According to Kitco, the global economy is declining, affecting silver consumption in the industrial sector, with demand forecast to decrease. However, this decrease is still too small to solve the imbalance between supply and demand in the market.

Last week, the Silver Institute predicted that silver will continue to lack supply for the fifth consecutive year, with a deficit of 95 million ounces. Although the deficit has fallen significantly since last year, that is still enough to keep silver prices at a record high.

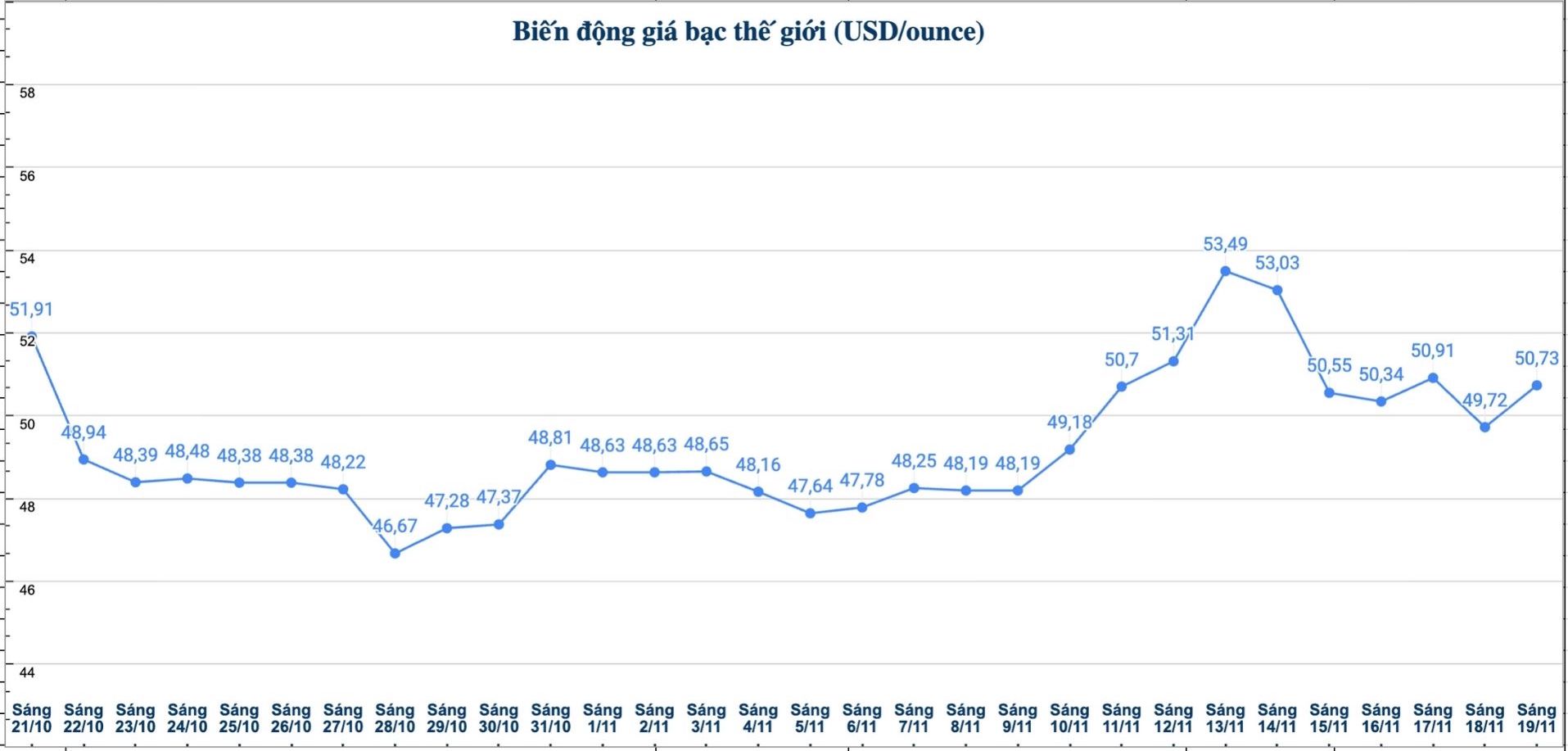

In fact, despite the failure to maintain prices above $54/ounce twice, the pressure to sell silver is still limited. Spot silver prices are currently at 50.75 USD/ounce, still up nearly 76% compared to the beginning of the year.

When industrial demand was still weak, investment demand had partly compensated for this decline. Mr. Philip Newman - CEO of Metals Focus Research Company - said that capital flows into ETFs have increased by 187 million ounces as of the present time of the year.

"This reflects investors' concerns about stagnant inflation, the policies of the US Federal Reserve (FED), public debt and geopolitical risks. The strong growth of silver prices and favorable supply and demand have strengthened investor confidence" - Mr. Newman shared.

Looking at industrial demand, Metals Focus forecasts that silver consumption this year will decrease to 665 million ounces, down 2% compared to last year.

The report by Metals Focus said that this reflects the impact of global economic uncertainty, tariff and geopolitical tensions, along with shopping savings due to rising silver prices. In fact, because the amount of silver used in each modular has decreased sharply, the demand for silver in the photovoltaics industry is expected to decrease by 5%.

The weakness in the US market was the main reason, although markets such as India, Germany and Australia still recorded growth.

