According to Ernest Hoffman - market analyst of Kitco News, banks and goldsmiths in India are mass-storage goods to prepare for the holiday season and to avoid higher import tariffs expected to be applied at the end of the month.

Over the past few weeks, banks and gold shops have been rushing to clear large amounts of gold, an unnamed Indian government official told Reuters. Its been a long time since weve seen such a bustling scene.

The government expects gold clearing on the last day of the month to be even higher, before a new basic import tax rate for gold and silver is issued.

In India, the government adjusts the import base price every 15 days and this price is used to calculate import tariffs.

Chirag Thakkar - CEO of Amrapali Group (one of the major precious metals importers in Gujarat) said that banks and gold dealers are rushing to complete customs clearance before the new base price takes effect from Wednesday.

Even when gold and silver reached historical peaks, buyers were still rushing to sell goods, investment demand increased sharply, said Mr. Thakkar, adding that Amrapali Group bought more gold and silver in September than twice as much as in August.

However, experts warn that this import increase could put pressure on the already weak rupee and widen India's trade deficit.

India spent $5.4 billion to import 64.17 tonnes of gold in August and $451.6 million for 410.8 tonnes of silver, the Ministry of Commerce said. September trade data will be released in mid-October.

For many months, Indian jewelry traders have temporarily stopped buying gold and silver, waiting for prices to decrease, but now forced to accept high prices to reserve for the holiday season when prices continue to peak, according to a private banking agent in Mumbai.

In October, Indian people will celebrate Diwali - an occasion for buying gold that is considered to bring good luck.

This week, Indian dealers are selling gold at a difference of up to 8 USD/ounce compared to the official domestic price (including 6% import tax and 3% sales tax).

S upward purchases from India are surprising the market, especially as China remains outside this price, said a gold dealer in Singapore.

In China, dealers have even extended the discount to $31-71/ounce against the global benchmark price, the lowest level in many years.

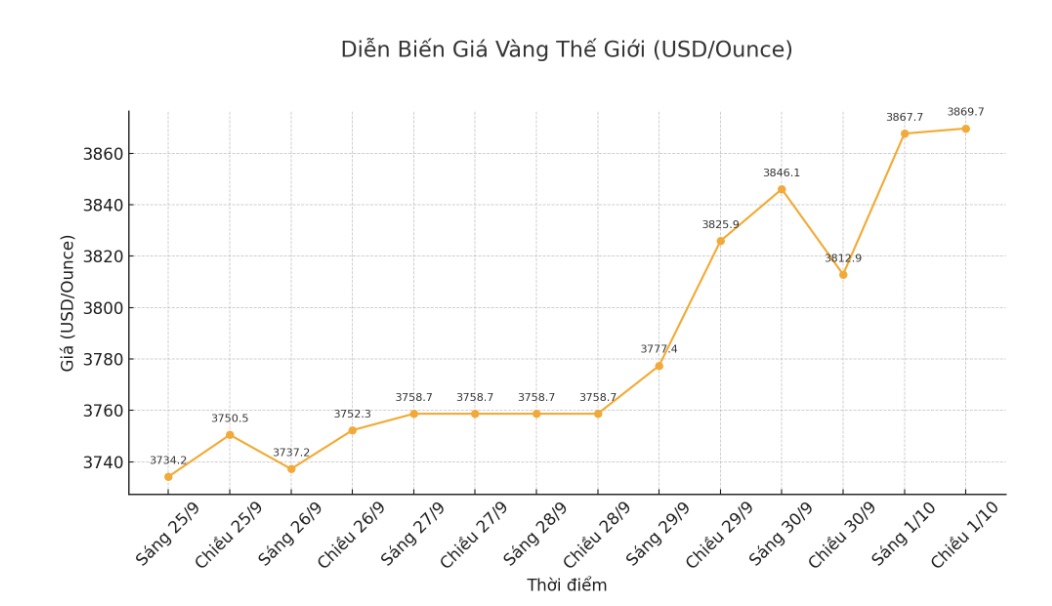

Meanwhile, spot gold prices peaked at $3,871.89 an ounce at nearly 3 a.m. (New York time) on Tuesday but then fell sharply due to many unsuccessful attempts to surpass the threshold. At the most recent time, spot gold prices stood at 3,836.12 USD/ounce, only increasing by 0.06% in the session.

See more news related to gold prices HERE...