Domestic silver price

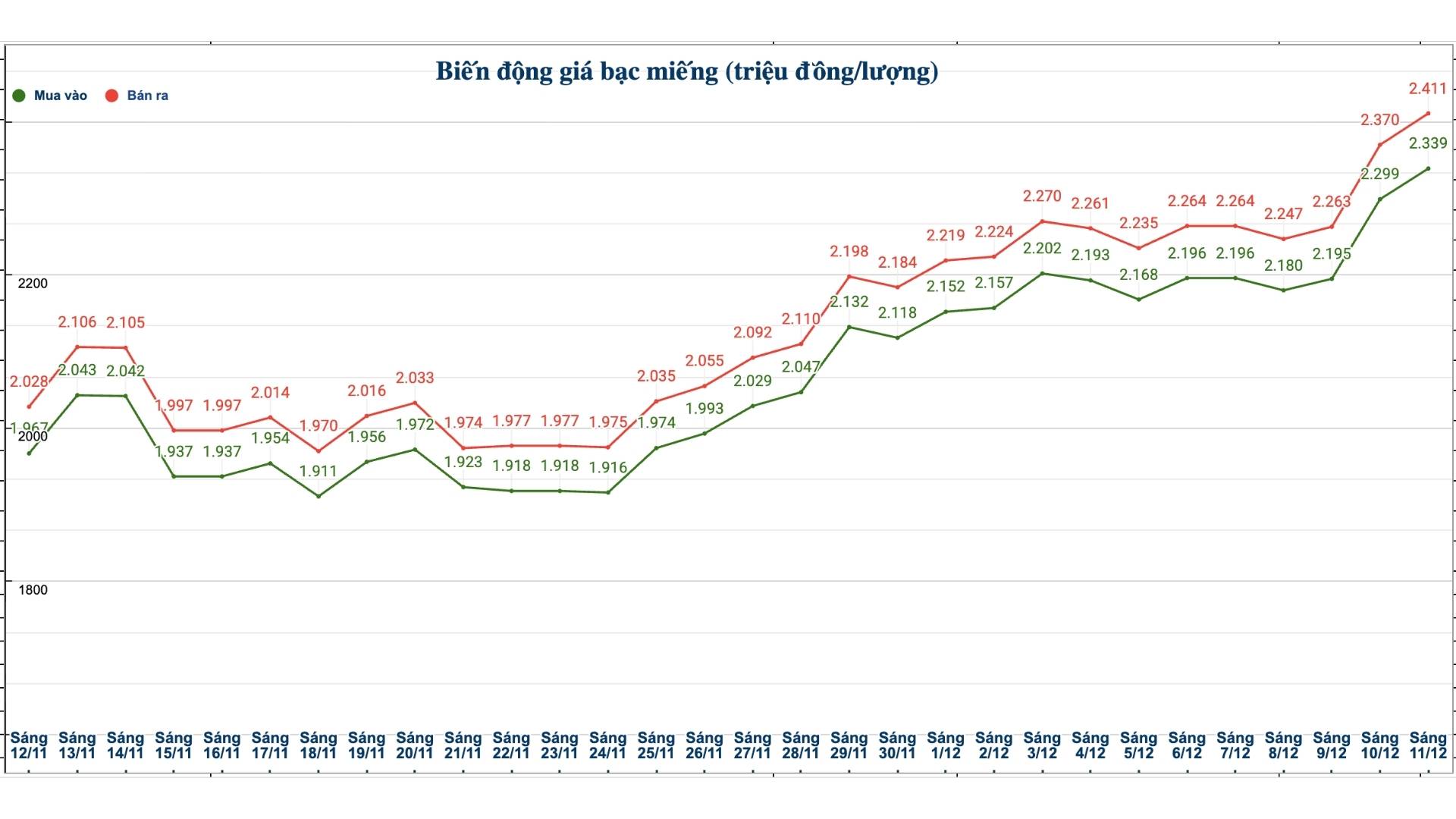

As of 11:15 a.m. on December 11, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Mineral and Environmental Company was listed at VND 2.331 - VND 2.386 million/tael (buy - sell); an increase of VND 31,000/tael for buying and an increase of VND 36,000/tael for selling compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) of silver bars at Ancarat Petrochemical Company was listed at VND61.266 - 63.126 million/kg (buy - sell); an increase of VND930,000/kg for buying and an increase of VND 960,000/kg for selling compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone One Member Co., Ltd. (Sacombank-SBJ) was listed at VND 2.292 - 2.346 million/tael (buy - sell); an increase of VND 75,000/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND 2.339 - 2.411 million/tael (buy - sell); increased by VND 40,000/tael for buying and increased by VND 41,000/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 62.373 - 64.293 million VND/kg (buy - sell); an increase of 1.067 million VND/kg for buying and an increase of 1.094 million VND/kg for selling compared to yesterday morning.

