That shows flexible adaptability, correct strategies and a commitment to sustainable development in the consumer finance industry in Vietnam.

Decade's journey to stay at the top of consumer finance

Established in 2010 as a consumer credit institution under Vietnam Prosperity Joint Stock Commercial Bank (VPBank), FE CREDIT has quickly become a pioneer for the modern consumer finance industry in Vietnam.

In 2015, the company officially operated as an independent legal entity, thereby starting the journey to build a specialized financial institution with the goal of popularizing consumer capital in an official, transparent and sustainable manner.

To become a leading name, FE CREDIT has chosen a different development strategy, focusing on customers without mortgaged assets, unable to access traditional banks such as workers, traders, and unskilled laborers. With the " pre- and deep coverage" strategy, the company not only accessed the right corridor market but also "left open" by credit institutions, but also quickly built a solid foundation for a long-term growth model.

From the first product, installment loans for motorbikes, FE CREDIT has continuously expanded its portfolio, including cash loans, installment loans for phone - electricity, credit cards and related insurance. This diversity helps the company reach more customer segments, while controlling credit risks better.

After a period of rapid development, the consumer finance market has entered a period of harsh screening, due to the impact of the Covid-19 pandemic, the pressure from credit control policies, high interest rates in the period of 2022 - 2023, along with changes in consumer spending behavior. Many businesses have narrowed or withdrawn. However, with a comprehensive restructuring strategy supported by parent bank VPBank and SMBC Group, FE CREDIT not only maintains stability, but still maintains its leading position.

A recognition for that journey is that FE CREDIT has been consecutively named at number one in the prestigious financial company rankings published by Vietnam Report in collaboration with VietnamNet newspaper on August 1, 2025. The ranking is based on three comprehensive assessment pillars: financial capacity, media reputation and customer, expert and partner trust.

In 2024, after two years of comprehensive restructuring, FE CREDIT achieved nearly VND515 billion in pre-tax profit, marking a strong recovery. Entering the first half of 2025, FE CREDIT continues to maintain its growth momentum with nearly 270 billion VND in pre-tax profit, recording a profit for the fifth consecutive quarter.

FE CREDIT is also a leading enterprise in building a distribution system with more than 13,000 points of sale nationwide. Total assets exceed VND 66,400 billion, not only strengthening the leading position in the industry in terms of scale but also demonstrating asset quality, operational efficiency and a solid capital foundation.

Diversify, digitize, and develop responsibly

FE CREDIT's success not only affirms its leading position in terms of market share and assets, but also by continuously adapting to market demand, innovating products, applying technology and maintaining a commitment to sustainable development. Three pillars: diversifying product portfolio, digitalizing customer journey and responsible development are the foundations that create current and future strength for businesses.

In the context of rapid market changes, FE CREDIT has flexibly expanded its product portfolio to no longer rely too much on cash loans, which are considered a high-risk segment.

The company diversified its segments into less risky groups such as installment loans for phones, electronics, motorbikes, credit cards and related insurance. These product lines not only meet people's actual spending needs but also help companies control credit risks more effectively, especially in the context of consumer behavior increasingly shifting towards convenience, flexibility and transparency.

