Domestic silver price

As of 9:40 a.m. on December 12, the price of 999 Phuc Loc 999 gold bars (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone One Member Co., Ltd. (Sacombank-SBJ) was listed at VND 2.358 - 2.412 million/tael (buy - sell); an increase of VND 66,000/tael in both directions compared to yesterday morning.

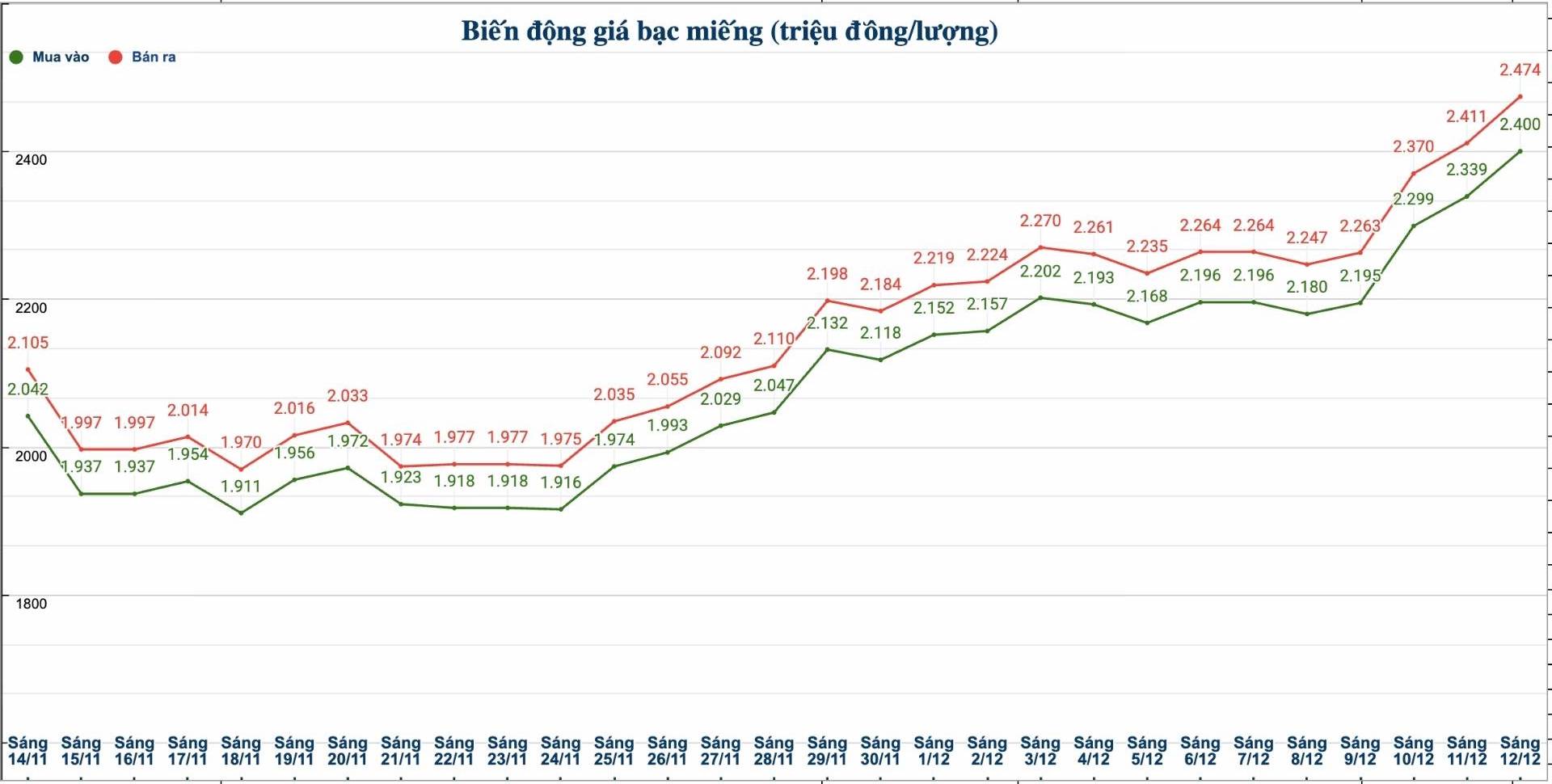

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND 2,400 - VND 2,474 million/tael (buy - sell); an increase of VND 61,000/tael for buying and an increase of VND 63,000/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 63.999 - 65.973 million VND/kg (buy - sell); an increase of 1.626 million VND/kg for buying and an increase of 1.68 million VND/kg for selling compared to yesterday morning.