World silver price

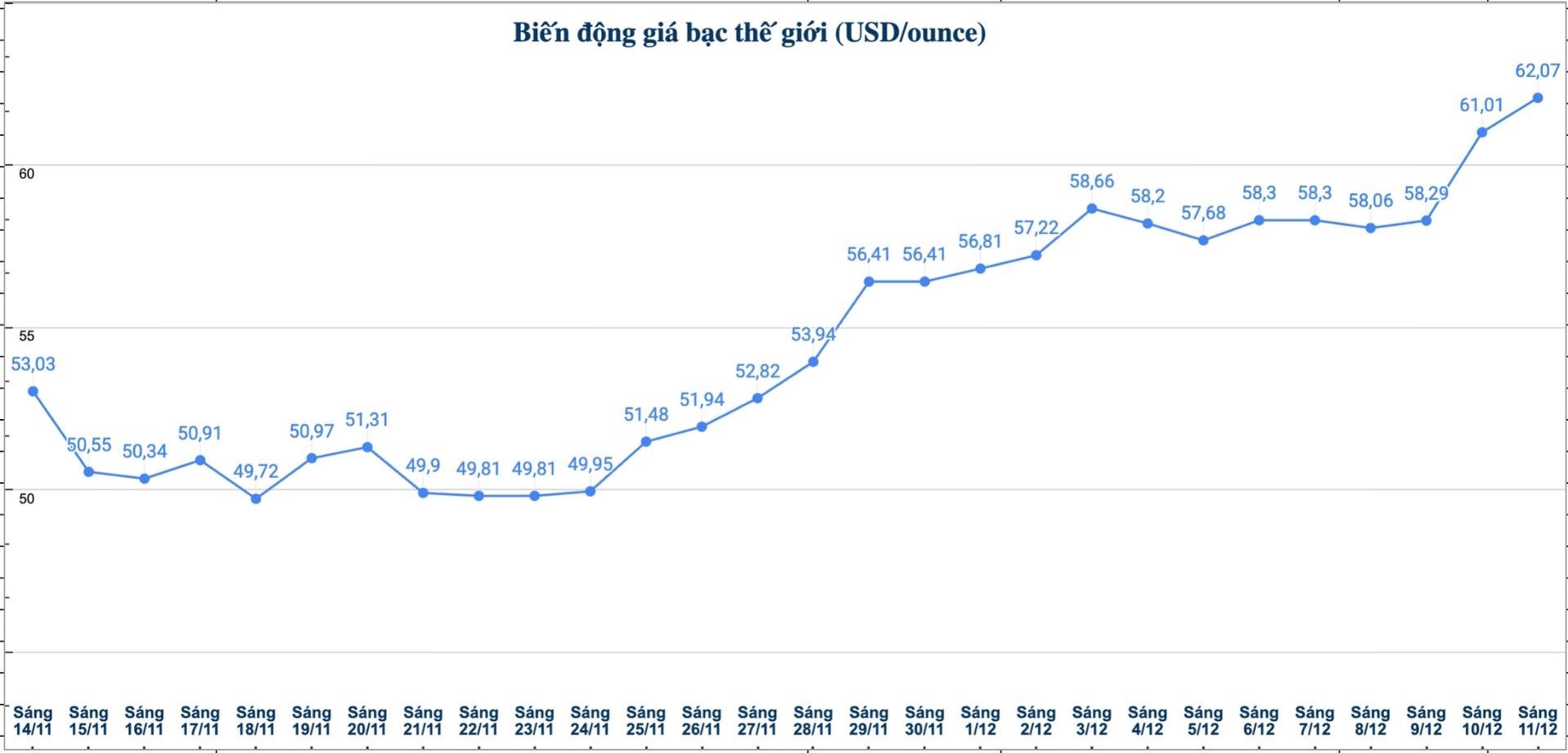

On the world market, as of 11:15 a.m. on December 11 (Vietnam time), the world silver price was listed at 62.07 USD/ounce; an increase of 1.06 USD compared to yesterday morning.

Causes and predictions

FxStreet financial analyst Sagar Dua stressed that the outlook for silver remains positive as the US Federal Reserve (Fed) is still open to continuing to cut interest rates after the 25 basis point cut at the recent meeting.

He said the Fed stressed that upcoming decisions will be based on economic data. Although the market is concerned that the Fed may stop cutting interest rates due to high inflation, Chairman Jerome Powell affirmed that the possibility of continuing to cut is difficult but has not been eliminated.

"The Fed's forecast also shows the possibility of another rate cut next year, which is often beneficial for assets such as silver," Sagar Dua emphasized.

In other financial markets, the US dollar is recovering slightly after falling sharply previously.

"In general, silver is still on the rise. However, due to the sharp increase in prices before, the market may have a short correction before continuing to increase. If prices remain above $63/ounce, the uptrend will be consolidated," Sagar Dua said.

See more news related to silver prices HERE...