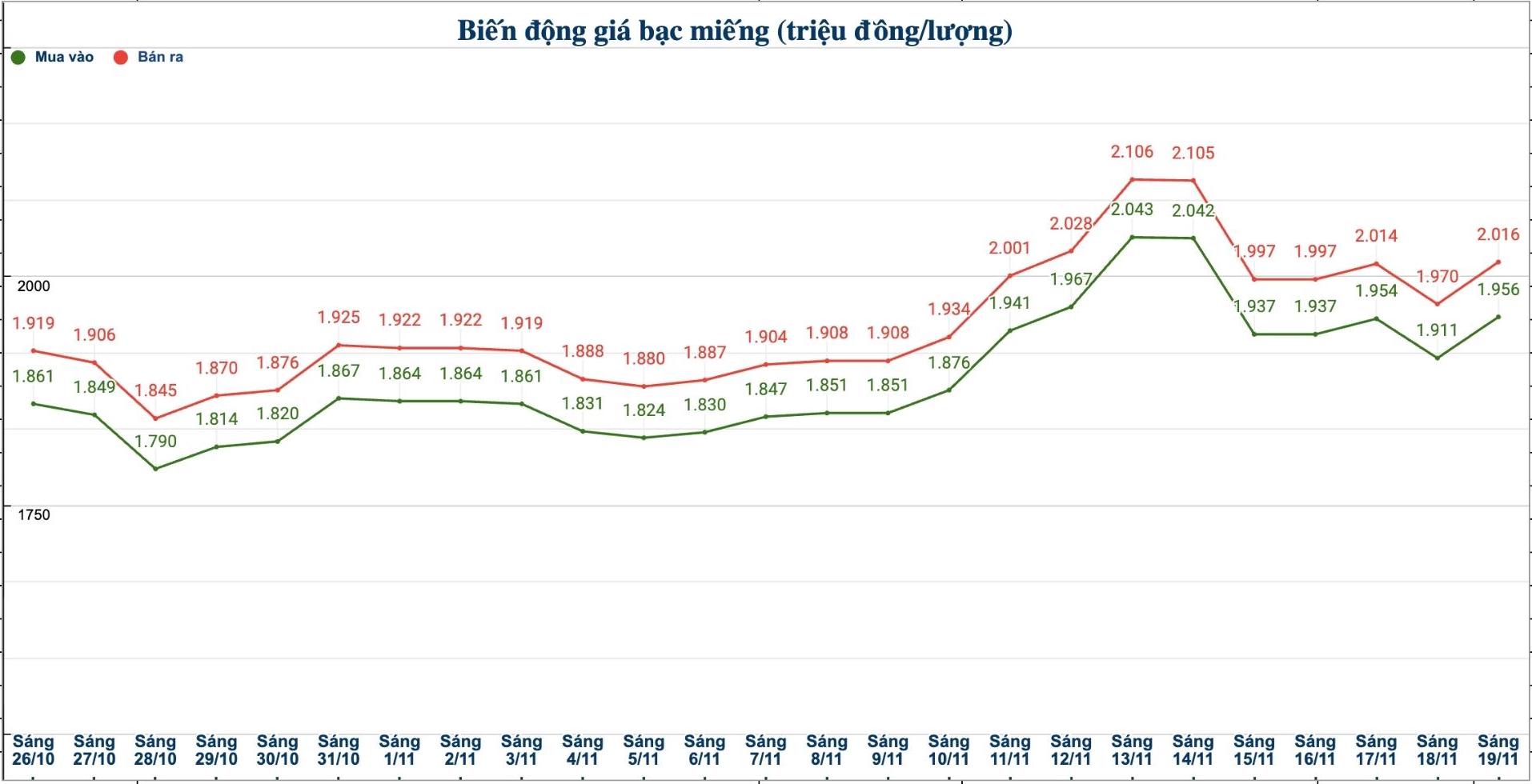

Domestic silver price

As of 10:35 a.m. on November 19, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND1.954 - 1.996 million/tael (buy - sell); an increase of VND44,000/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 51.326 - 52.776 million VND/kg (buy - sell); an increase of 1.162 million VND/kg for buying and an increase of 1.172 million VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at 1.941 - 1.992 million VND/tael (buy - sell); an increase of 36,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.956 - 2.016 million VND/tael (buy - sell); an increase of 45,000 VND/tael for buying and an increase of 46,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 52.159 - 53.759 million VND/kg (buy - sell); an increase of 1.2 million VND/kg for buying and an increase of 1.226 million VND/kg for selling compared to yesterday morning.

