Neils Christensen - analyst at Kitco News - said that the breakthrough increase of silver prices to the 100 USD/ounce mark reflects the superior strength of market momentum, in the context that investor sentiment is completely overwhelming traditional valuation factors.

Last week, we saw some initial signs that silver's upward momentum was slowing down and warned investors that prices may be approaching their peak. However, premature identification can sometimes cause damage to the portfolio no less than false predictions - that is a familiar lesson that the market always reminds investors" - Neils Christensen said.

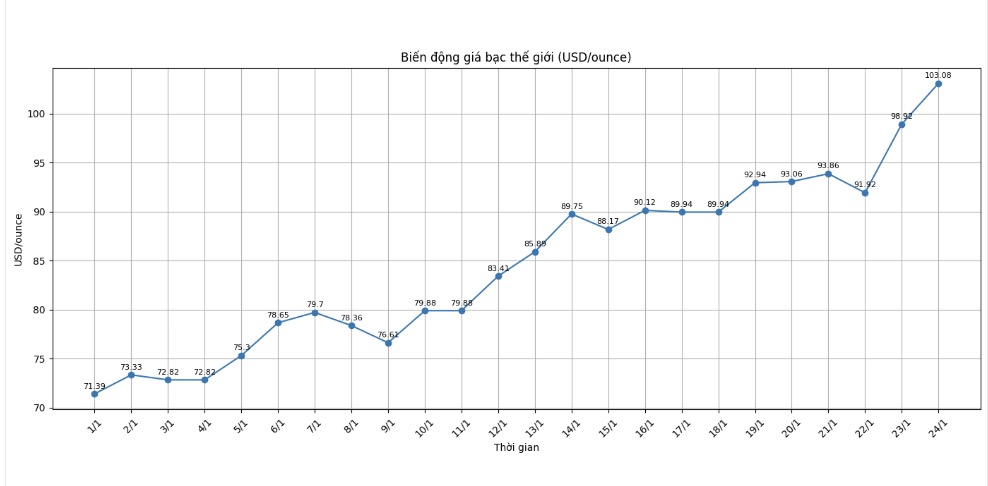

Entering the end of the week, silver has touched an important milestone when it surpassed the 100 USD/ounce mark. Gold has not yet reached the 5,000 USD/ounce mark, but the market is less than 20 USD away - and in the current context, that is entirely possible before a trader's morning coffee cup cools down.

Silver prices have increased by 44% in this month alone and more than 180% since the breakthrough began in the second half of last year. Last week, we warned that this increase is taking unreasonable form, and that may still be true. But as the familiar saying goes: "The market may be unreasonable longer than your ability to maintain liquidity". Unfortunately, the market has very good memory, but your margin does not.

It is noteworthy that some analysts believe that the upward momentum of gold and silver has a certain basis. The precious metal regained momentum early next week when President Donald Trump announced that he could impose taxes on European countries that do not support his efforts to annex Greenland. Then Mr. Trump withdrew the threat of using force to occupy Greenland - but psychological damage to the market occurred.

In the past week, we have witnessed a new momentum of "US asset sales" transactions, when some European companies are said to be looking for ways to sell off US Treasury bonds. This "money price hedging" trend is creating a solid fundamental support for gold and silver, even when prices are already high. In that context, analysts believe that gold could completely surpass $5,000/ounce, while silver could approach the $150/ounce mark.

However, it would be irresponsible not to mention the other side of the problem. Although silver may still have room to increase, many analysts note that too high prices will ultimately put pressure on industrial demand. As the familiar saying goes: "The way to fix high prices is higher prices" - this expert said.

Silver at the 100 USD/ounce mark is very exciting, and clearly the upward momentum is still very strong. But at these price levels, caution is necessary - investors should be patient and avoid chasing prices. In the current environment, silver can fluctuate 10% in just one day in an alarming way, and such fluctuations are not for those with weak hearts.

There will be times when both silver and gold will adjust. Based on recent price movements, any adjustment is likely to be shallow and short. But it is those times - not the excited headlines - that are the opportunities that investors should wait for.

Update on domestic silver prices

As of 9:00 am on January 24, domestic silver prices skyrocketed. The price of 1kg silver bars at Ancarat Jewelry Company is listed at 103.387 - 106.587 million VND/kg (buying - selling). The price of 1 tael bars is at 3.877 - 3.997 million VND/kg (buying - selling)

At the same time, the price of 1kg silver bars at Phu Quy Jewelry Group was listed at the threshold of 103.519-106.719 million VND/tael (buying - selling).