Domestic silver price

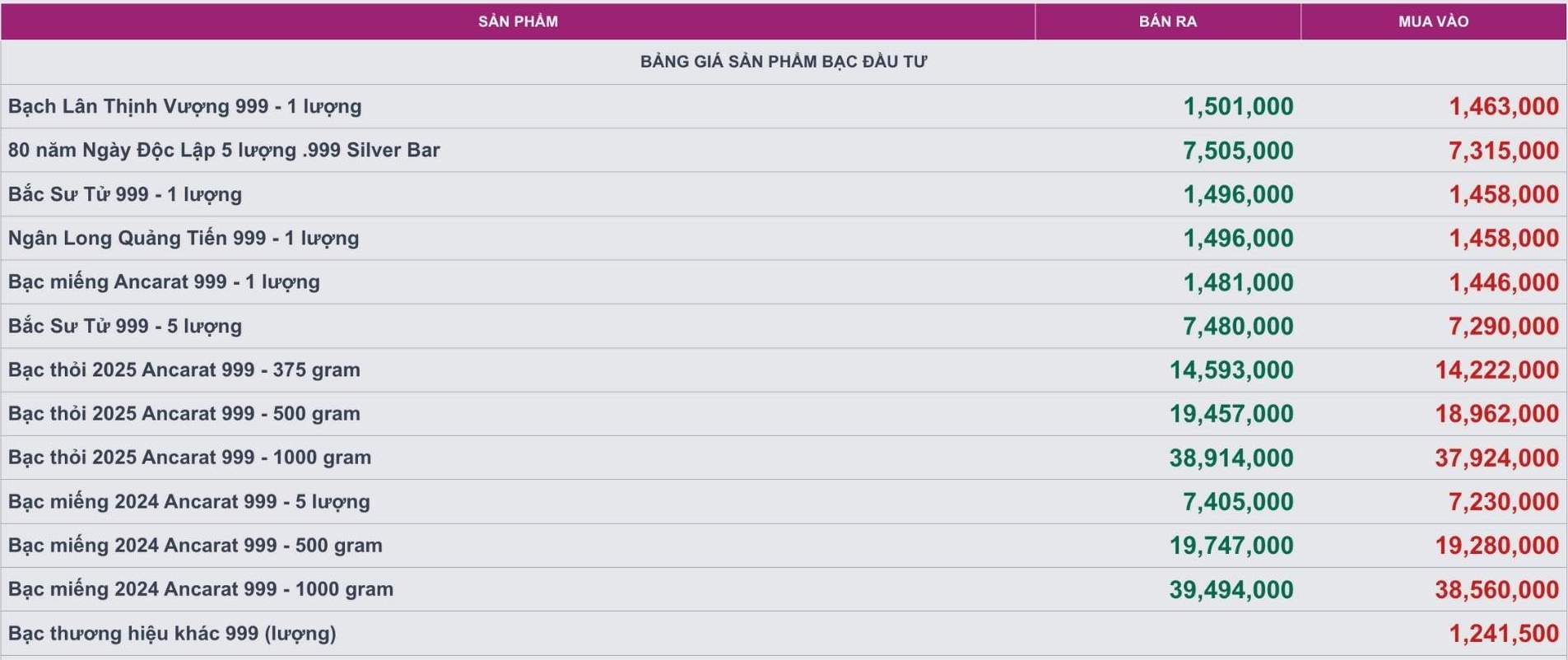

As of 9:35 a.m. on August 18, the price of 999 silver bars at Ancarat Metallurgy Company was listed at VND1.446 - 1.481 million/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 37.924 - 38.914 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 38,560 - 39.494 million VND/kg (buy - sell).