World silver price

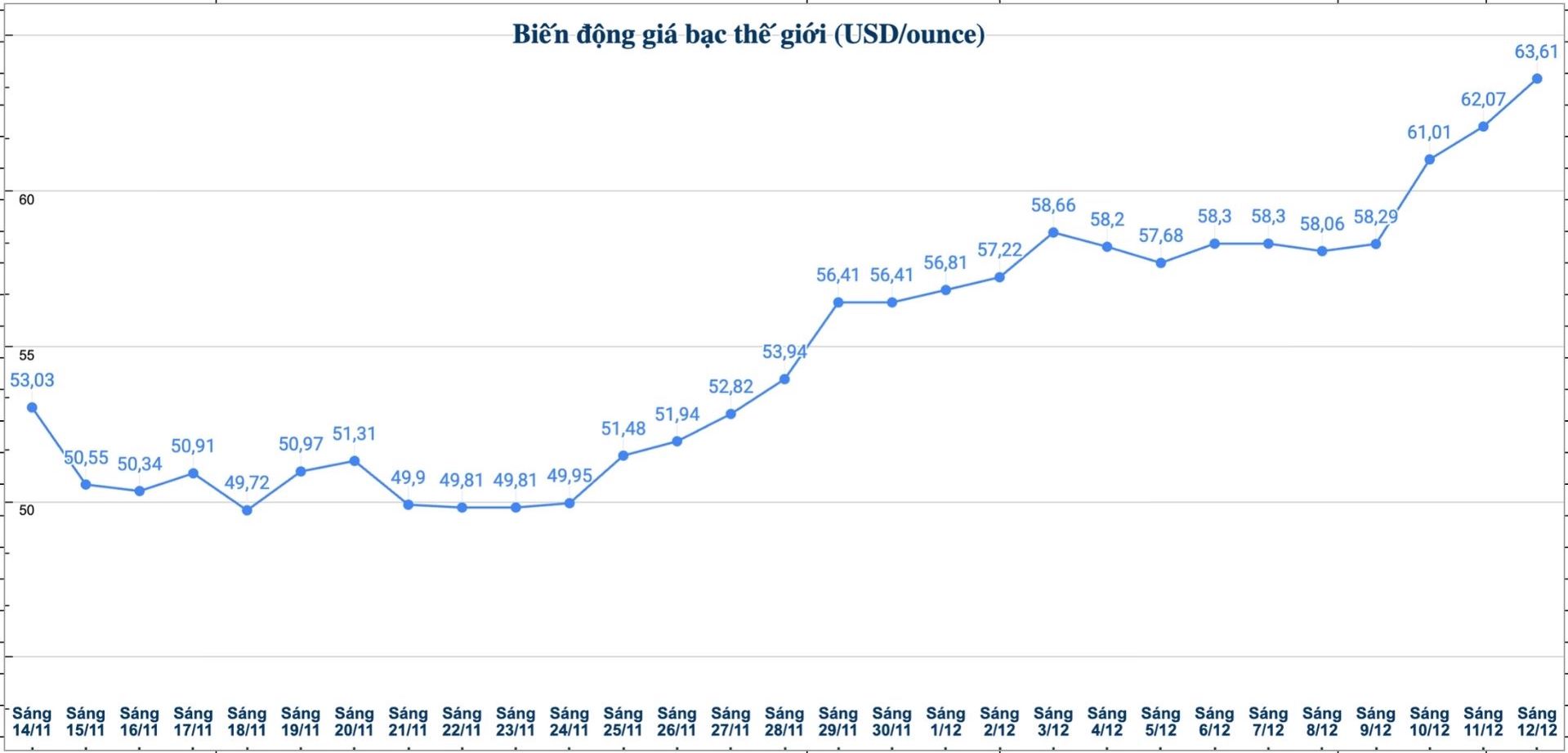

On the world market, as of 10:00 a.m. on December 12 (Vietnam time), the world silver price was listed at 63.61 USD/ounce; an increase of 1.54 USD compared to yesterday morning.

Causes and predictions

World silver prices continued to increase strongly, setting a new record in the trading session on Friday morning. FX Empire precious metals analyst James Hyerczyk said traders are closely monitoring key support zones as silver supply continues to be limited - a factor that is still supporting expectations of further price increases.

According to James Hyerczyk, since the beginning of the year, silver prices have increased by more than 115%, a rare increase even for this metal. The main driving force comes from strong industrial demand, especially in the renewable energy and electronics industries; deeply decreased inventories, making the market more sensitive to shortages. In addition, the US included silver in the list of essential minerals, promoting hoarding.

"This makes silver a dynamic two-way market: both a currency metal and an industrial commodity. With industrial demand remaining high, the possibility of deep price declines will be unlikely as expected by sellers," said James Hyerczyk.

The expert said that being classified as an important mineral group can cause the buying and storage activity to increase sharply. "If this happens, the limited supply situation could become more serious, creating more upward pressure," he said.

However, James Hyerczyk also noted that the overheating increase in silver could put the market at risk of a short-term correction.

"In the short term, the upward trend of silver is still dominant, but it is also in a very sensitive state. When prices are far above technical thresholds, profit-taking can take place at any time, creating sharp declines" - James Hyerczyk commented.

See more news related to silver prices HERE...