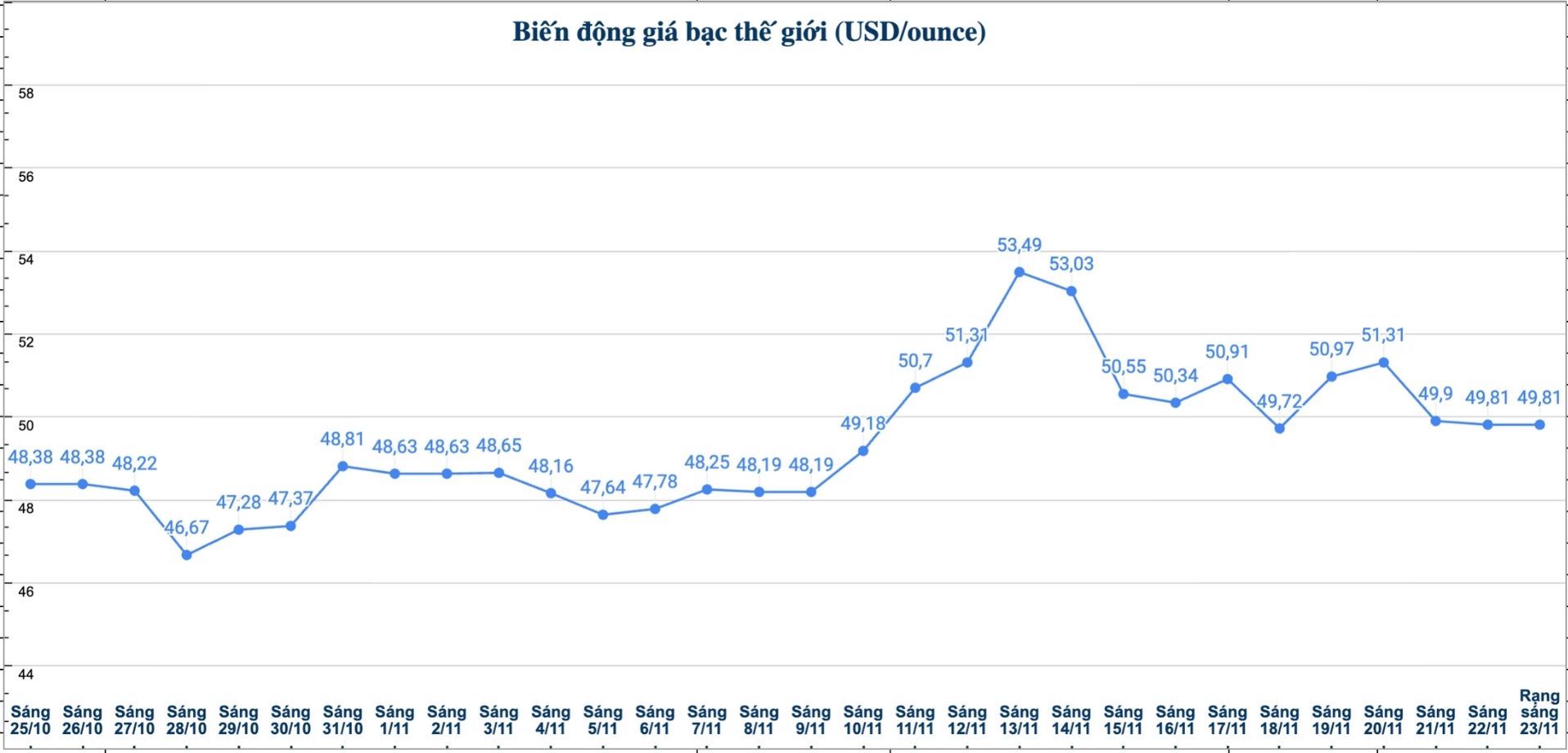

Silver prices ended the trading week below $50/ounce, recording a decrease as the US dollar (USD) strengthened, putting pressure on precious metals. This situation comes as investors are cautious, waiting for new signals from the US Federal Reserve (FED) on a roadmap for interest rate adjustment.

The market focus is currently the minutes of the Fed's latest policy meeting and important US employment data, both of which could impact gold and silver prices in the coming days.

Gary Wagner - commodity broker and market analyst at Kitco - commented: "This week, the precious metal has shown weak developments, as factors such as geopolitical tensions and expectations of monetary policy easing from the US Federal Reserve (FED) are not enough to promote sustainable growth".

Sharing the same view, Dr. Renisha Chainani - Head of Research at Augmont - commented that the precious metal is under pressure as hopes for a US interest rate cut weaken.

"The precious metal is witnessing a sell-off as investors await signals from the Fed through upcoming economic data," she said.

Chainani said the possibility of the Fed cutting interest rates in December has declined due to weak US economic data over the past six weeks and some Fed officials making tough statements. "The possibility of a 25 basis point cut in December by the Fed has fallen from nearly 60% to 43%," she said.