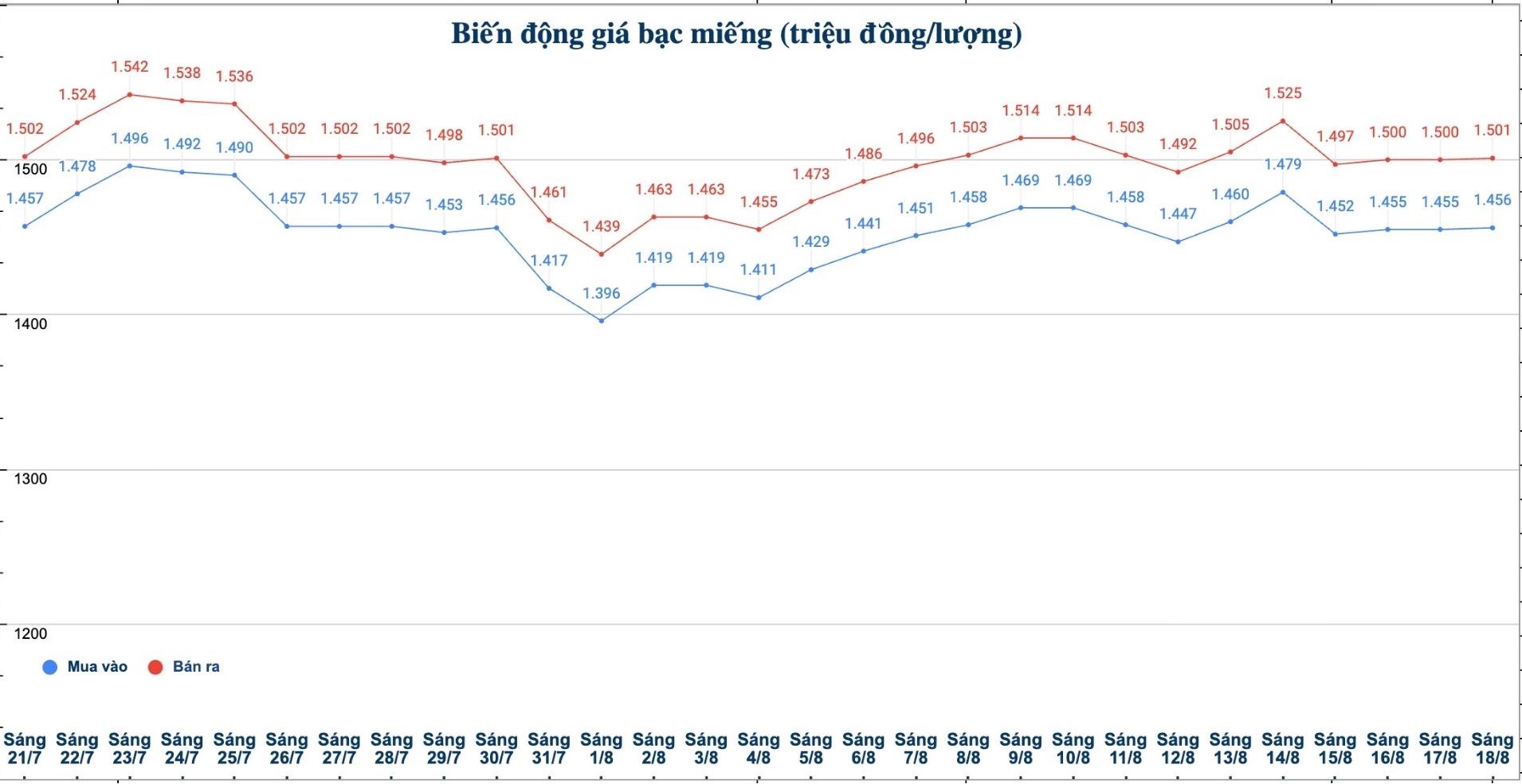

At the same time, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.456 - 1.501 million VND/tael (buy - sell); an increase of 1,000 VND/tael in both directions compared to yesterday morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.456 - 1.501 million VND/tael (buy - sell); increased by 1,000 VND/tael in both directions compared to yesterday morning.

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 38,826 - 40,026 million VND/kg (buy - sell); an increase of 27,000 VND/kg in both directions compared to yesterday morning.

