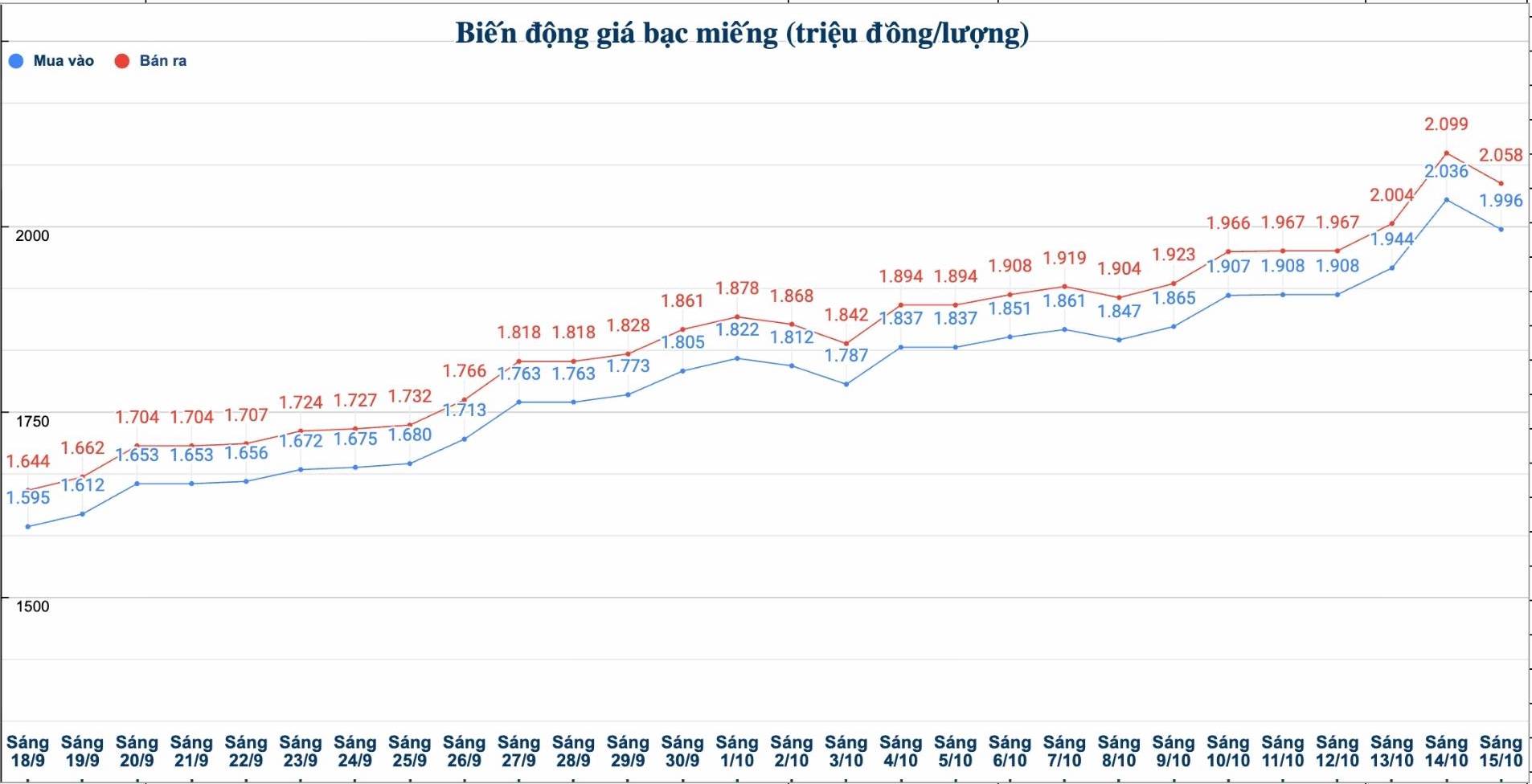

Domestic silver price

As of 9:25 a.m. on October 15, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND2.004 - VND2.042 million/tael (buy - sell); down VND7,000/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company was listed at 52.424 - 53.874 million VND/kg (buy - sell); down 186,000 VND/kg in both directions compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at 2.019 - 2.070 million VND/tael (buy - sell); down 24,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.996 - 2.058 million VND/tael (buy - sell); down 40,000 VND/tael for buying and down 41,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 53.226 - 54.879 million VND/kg (buy - sell); down 1.067 million VND/kg for buying and down 1.094 million VND/kg for selling compared to yesterday morning.

