Despite the risk of short-term fluctuations and the possibility of regulation, Bank of America (BofA - one of the largest banks in the US and the world) believes that gold and silver are still in a strong uptrend, with the forecast that gold prices could reach 5,000 USD/ounce and silver could reach 65 USD/ounce next year.

According to the bank's forecast, the average gold price in 2026 will be around 4,438 USD/ounce, while silver will average around 56.25 USD/ounce.

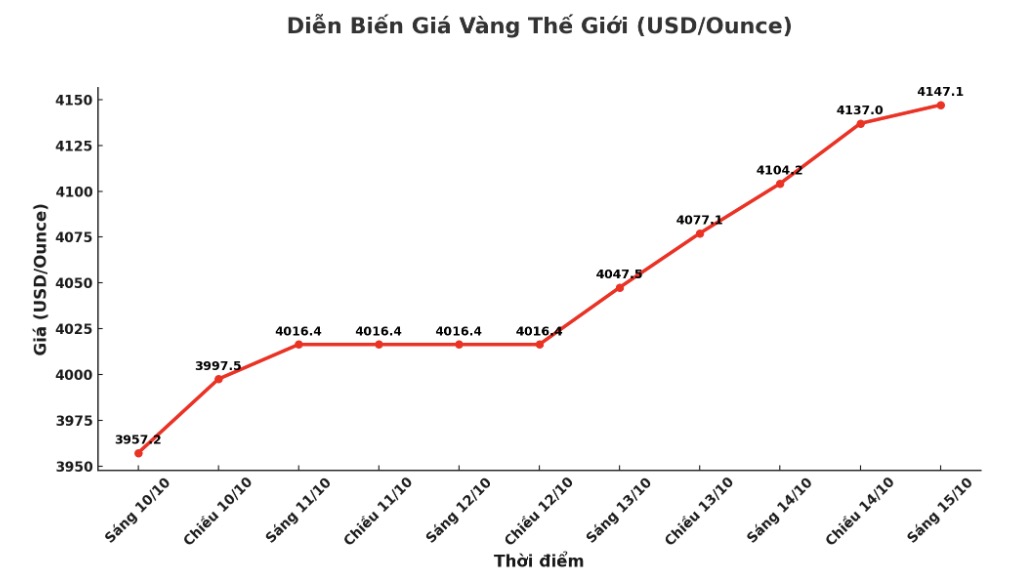

Bank of America is one of the first organizations to predict gold will reach the $4,000/ounce mark, and after this target became a reality, the bank's analysis team continued to raise expectations.

The White Houses fiscal policy with high deficits, rising public debt, efforts to reduce temporary account deficits and capital flows into the US, along with the trend of interest rate cuts when inflation remains around 3%, will continue to support gold - analysts of this bank commented.

The analysis team led by Michael Widmer said that a 14% increase in investment demand could push gold prices to $5,000/ounce, and in a more optimistic scenario, prices could reach $6,000/ounce.

To reach $6,000 an ounce, investor purchases need to increase by about 28% not impossible, but a big challenge, the analysis team said.

Despite maintaining a positive view on both gold and silver, Bank of America warned of the risk of adjustments in the short term.

Cital flows into ETFs increased by 880% year-on-year in September, reaching a record of $14 billion; total investment in physical gold and account gold also nearly doubled, accounting for more than 5% of the total value of global stocks and bonds. Therefore, we believe that the market may enter a period of accumulation and adjustment in the coming time".

Regarding silver, bank experts still see potential for price increases, although overall demand is forecast to decrease. We expect demand for silver to fall by about 11% next year, but the market remains in a state of shortage a supporting factor for this white metal, the report said.

Bank of America believes that the biggest risk for silver lies in changes in demand from the solar industry, as silver consumption in ph photovoltaic battery production is expected to peak next year.

Technically, December gold buyers still dominated in the short term, but the increase showed signs of weakening. The next target for buyers is to close above the strong resistance level of 4,300 USD/ounce, while the seller aims to pull prices below the solid support zone of 3,900 USD/ounce.

The immediate resistance level is at 4,190 USD/ounce and then 4,200 USD/ounce. The most recent support level is 4,105 USD/ounce, followed by 4,100 USD/ounce.

See more news related to gold prices HERE...