Although the price of precious metals is under pressure to decrease in the short term, Ms. Chainani said that the long-term support trend is still very strong, thanks to many fundamental factors. These include global geopolitical tensions and fluctuations, high US public debt, the trend of countries diversifying reserves away from the US dollar, along with continuous buying by central banks around the world.

"These factors create a stable support force, helping the precious metal maintain its value and attractiveness to investors in the long term" - Renisha Chainani said.

Updated silver price

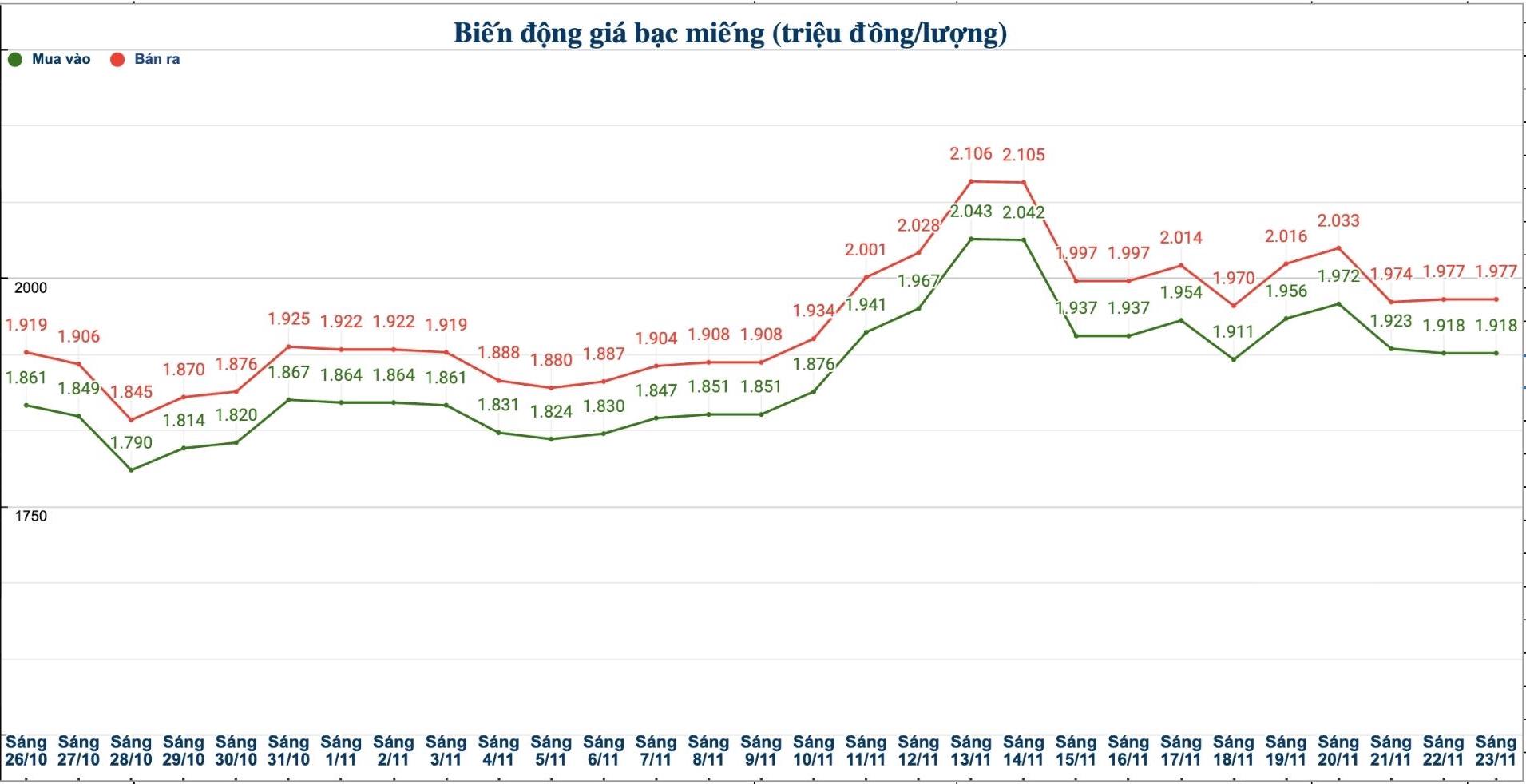

As of 6:00 a.m. on November 23, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.917 - 1.959 million VND/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 50.370 - 51.790 million VND/kg (buy - sell).

The price of 999 gold bars of the Golden Rooster Bank of Vietnam (Sacombank-SBJ) is listed at 1.908 - 1.959 million VND/tael (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.918 - 1.977 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 51,146 - 52,719 million VND/kg (buy - sell).

See more news related to silver prices HERE...