According to a report by Metals Focus, the silver market this year has seen a significant disruption in the supply chain, when the metal is in stock in the wrong place or in an unsuitable form for use. Earlier this year, a large amount of silver poured into the US as gold bar banks and other market participants hoarded it to avoid potential tariffs. Although the US government has said precious metals, including silver, will be exempt from taxes, there are still concerns about import taxes, causing silver to remain mainly in New York.

Meanwhile, in London, demand from India and investment in ETFs has tightened the market, pushing silver rental prices to record highs. Although some metals have returned to London to take advantage of higher insurance rates, silver analysts warn that they will continue to face supply chain challenges, as supply fails to meet demand.

Matthew piggott - Director of Gold and Silver at Metals Focus - commented: "Siliver supply may be in continuous shortages in the coming years, and the global market will need to reduce consumption to balance supply and demand".

Updated silver price

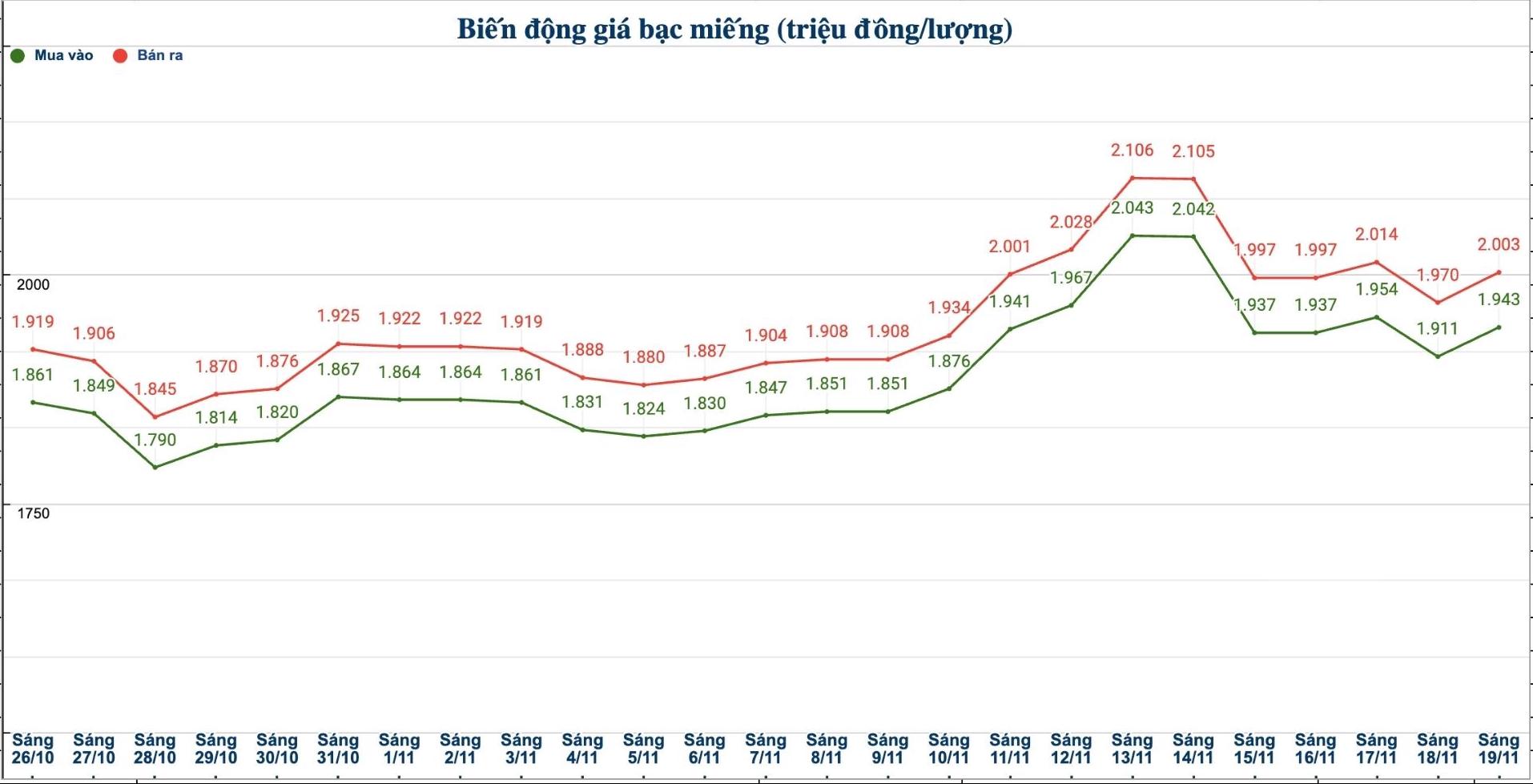

As of 8:40 a.m. on November 19, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1,940 - 1.982 million VND/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 50.934 - 52.404 million VND/kg (buy - sell).

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at VND1.905 - VND1.956 million/tael (buy - sell); down VND90,000/tael in both directions compared to yesterday morning.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.943 - 2.003 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 51.813 - 53.413 million VND/kg (buy - sell).

On the world market, as of 8:48 a.m. on November 19 (Vietnam time), the world silver price was listed at 50.73 USD/ounce.

See more news related to silver prices HERE...