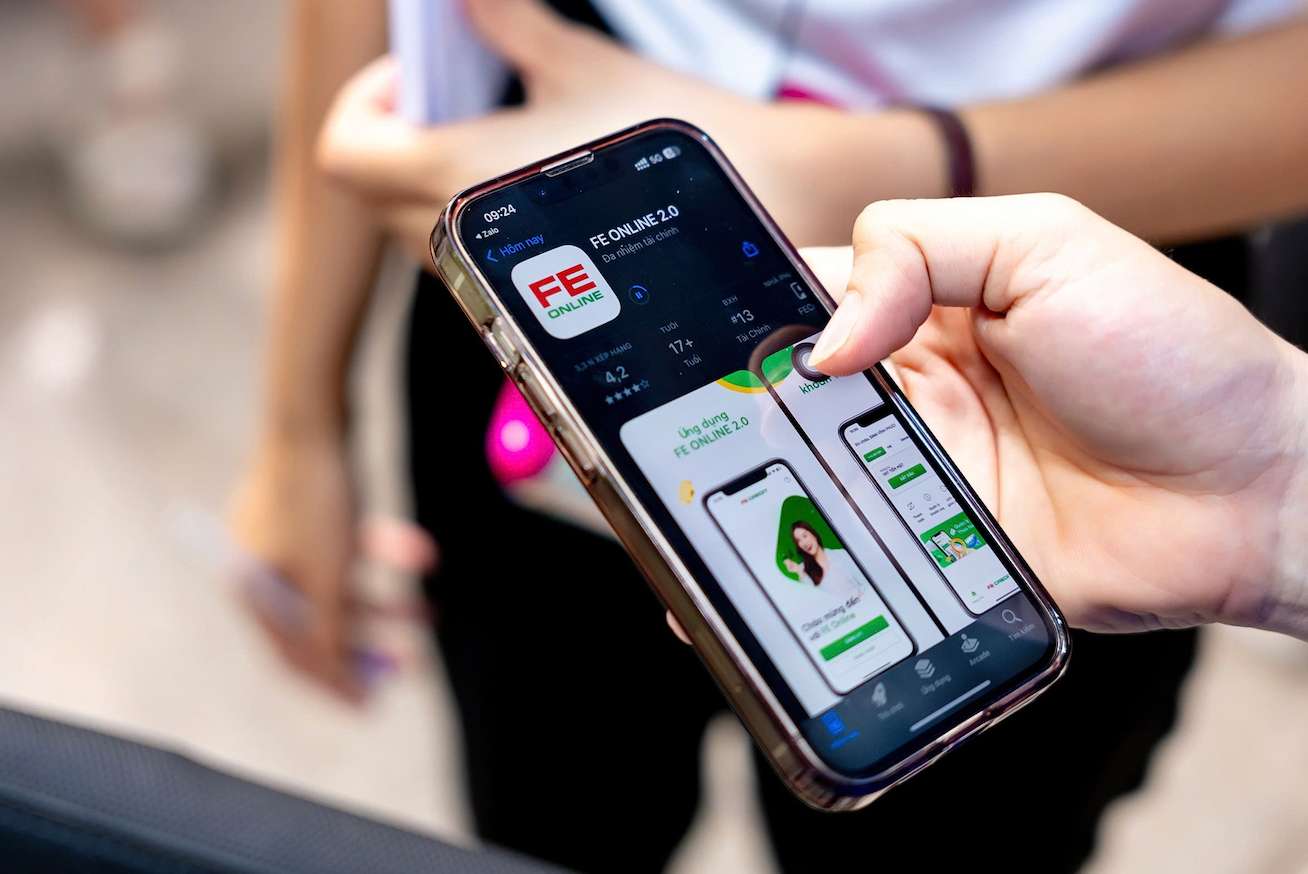

To serve a variety of customers, especially large groups such as workers, traders, freelance workers or people in remote areas - a segment often left unused by traditional financial institutions - FE CREDIT has invested heavily in digitalization. The FE ONLINE 2.0 application is a significant step forward, allowing customers to fully access financial services, from flexible loans, opening credit cards, looking up loans to tracking debt repayment schedules, with just a few simple steps on the phone.

The FE ONLINE 2.0 application and the company's strong digitalization strategies are also a "step" to anticipate long-term consumer trends, especially when Gen Z - a group of users who have the habit of spending and paying through digital platforms, is increasing in quantity, purchasing power and increasingly influential in the market.

Along with business development, FE CREDIT also does not forget the role of a responsible financial institution. With the goal of spreading financial knowledge and raising public awareness, the company has launched a series of financial education and communication programs "Finance Explorer".