Domestic silver prices

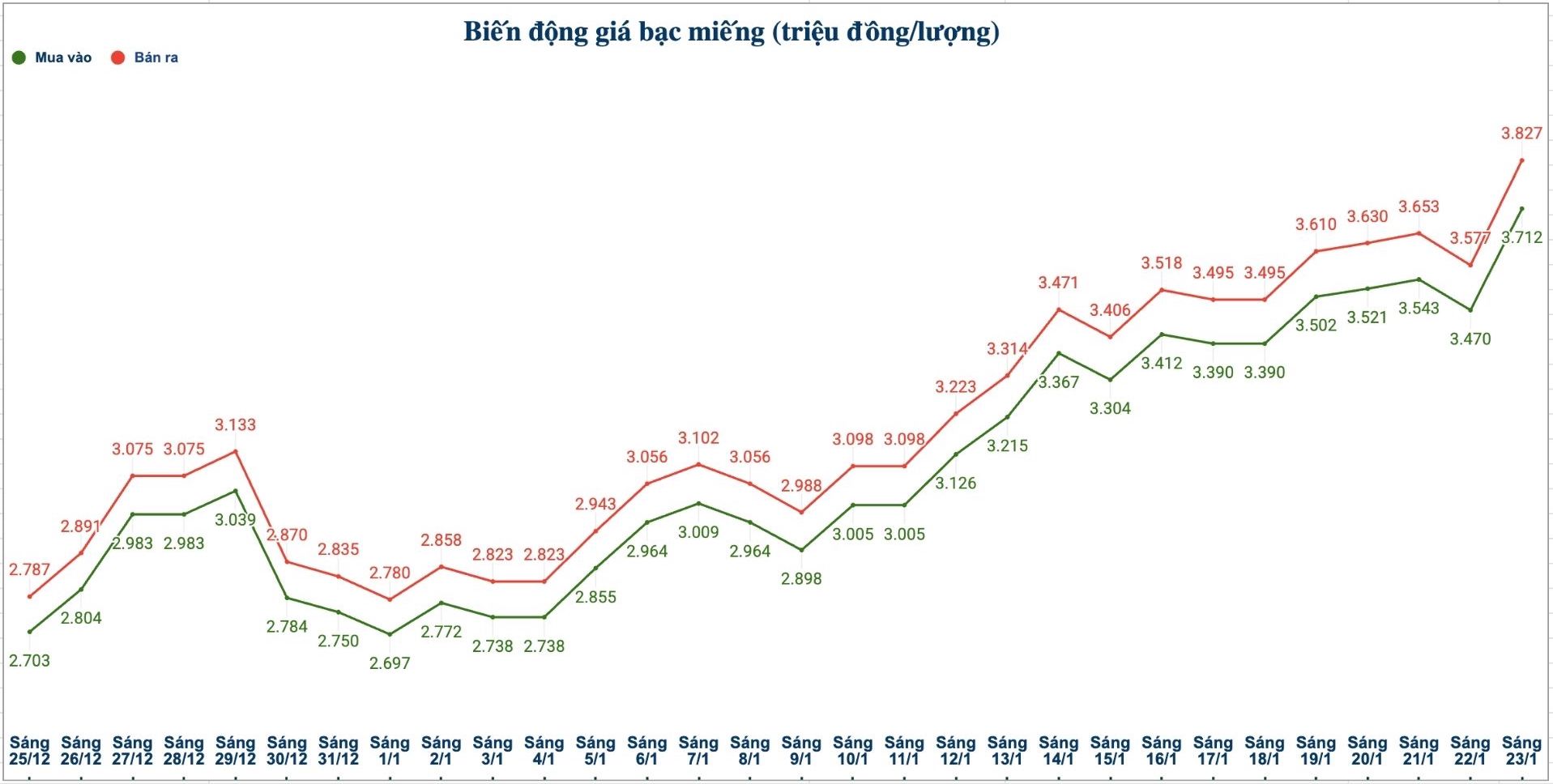

As of 10:00 AM on January 23, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Jewelry Company was listed at the threshold of 3.709 - 3.800 million VND/tael (buying - selling); an increase of 237,000 VND/tael on the buying side and an increase of 243,000 VND/tael on the selling side compared to yesterday morning.

The price of 2025 Ancarat 999 (1kg) at Ancarat Jewelry Company is listed at 97.864 - 100.834 million VND/kg (buying - selling); an increase of 6.29 million VND/kg on the buying side and an increase of 6.48 million VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Jewelry Company Limited (Sacombank-SBJ) is listed at the threshold of 3.735 - 3.831 million VND/tael (buying - selling); an increase of 204,000 VND/tael on the buying side and an increase of 210,000 VND/tael on the selling side compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 3,712 - 3,827 million VND/tael (buying - selling); an increase of 242,000 VND/tael on the buying side and an increase of 250,000 VND/tael on the selling side compared to yesterday morning.

It's a bit of a bit of a bit of a bit of a bit of a bit.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at the threshold of 98.986 - 102.053 million VND/kg (buying - selling); an increase of 6.453 million VND/kg on the buying side and an increase of 6.667 million VND/kg on the selling side compared to yesterday morning.

