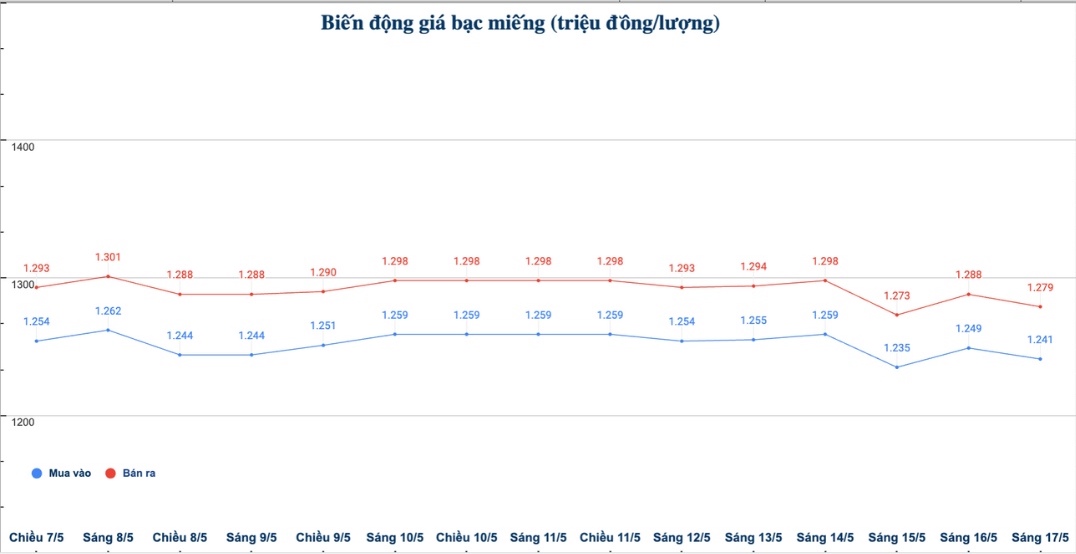

Domestic silver price

As of 9:05 a.m. on May 17, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.241 - VND1.279 million/tael (buy - sell); down VND8,000/tael for buying and down VND9,000/tael for selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.241 - 1.279 million VND/tael (buy - sell); down 8,000 VND/tael for buying and down 9,000 VND/tael for selling compared to early this morning.

At the same time, the price of 999 (1kilo) taels of silver at Phu Quy Jewelry Group was listed at 33.093 - 34.106 million VND/kg (buy - sell); down 213,000 VND/kg for buying and down 240,000 VND/kg for selling compared to early this morning.

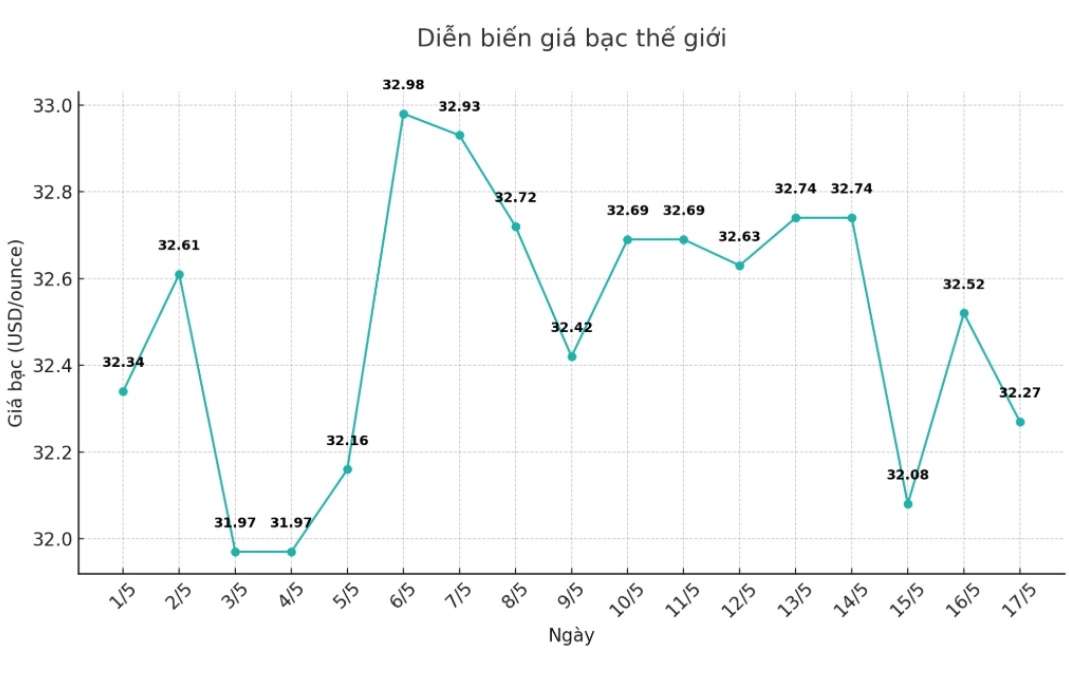

World silver price

On the world market, as of 9:10 a.m. on May 17 (Vietnam time), the world silver price listed on Goldprice.org was at 32.27 USD/ounce; down 0.25 USD compared to yesterday's trading session.

Causes and predictions

According to FX Empire, silver prices suddenly fell sharply due to market sentiment leaning towards risky assets, causing selling pressure to increase and push prices below important technical thresholds.

James Hyerczyk - market analyst at FX Empire - commented: "The fact that silver cannot recover beyond the threshold of 32.82 USD/ounce has further put downward pressure on prices. Accordingly, traders are increasingly interested in the possibility of silver prices continuing to decline."

James Hyerczyk added that outside market factors also increased downward pressure on silver prices.

"The US dollar is strengthening, heading for the fourth consecutive week of gains, causing demand for USD-denominated metals such as silver to decline.

In addition, the positive sentiment associated with the progress in the US-China trade dialogue has forced investors to withdraw from safe-haven assets such as silver and gold," he said.

Some data shows that inflation has cooled down, according to James Hyerczyk. This raises expectations that the US Federal Reserve (FED) may cut interest rates by the end of the year, but this is still not enough to significantly support silver.

"Currently, the risk appetite and strength of the US dollar are still the factors leading the market," James Hyerczyk emphasized.

In the short term, he said that silver will continue to decline.

"If the silver price does not soon regain the 32.82 USD/ounce level, the seller can push the price down to the support zone around 31.45 - 31.31 USD/ounce. Unless the market has a clear change in sentiment or the US dollar weakens, silver prices are still at risk of continuing to decline next week," Hyerczyk said.

See more news related to silver prices HERE...