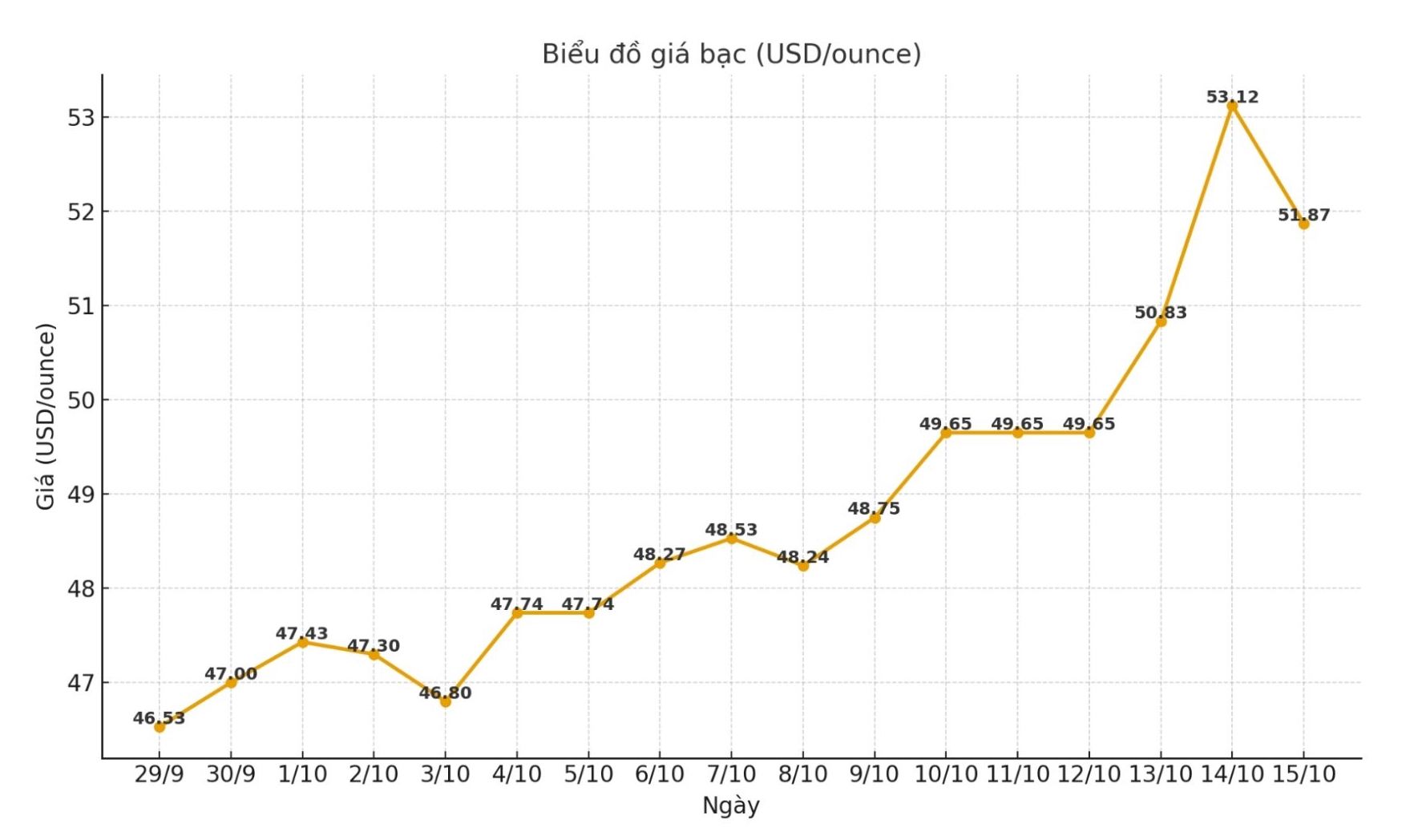

World silver price

On the world market, as of 9:35 a.m. on October 15 (Vietnam time), the world silver price was listed at 51.87 USD/ounce; down 1.25 USD compared to yesterday morning.

Causes and predictions

Silver prices fell slightly after hitting a multi-year high of 53.62 USD/ounce, currently trading around 52.27 USD/ounce. According to market analyst James Hyerczyk, the decline comes as buying pressure weakens and profit-taking increases, signaling the possibility of a short-term correction after a period of strong increases due to scarce supply and safe-haven demand.

"If prices cannot hold above 50.48 USD/ounce, silver could retreat to the 47.33 USD/ounce zone, while 42.42 USD/ounce still plays an important support role," said James Hyerczyk.

The expert said that despite Fed Chairman Jerome Powell's dovish statement, silver prices could not maintain their upward momentum, showing that the market has reflected most of the expectations for the upcoming interest rate cut.

"In London, the selling pressure on counterfeit goods - a factor that has pushed silver prices to skyrocket - is decreasing, but physical supply is still tight and gold prices continue to increase strongly to support the metal," he added.

Regarding the short-term trend, James Hyerczyk said that silver is still leaning towards price increase. "However, traders need to closely monitor the technical signals and developments of the Fed's monetary policy, as well as the US-China trade tensions in the coming time" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...