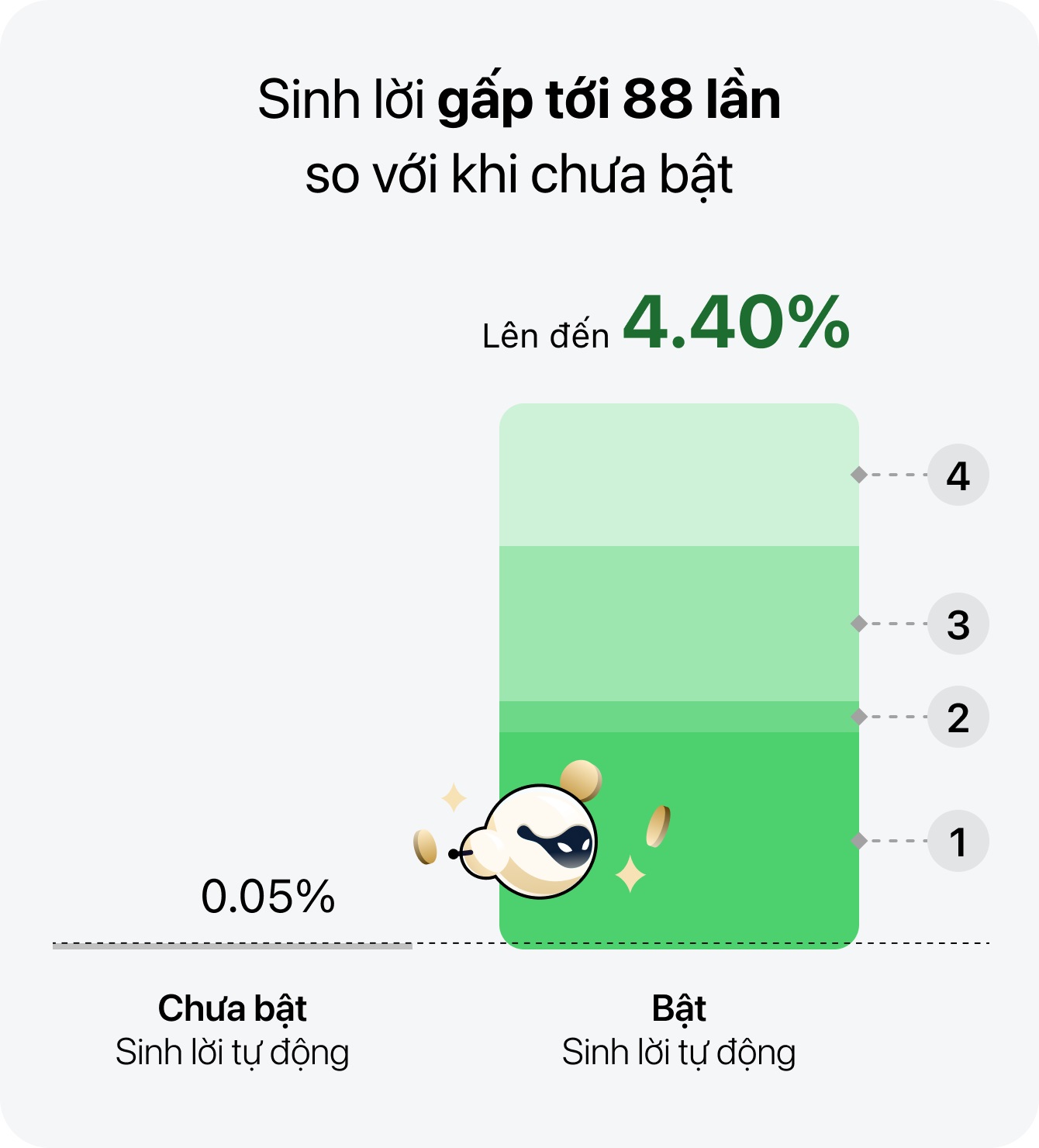

Obviously, in addition to the bank's efforts in researching and developing the product "Autumn profits", the change in customer behavior and awareness is the main driving force leading to the popularity of this wave. In the context of economic development and increasingly improved education, people are increasingly familiar with finance, more sensitive to profit opportunities and even more un accepting to leave money "standing still" at only 0.05%/year interest rate. Customers, especially Gen Y and Gen Z, who are sensitive to international trends, are always looking for flexible solutions, with the expectation of both optimizing the profitability of cash flow and being willing to spend 24/7. This shift reflects a new awareness of money: no longer just a transaction tool, but an asset that must "work" effectively anytime, anywhere.

