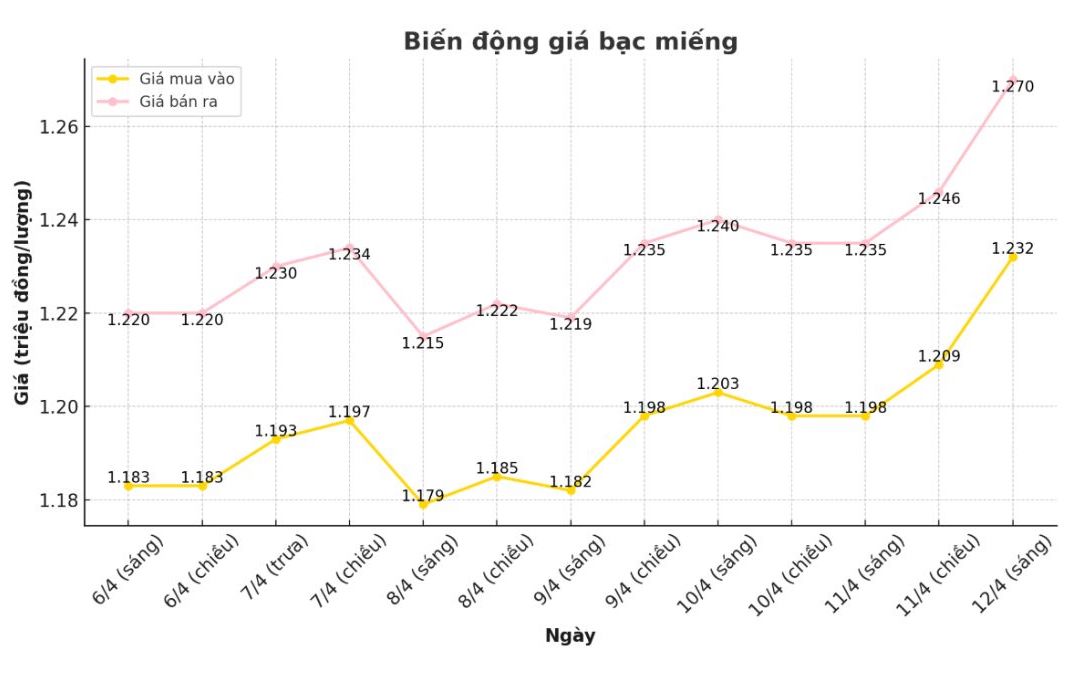

Domestic silver price

As of 11:25 a.m. on April 12, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.232 - 1.270 million/tael (buy - sell); an increase of VND34,000/tael for buying and an increase of VND35,000/tael for selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.232 - 1.270 million VND/tael (buy - sell); an increase of 34,000 VND/tael for buying and an increase of 35,000 VND/tael for selling compared to early this morning.

At the same time, the price of 999 (1kilo) taels of silver at Phu Quy Jewelry Group was listed at 32.853 - 33.866 million VND/kg (buy - sell); an increase of 1.204 million VND/kg for buying and an increase of 933,000 VND/kg for selling compared to early this morning.

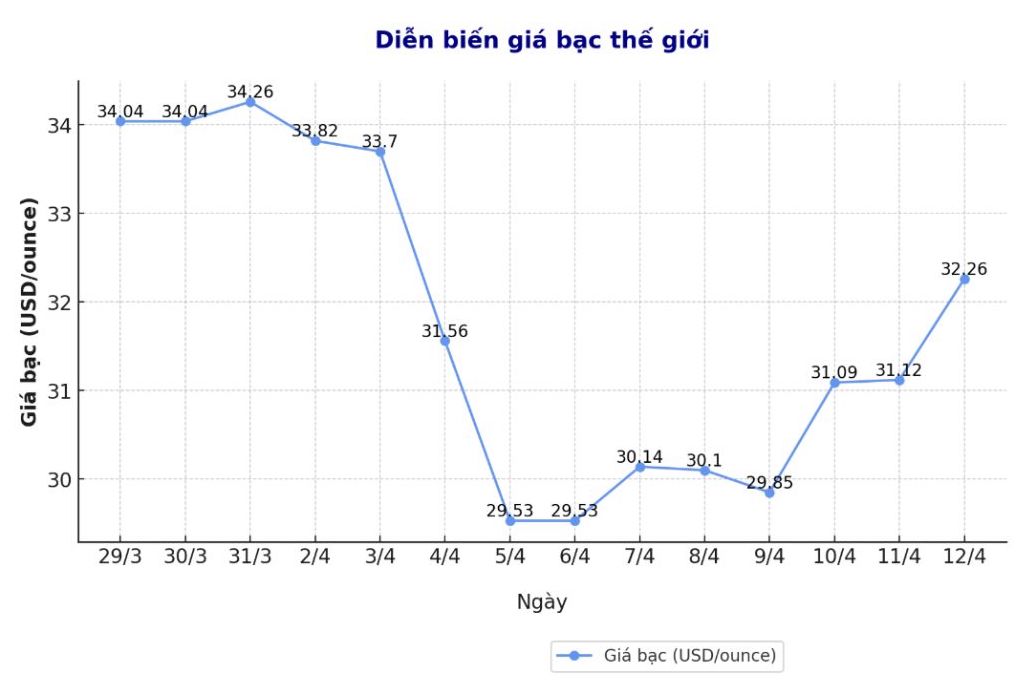

World silver price

On the world market, as of 8:30 a.m. on April 12 (Vietnam time), the world silver price listed on Goldprice.org was at 32.26 USD/ounce; up 4.85% compared to yesterday's trading session.

Causes and predictions

According to FX empire, silver prices continue to move up with the increase of gold. The white precious metal is benefiting from safe-haven cash flow and expecting improved industrial demand.

Arslan Ali, currency and commodity analyst at FX Empire, said the US consumer price index (CPI) unexpectedly fell 0.1% in March, as overall inflation fell to 2.4% year-on-year, down from 2.8% in February. This was lower than the forecast of 2.6%, showing that inflation is cooling down faster than expected.

The core CPI (excluding volatile food and energy prices) also fell to 2.8%, reinforcing expectations that the US Federal Reserve (FED) will switch to cutting interest rates. The cooling of inflation also helps reduce production costs, creating a positive sentiment for industrial commodity groups.

"Technical indicators show that the upward trend of silver is still solid, as long as prices remain above the threshold of 30.50 USD/ounce" - Arslan Ali commented.

Meanwhile, geopolitical tensions have increased after President Donald Trump imposed a 125% tariff on Chinese goods. Although the US has temporarily suspended tariffs on some countries, a tough stance on China still makes many people worry that the global economy could fall into recession.

If tensions escalate, global growth could be affected. Thereby continuing to support gold and silver as safe-haven assets.

"The current trend is still in the uptrend. However, due to many technical resistance zones at the same time, silver prices may move sideways or have a slight adjustment in the short term, said Arslan Ali.

See more news related to silver prices HERE...