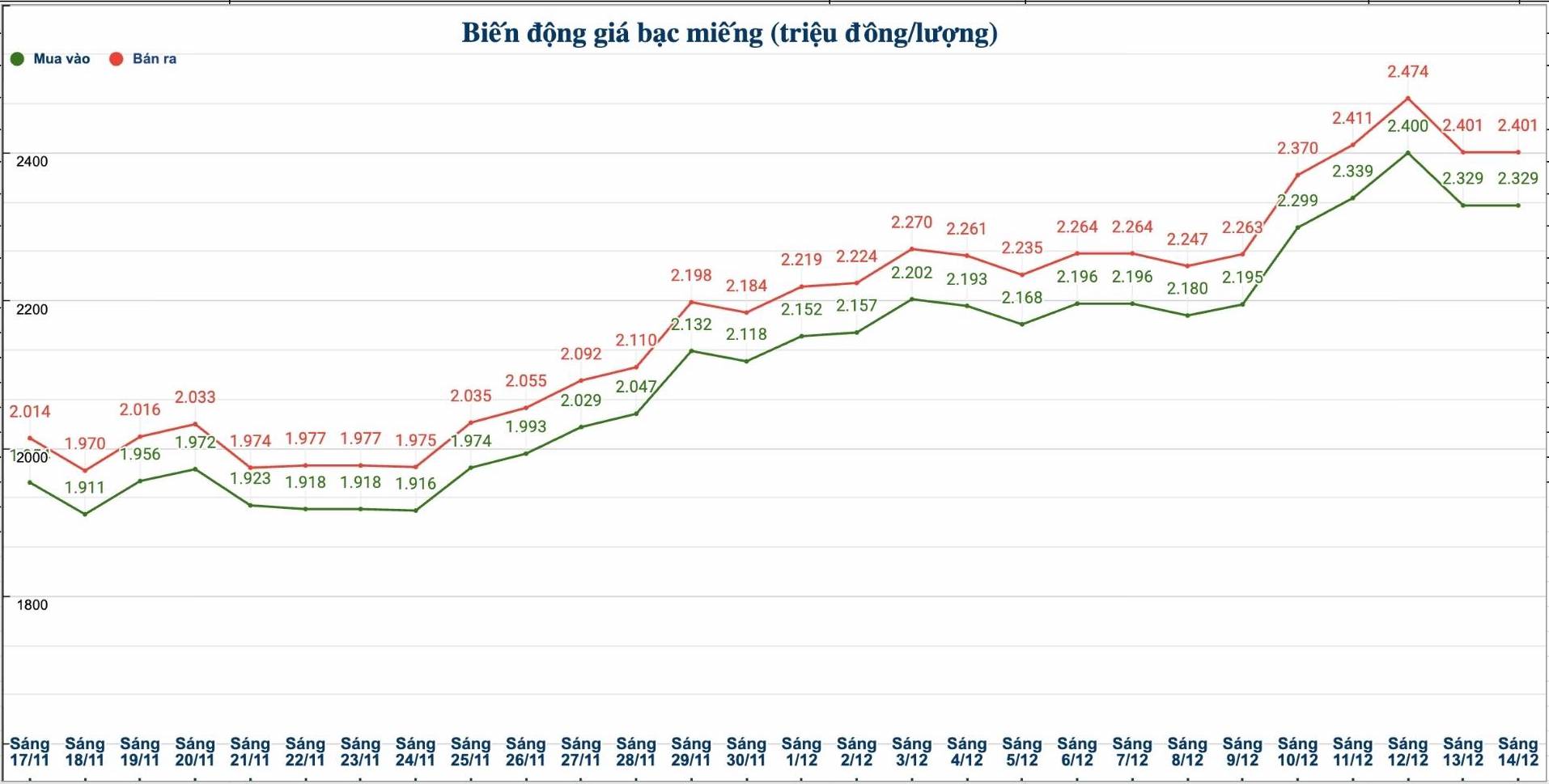

Domestic silver price

As of 9:50 a.m. on December 14, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND2.329 - 2.386 million/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 61.266 - 63.126 million VND/kg (buy - sell).

In the trading session last week (morning of December 7, 2025), the price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 57.590 - 59.340 million VND/kg (buy - sell).

Thus, if buying 999 999 Ancarat 999 (1kg) of 2025 silver bars at Ancarat Golden Rooster Company on December 7 and selling them this morning (December 14), buyers will make a profit of 1.926 million VND/kg.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 2.329 - 2.401 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at VND62.106 - 64.026 million/kg (buy - sell).

In the trading session last week (morning of December 7, 2025), the price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 58.559 - 60.373 million VND/kg (buy - sell).

Thus, if buying 999 taels of silver (1kg) at Phu Quy Jewelry Group on December 7 and selling it this morning (December 14), buyers will make a profit of VND 1.733 million/kg.