Second, the development of digital banking and the "use" of technology by the people are the catalysts for this trend. Specifically, according to the Ministry of Information and Communications, as of the first 6 months of 2024, the rate of Internet users in Vietnam has reached 78.1%, and there are more than 100.7 million mobile subscribers using smartphones. According to data from the State Bank, many credit institutions have recorded a transaction rate via digital channels exceeding 90%. Accordingly, products such as Automatic Profit take advantage of technology to automatically scan balances, transfer idle money to profit channels, do not require customers to intervene manually but can still make transactions at any time, track balances and manage specific profit levels on mobile applications.

Third, the benefits of this model have helped strengthen this trend. For customers, the profit interest rate is higher than the regular deposit interest rate (up to 4.4%/year compared to 0.1-0.5%), helping them earn more income without losing liquidity. On the bank side, especially for units with technological advantages and management systems, this model helps increase the CASA ratio - reduce time and capital mobilization costs. From the reality of a huge resource that is just "standing still", profits automatically become an indirect investment capital for production and business development... to optimize benefits for the economy.

For many years, many banks in the world have developed financial products that allow automatic money transfers from payment accounts to financial instruments with higher interest rates such as sweep Account: money is automatically managed between major cash accounts and secondary investment accounts, Multiplier Account: combining payment, investment and insurance accounts... It can be said that the Vietnamese financial market must proactively Viet own products that are being favored in the world, which is an inevitable trend.

When pioneers are welcomed

We have invested in research and testing the product for more than 18 months to ensure improvement of features, safety and best meeting the actual needs of Vietnamese people a representative of Techcombank shared about the journey of nurturing a spiritual child and could also be said to be a Strategic flag country to renew CASA Bank.

With a yield of up to 4.4%/year but still maintaining the ability to pay immediately, without interruption/division, a dong is also profitable and a day is also profitable - considered a remarkable step forward in the banking industry, specifically on regular payment accounts. Not only stopping at outstanding profit performance, flexibility 24/7 but also ensuring liquidity safety with multi-layered protection layers: legal regulations, supervision by the State Bank, regulations on deposit insurance insurance and technology systems, security and risk management processes according to international standards.

The market and customers have changed greatly with practical experiences when cash flow has been " awakened" by Automatic Profit:

Ms. Thu Thuy (Hanoi) said: Techcombank is a prestigious brand and has made many contributions to the country and the community over the years, so I feel very secure when using the Bank's Automatic Profit - money that is still ready to be spent at any time, but automatically makes a profit without needing to do anything more. It is both safe, convenient and beneficial!.

In addition to its convenience, the safety of this product is highly appreciated by many customers: Just keep money in the account, it makes a profit and every month it reports clear and complete profits on the application. I have never had any problems with the bank's products and the customer service is also very dedicated. I find this product convenient, good, and extremely safe. It is true that technology development is to serve people!", Ms. Nhu Ngoc in Ho Chi Minh City shared.

In addition to the "sweet fruits" of customer trust, Techcombank Automatic profits has also proven its difference when surpassing many other competitors to excellently win 1 gold prize and 2 bronze awards for the categories: Best Product of 2025; Best AI Application Product and Best Financial Services product within the framework of the 22nd International Business Awards organized by Stevie Awards. Known as "Oscar in the international business field", Stevie Awards and the International Business Awards® (IBA) are one of the most prestigious and prestigious awards in the world for businesses.

The " profitable" revolution in the financial industry

The price that Techcombank paid to pioneer was also well rewarded when the product was warmly welcomed by the gods. More than 4.1 million customers have "taken" Automatic profits along with many other impressive financial indicators from Techcombank's digital banking have proven this.

In particular, Techcombank Automatic Profit has also promoted changes throughout the industry. The market picture of profit accounts has become more colorful with the participation of nearly a dozen banks since then with many products with different names: "super-yield account", "eKash", " sinh Loi bat bat", "Smart investment account"... and the difference is also the values that banks bring to users.

Despite different mechanisms, these products all aim to optimize customers' idle cash flow while mobilizing more capital to develop the country's economy in the new period.

Of course, leading banks will continue their journey to optimize value for cash flow and bring different experiences, Ms. Nguyen Van Linh - Deputy Director of Techcombank Retail Banking said: With Techcombank Automated Profit, we create an advanced financial product that is most suitable and optimal for the practical needs of Vietnamese people. Stevie Awards has recognized the excellence of this product in an effort to bring customers the most optimal benefits and at the same time, it is also a testament to the comprehensive Vietnamese product that is capable of competing with similar models in the region. With the spirit of excellent every day, we will continue to look at new versions with even higher features, utilities and protection in the future.

The Automatic Profit wave has brought new standards to the financial industry, similar to the "Zero Fee" revolution 10 years ago. A decade to build a habit of cashless and faster payments so that Profit Automation reshapes the way of financial management for Vietnamese people: the smartest, safest and most flexible.