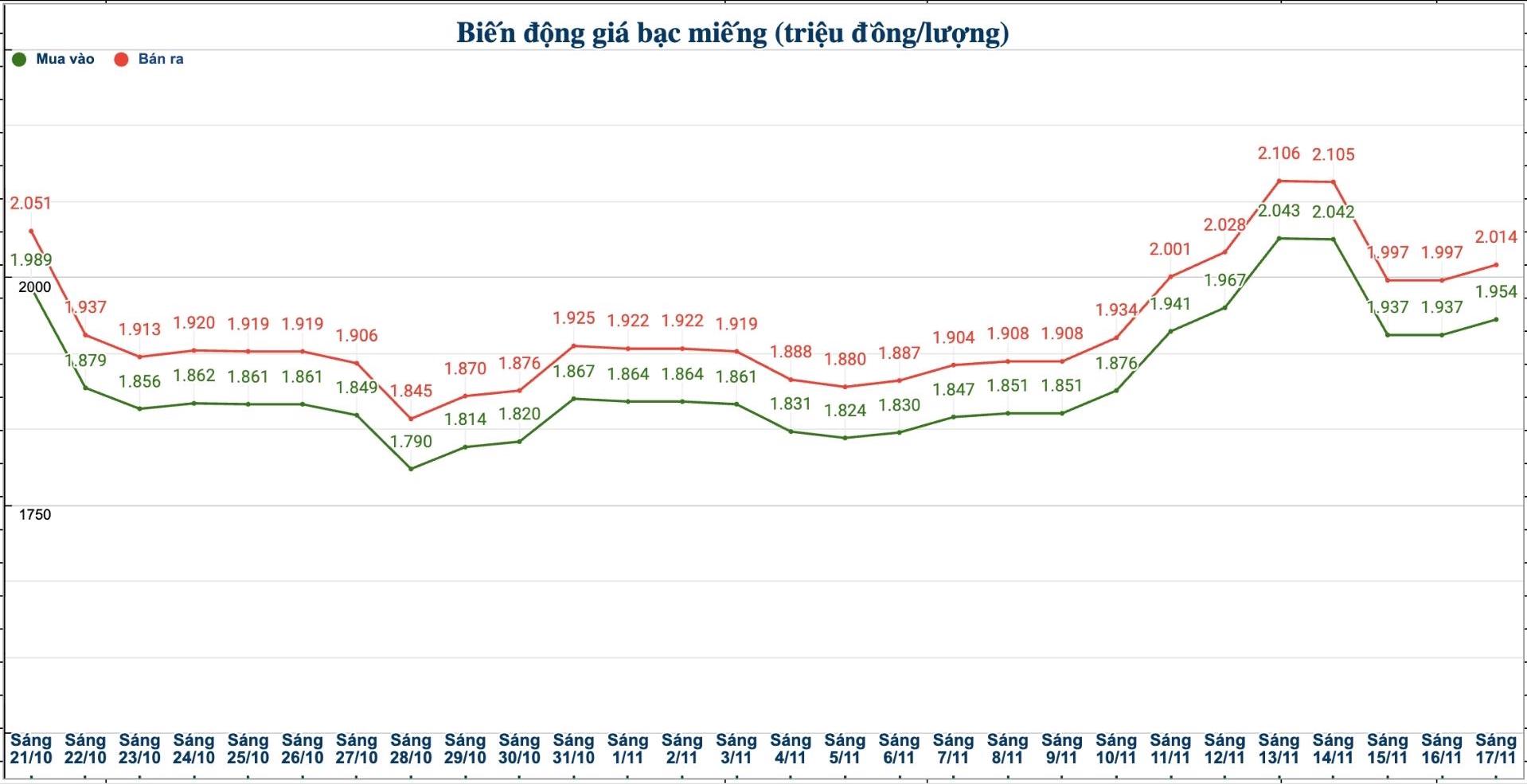

Domestic silver price

As of 11:30 a.m. on November 17, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1,950 - 1.992 million VND/tael (buy - sell); an increase of 14,000 VND/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 51,200 - 52,670 million VND/kg (buy - sell); an increase of 424,000 VND/kg for buying and an increase of 374,000 VND/kg for selling compared to yesterday morning.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.954 - 2.014 million VND/tael (buy - sell); an increase of 17,000 VND/tael in both directions compared to yesterday morning.

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 52.106 - 53.706 million VND/kg (buy - sell); an increase of 453,000 VND/kg in both directions compared to yesterday morning.