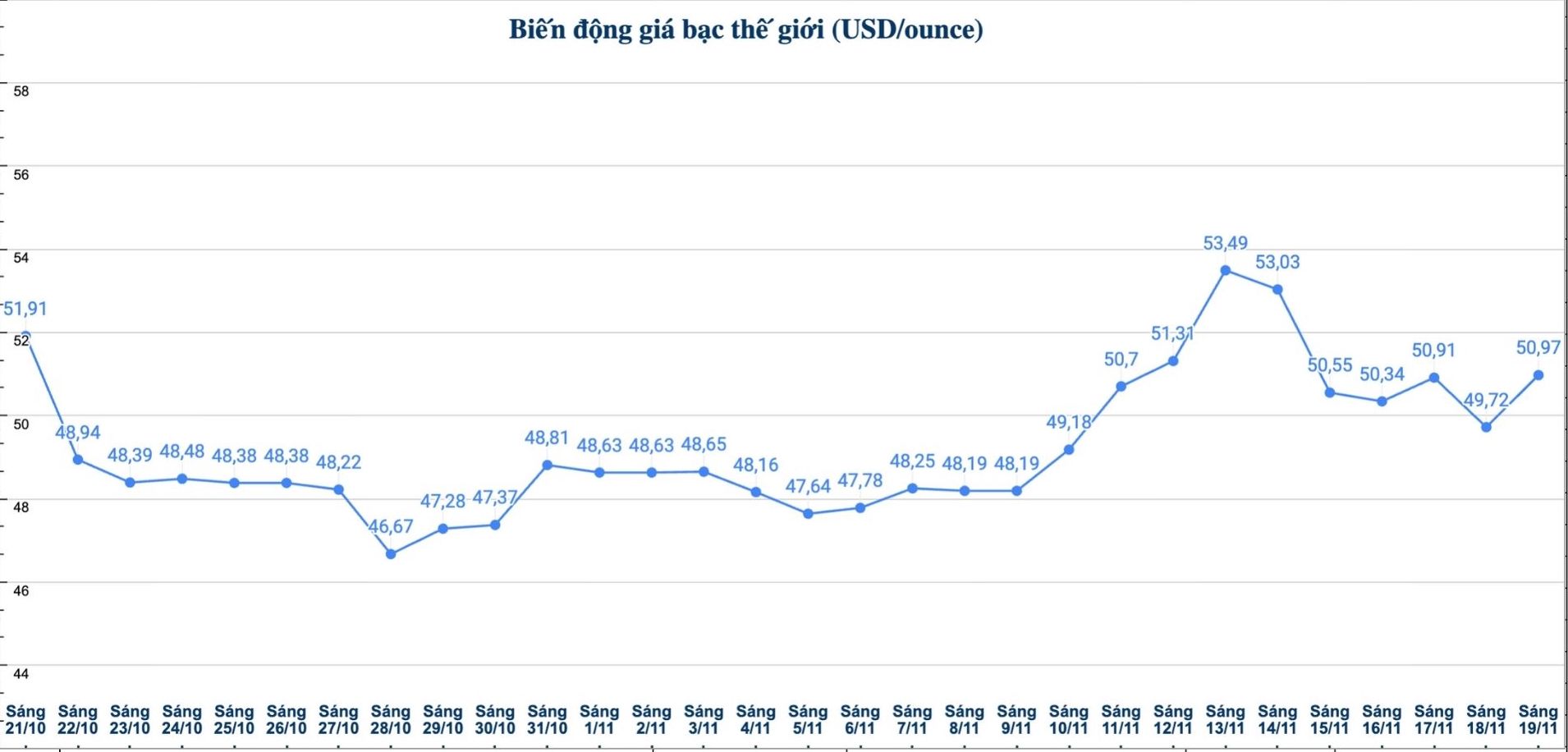

World silver price

On the world market, as of 10:35 a.m. on November 19 (Vietnam time), the world silver price was listed at 50.97 USD/ounce; an increase of 1.25 USD compared to yesterday morning.

Causes and predictions

Silver prices fell in the first trading session of the week but quickly recovered this morning, fluctuating around 50 USD/ounce. According to precious metals analyst Christopher Lewis at FX Empire, trading volumes have decreased compared to the beginning of the week, showing that buying pressure is no longer as strong as at first.

"However, the market remains volatile and closely monitored, as many investors are interested in key support and resistance levels - the $50/ounce threshold," Christopher Lewis said.

The expert said that the threshold of 50 USD/ounce currently acts as a strong attraction, helping prices rebound. If silver recovers and breaks above $51.50 an ounce, the chance of rising to $54 an ounce is very high.

On the contrary, he said that if he cannot keep the $50/ounce mark, $47/ounce could be the next test point. The decrease in trading volume reflects the cautious sentiment of the market.

"However, when silver prices fluctuate, many investors still rush to buy, showing optimism about the risk of a real shortage of silver compared to the amount of contract silver in the market. Therefore, the silver market still has many potential fluctuations, and investors need to monitor closely, because if prices surpass important levels, the trend can continue strongly" - Christopher Lewis expressed his opinion.

See more news related to silver prices HERE...