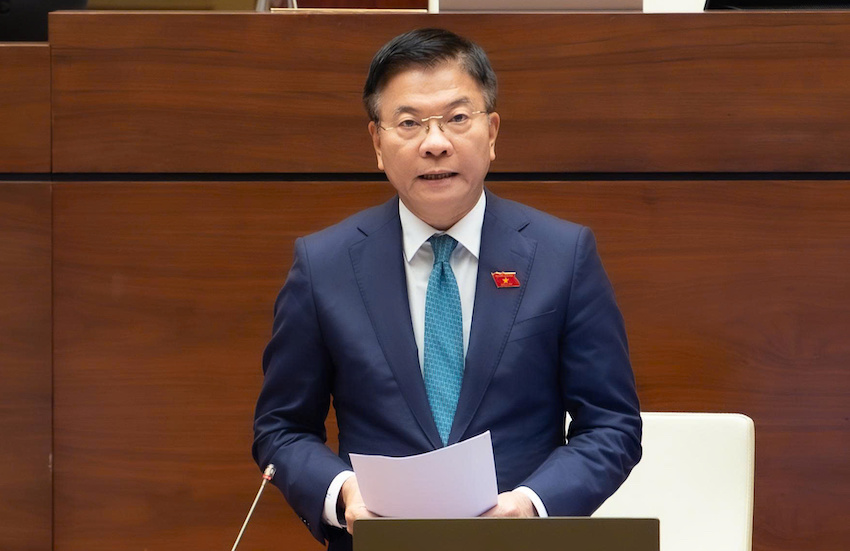

Deputy Prime Minister Le Thanh Long stated that in the context of many difficulties, we have made the highest efforts and determination in implementing the state budget revenue and expenditure estimate, achieving and exceeding all 12/12 main targets of the entire term. State budget revenue is estimated at 9.6 million billion VND, 1.36 times higher than the previous term, far exceeding the target of 8.3 million billion VND, while tax, fee, and charge exemptions, reductions, and extensions... are about 1.1 million billion VND; increased revenue and expenditure savings are 1.57 million billion VND.

Public debt, government debt, foreign debt, and state budget deficit are well controlled, much lower than the prescribed limit; public debt decreased from 44.3% of GDP in 2020 to about 35 - 36% in 2025 (limited to 60% of GDP); the average state budget deficit decreased from 3.53% of GDP in the 2016 - 2020 period to 3.1 - 3.2% of GDP in this term.

Domestic revenue from production and business increased by about 11.1% - the highest level ever strived

According to Deputy Prime Minister Le Thanh Long, the Government has directed the management of collection, ensuring correct, sufficient and timely collection; promoting the application of digital transformation, expanding the scope of application of electronic invoices; focusing on preventing revenue loss for e-commerce, service activities ( catering, hotels, etc.).