World silver price

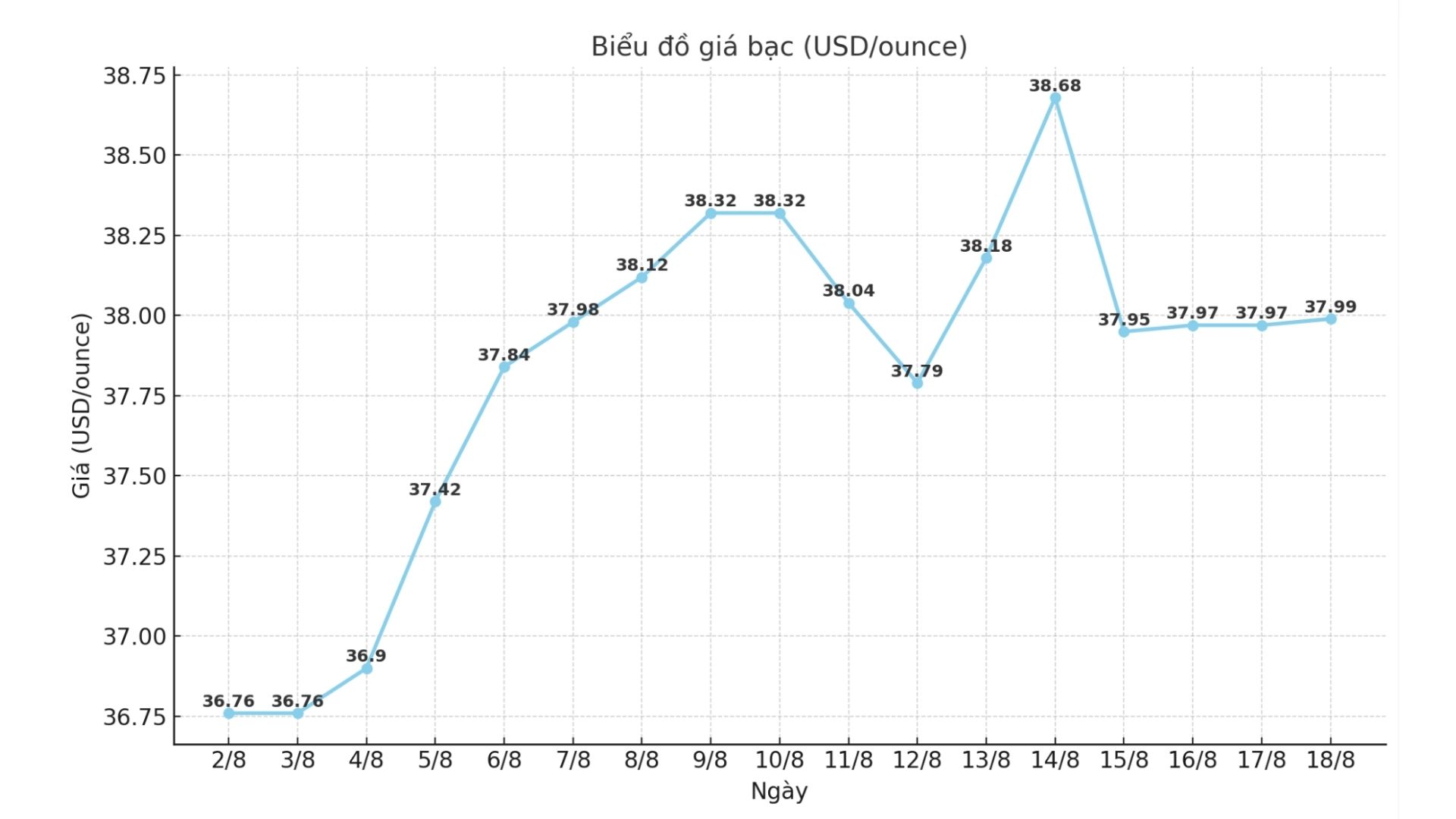

On the world market, as of 9:35 a.m. on August 18 (Vietnam time), the world silver price was listed at 37.99 USD/ounce; up 0.02 USD compared to yesterday morning.

Causes and predictions

Silver prices fell slightly last week after failing to hold up to 38.74 USD/ounce. This is considered a short-term ceiling, while the market is still fluctuating around the key threshold of 37.87 USD/ounce.

Analyst James Hyerczyk commented that this price point is like the deciding point: "If you keep it, silver can increase; but if you lose it, the price will plummet. Some took the opportunity to buy when silver retreated to nearly 37 USD/ounce, while others waited for the price to clearly exceed 38.74 USD/ounce before getting paid. No matter which way is chosen, there are potential risks".

The expert said that this week, all eyes are on the Jackson Hole Conference, especially the speech of FED Chairman Jerome Powell on Friday.

"After the PPI data unexpectedly increased sharply, the market began to doubt the possibility of the FED cutting interest rates in September. In addition, the FOMC meeting minutes, unemployment claims and preliminary PMI will also affect interest rate expectations," James Hyerczyk assessed.

In the short term, he said, silver could go sideways to support, but could not stand still for long.

"If Powell signals ease, silver has a chance to break out again at 39.53 USD/ounce. If the opposite is the case, the scenario of falling to 36.21 USD/ounce is very likely to happen" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...