Domestic silver price

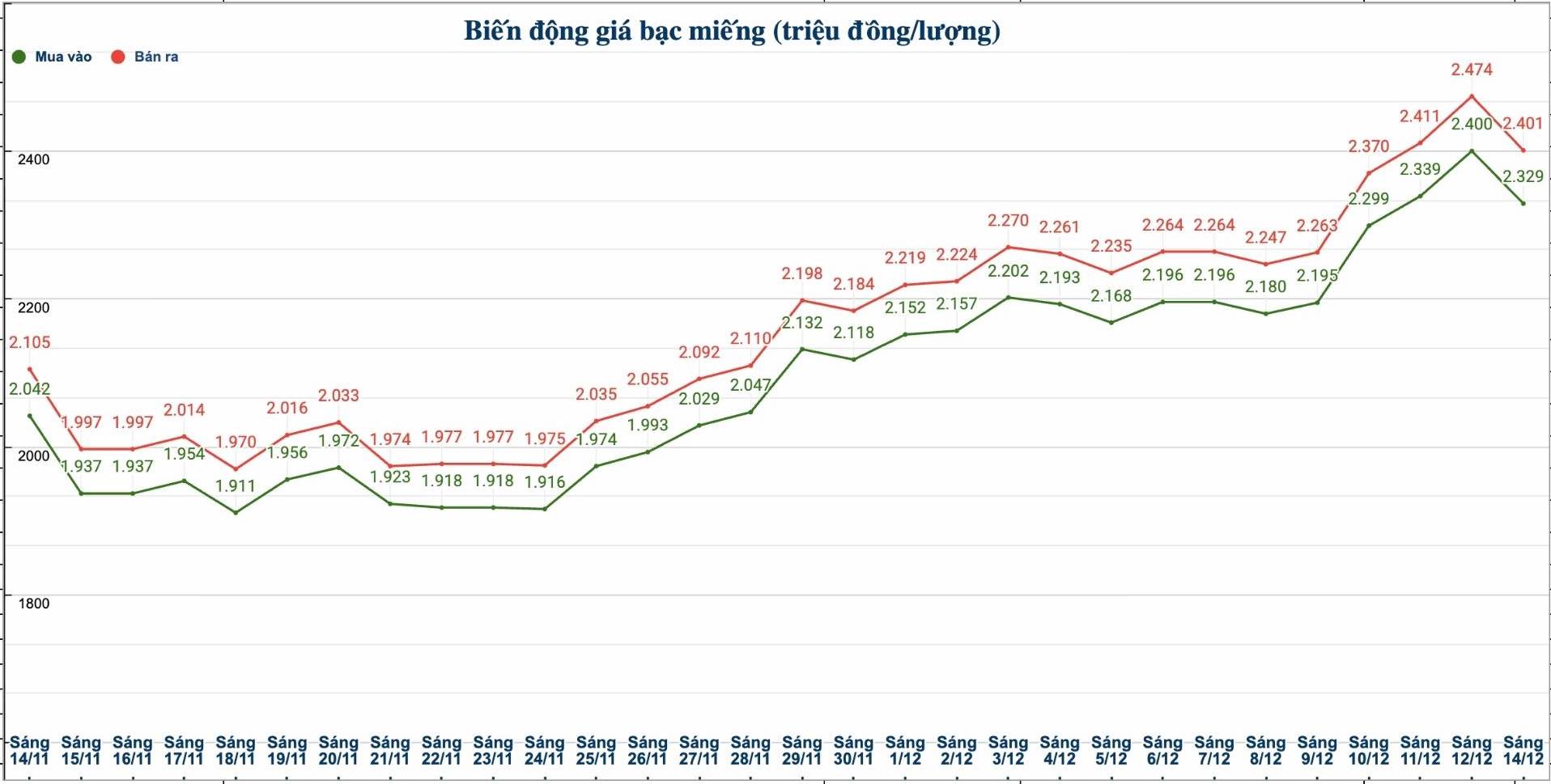

As of 9:50 a.m. on December 13, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND2.329 - 2.386 million/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 61.266 - 63.126 million VND/kg (buy - sell); down 1.55 million VND/kg for buying and down 1.69 million VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of the Golden Rooster Bank Limited (Sacombank-SBJ) is listed at 2.385 - 2.442 million VND/tael (buy - sell).

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 2.329 - 2.401 million VND/tael (buy - sell); down 71,000 VND/tael for buying and down 73,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 62.106 - 64.026 million VND/kg (buy - sell); down 1.893 million VND/kg for buying and down 1.947 million VND/kg for selling compared to yesterday morning.