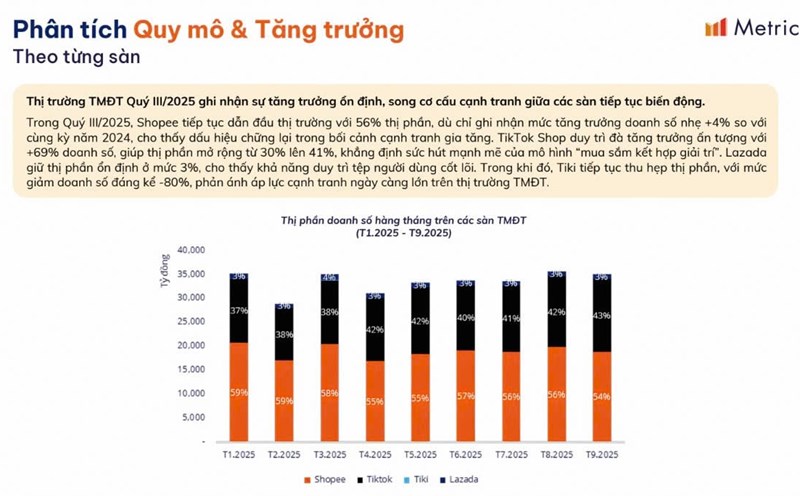

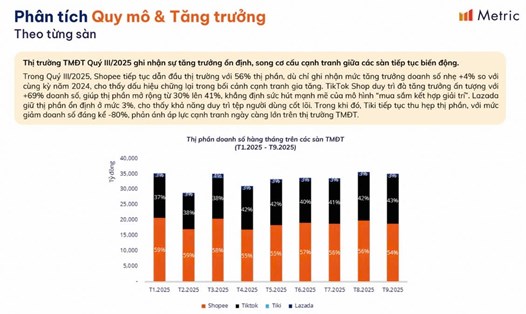

Revenue from e-commerce in 2025 will reach about 172 trillion VND, an increase of 67% compared to 2024; applying new tax collection solutions for business households, in the first 9 months of 2025, it will reach 25.1 trillion VND (an increase of 29.6% over the same period in 2024); the whole year is estimated to reach over 33 trillion VND. The total increase in state budget revenue for the entire 2021 - 2025 term will reach 1.57 million billion VND, used to increase spending on development investment, spending on people (increased salaries), national defense and security and other important urgent tasks.

In the budget revenue structure for the period 2021 - 2025, revenue from production and business accounts for mainly 62.5%, revenue from land use fees accounts for 13%, revenue from import and export accounts for 13.2% (pre-term expectations were 61.7%; 10.1% and 14.1% respectively). Regarding the structure of state budget expenditures, expenditures for development investment account for 32-33%; regular expenditures account for 57 - 58% (pre-term expenditures accounted for 28% and 63.2% respectively). Plan 2026 - 2030, development investment expenditure will increase to 40%; regular expenditure will be about 50.7%.

"The 2026 state budget revenue estimate is built closely following the goals and tasks according to the Resolutions of the Party and the National Assembly. Of which, domestic revenue from production and business increased by about 11.1%, the highest level of striving to date, higher than the economic growth target (10%); at the same time, taking into account the impacts and impacts of factors such as revenue from import and export, land, resources, etc.," the Deputy Prime Minister stated.

In the coming time, the Government will continue to direct the Ministry of Finance and relevant agencies to implement solutions to increase the application of information technology, digital transformation, focusing on doing a good job of analysis and forecasting to serve the development of state budget revenue and expenditure estimates and management of state budget revenue and expenditure.

Public investment disbursement was low at the beginning of the year, increasing sharply at the end of the year

Deputy Prime Minister Le Thanh Long said that the disbursement of public investment capital from the beginning of the year to the end of October 23, 2025 is VND 465 trillion, reaching 51.7% of the plan assigned by the Prime Minister; the disbursement rate is equivalent to the same period in 2024 of 51.5%, but the absolute capital is about VND 115,658 billion higher (same period in 2024 is VND 349,170 billion).

In general, public investment capital disbursement tends to be low at the beginning of the year, increasing sharply at the end of the year because contractors need time to construct, accumulate enough volume to accept and pay at the end of the year (during the term, the total 9 months of disbursement years are only about 49-51%; while the year-end disbursement results are from 91-95%).

Deputy Prime Minister Le Thanh Long said that since the beginning of the term, the Government and the Prime Minister have focused on directing strongly to promote the implementation and disbursement of public investment capital from the beginning of the year. However, the disbursement of public investment capital is sometimes and in some places still slow, and generally does not meet requirements, due to many objective and subjective reasons.

The scale of public investment capital in 2025 is about 900 trillion VND, an increase of about 33% compared to 2024 (678 trillion VND)...

According to the Deputy Prime Minister, taking into account the opinions of National Assembly deputies, the Government focuses on directing ministries, branches and localities to urgently overcome the above limitations and shortcomings, determined to strive to complete the disbursement rate of public investment capital in 2025 to reach the target of 100% of the plan assigned by the Prime Minister.