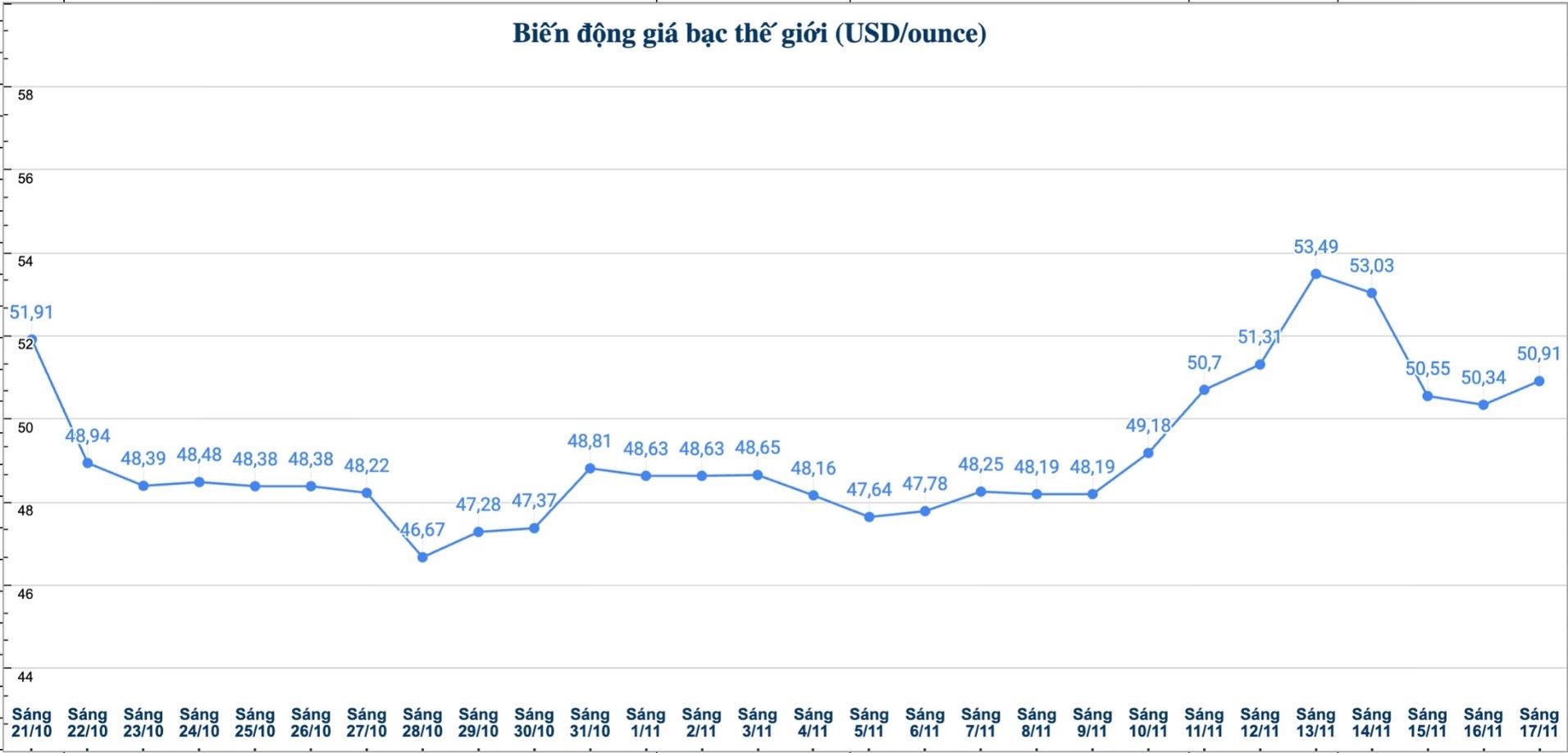

World silver price

On the world market, as of 11:30 a.m. on November 17 (Vietnam time), the world silver price was listed at 50.91 USD/ounce; up 0.57 USD compared to yesterday morning.

Causes and predictions

Spot silver prices increased again in the first session of the week. Purchasing power has appeared but is not strong enough to make a breakthrough, according to FX Empire precious metals analyst James Hyerczyk.

"Selling also put pressure but did not pull prices below the support zone. The general trend is still increasing, but the upward momentum is stagnating in the short-term fluctuation zone. As long as prices remain above 45.55 USD/ounce, the uptrend will continue," said the expert.

However, he said that if prices fall to this threshold, the market may be at risk of reversal.

In addition, the minutes of the Federal Open Market Committee (FOMC)'s November meeting, due this week, will be an important factor.

"Due to the 43-day US government shutdown, there was almost no inflation and labor market data in October, leaving investors lacking direction. The forecast for the US Federal Reserve (FED) to cut interest rates in December has fallen sharply from 95% to 49%," said James Hyerczyk.

He said the meeting minutes could show that the Fed is actually considering whether to take the next step or still temporarily "standing still" waiting for more data.

"Buyers hope the Fed meeting minutes will give a positive signal or suggest the possibility of policy easing. Meanwhile, the sellers are betting on the Fed's caution and the lack of economic data in the market," said James Hyerczyk.

See more news related to silver prices HERE...