World silver price

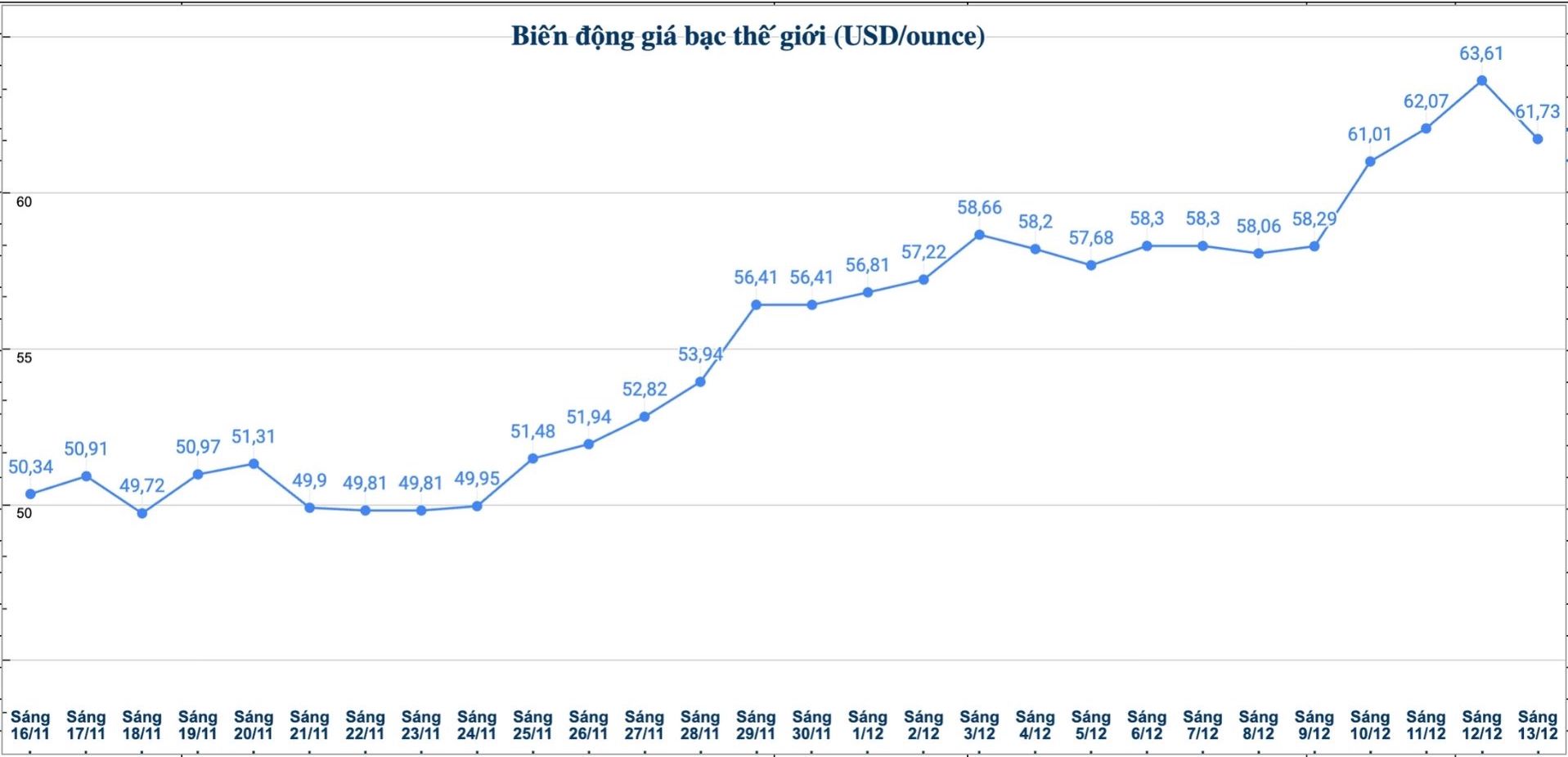

On the world market, as of 9:55 a.m. on December 13 (Vietnam time), the world silver price was listed at 61.73 USD/ounce; down 1.88 USD compared to yesterday morning.

Causes and predictions

After a period of strong increases, silver prices are now turning to adjust down. precious metals analyst Christopher Lewis at FX Empire said that this move shows that the market is starting to cool down after prices increased too quickly in a short time, as many investors took advantage of taking profits.

Christopher Lewis believes that betting on a decrease in silver prices at this time is very risky, because prices are still likely to increase further in the coming time.

According to him, sharp declines may come unexpectedly. "In reality, the market has repeatedly recorded rapid declines of about 3 USD/ounce when prices were pushed too high, then there was profit-taking momentum" - he said.

Technically, Christopher Lewis said, if silver prices adjust to the $60/ounce zone, this could be a short-term buying opportunity. "In case prices fall below $60/ounce, the $55/ounce mark will be the next support zone to watch. However, the current trend is still "one-way transactions", and this market is not suitable for short selling" - the expert commented.

In the long term, selling counterfeit money may become a strategy worth considering, but according to Mr. Lewis, that time is not yet come.

"Certain concerns about a shortage of silver have been raised for decades. Therefore, considering this the main reason for the strong fluctuations in silver prices at the present time still needs to be considered carefully" - Christopher Lewis emphasized.

See more news related to silver prices HERE...