World silver prices

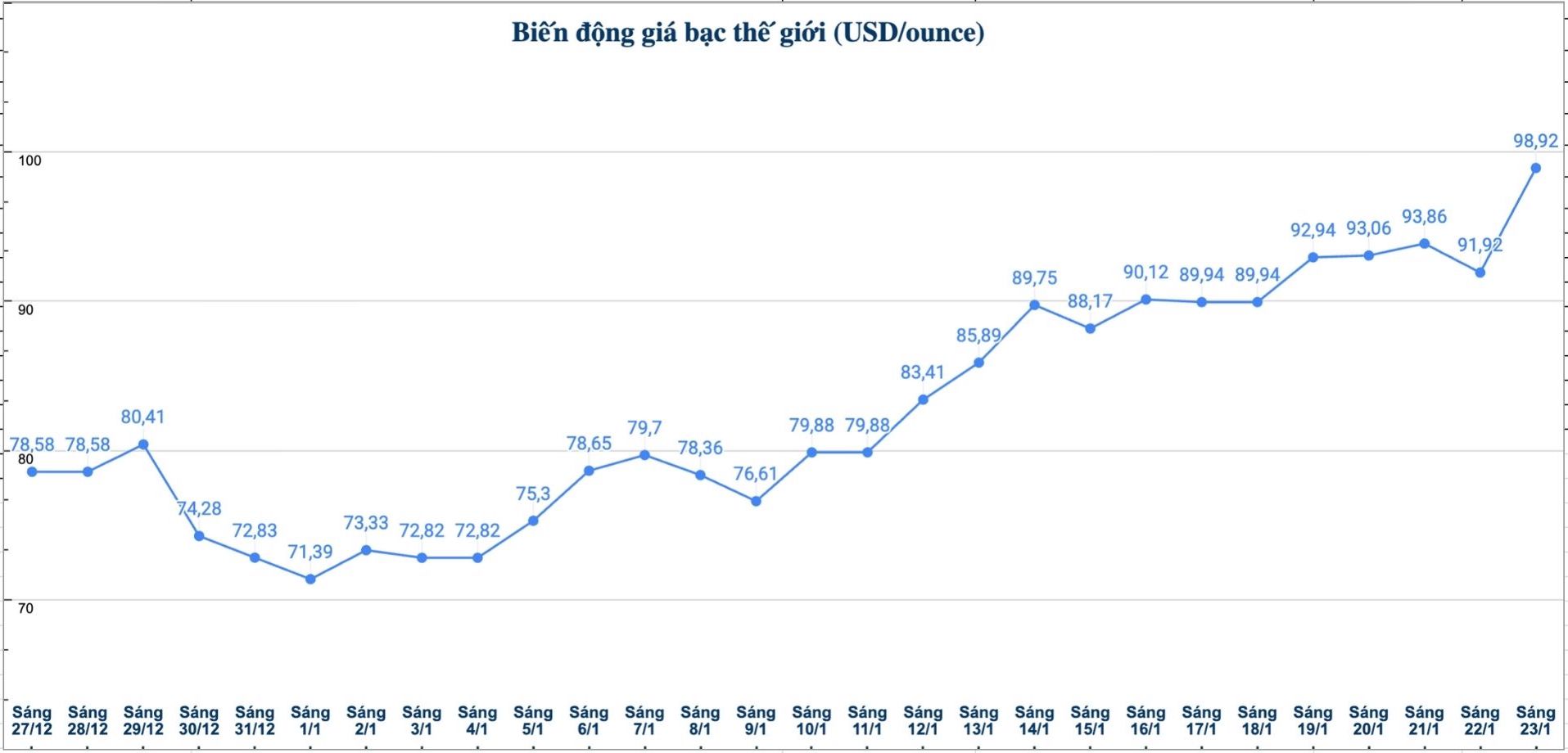

On the world market, as of 10:05 am on January 23 (Vietnam time), the world silver price was listed at 98.92 USD/ounce; up 7 USD compared to yesterday morning.

Causes and forecasts

Silver prices rose sharply after a notable drop in Thursday's trading session. According to precious metals analyst Christopher Lewis at FX Empire, in the early hours of Thursday, silver prices recorded a fluctuating development with alternating increases and decreases, in the context of strong support continuing to appear around the threshold of 90 USD/ounce.

This is a round price point, of important psychological significance to the market and is assessed to still play a key role in the coming time" - he said.

Christopher Lewis added that the current trend of the silver market is considered "one-sided", as there is not much basis to bet on a price reduction scenario.

Faux selling in this context is considered to be highly risky" - he assessed.

Christopher Lewis believes that the shortage of physical silver supply, combined with the general optimistic sentiment of the market, is creating the main driving force for prices. Although losing investors may appear if going against the trend, at the present time, the upward trend is still dominant.

Overall, the silver price outlook is still positively seen, but the strategy prioritized is to wait to buy in lower-adjusted price areas to optimize investment efficiency" - Christopher Lewis gave his opinion.

It's a bit of a bit of a bit of a bit of a bit of a bit.

See more news related to silver prices HERE...