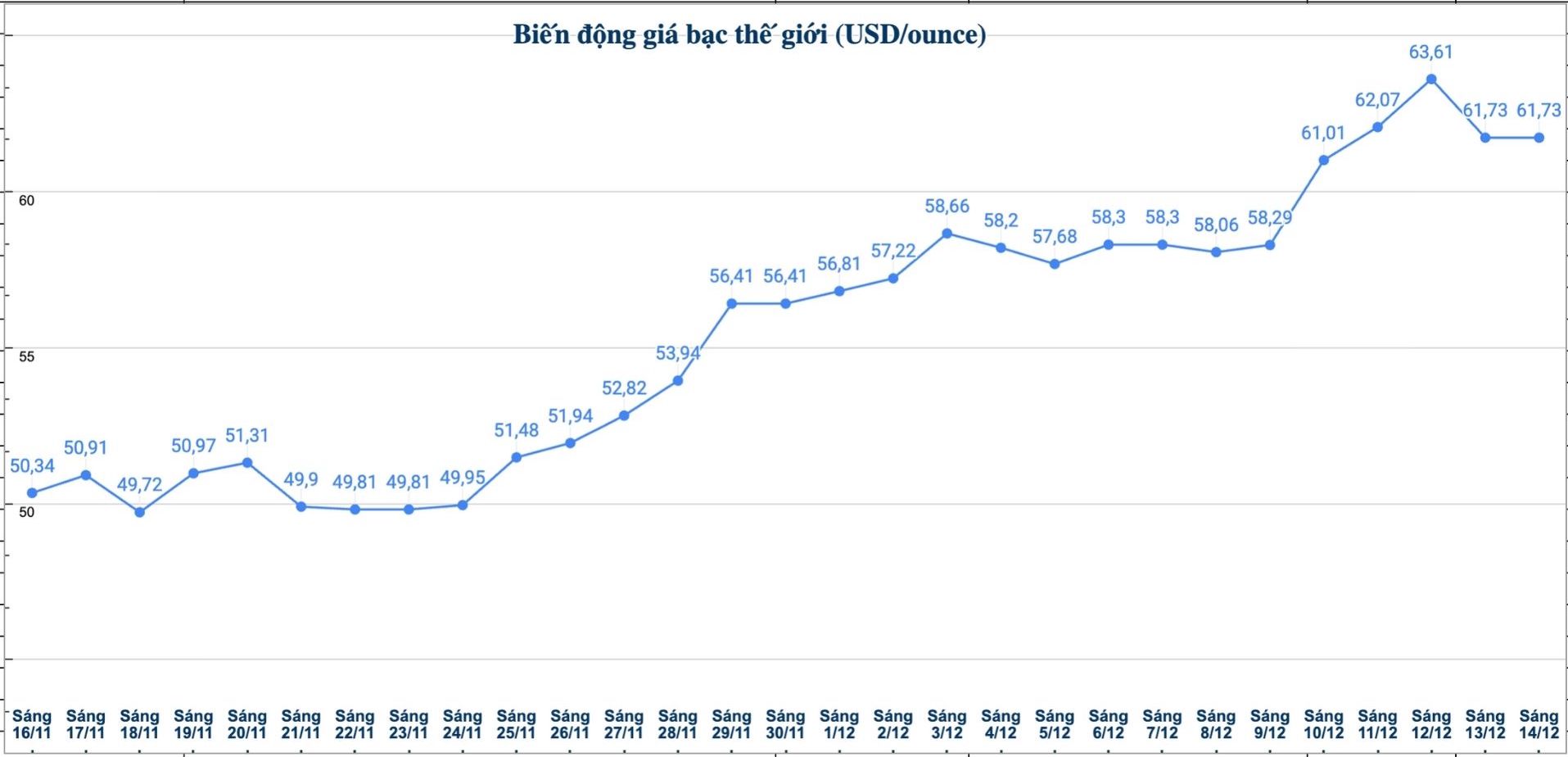

World silver price

On the world market, as of 9:55 a.m. on December 14 (Vietnam time), the world silver price was listed at 61.73 USD/ounce.

Causes and predictions

Since the beginning of the month, silver prices have recorded a strong increase and become one of the precious metals with the most positive developments in the market.

According to precious metals analyst James Hyerczyk at FX Empire, the main driver comes from the US Federal Reserve (Fed) cutting interest rates by 0.25 percentage points, along with expectations that monetary policy will continue to be loosen in the coming time, thereby supporting non-interest-bearing assets such as precious metals.

"Thanks to these favorable factors, in the weekend trading session, spot silver prices rose to a new record high, reaching 64.67 USD/ounce. However, the increase was not maintained until the end of the session when profit-taking pressure appeared strongly in the high price range" - James Hyerczyk said.

According to the expert, this development shows that buying power has weakened after a week of heating up, reflecting short-term profit-taking rather than a change in long-term trends.

Adjustment pressure also increased in the trading session at the end of the week as US Treasury yields for 10-year terms increased and the USD increased slightly, reducing the attractiveness of non-interest-bearing assets.

James Hyerczyk believes that the $60.52/ounce mark plays an important support role in the short term. "Staying above this threshold will help silver prices maintain an upward trend. In the case of the opposite case, if it falls below the support level, prices may be under further downward pressure" - James Hyerczyk analyzed.

In the coming time, the expert believes that the demand for physical silver will remain high, while cash flow into ETFs and positive expectations for the Fed's policies will continue to be factors that investors are monitoring, as the market gradually cooles down after reaching a record peak.

See more news related to silver prices HERE...