Domestic silver price

As of 11:10 a.m. on December 26, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Mineral and Environmental Company was listed at VND2.807 - VND2.876 million/tael (buy - sell); an increase of VND106,000/tael for buying and an increase of VND109,000/tael for selling compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 73.944 - 76.194 million VND/kg (buy - sell); an increase of 2.818 million VND/kg for buying and an increase of 2.908 million VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone One Member Co., Ltd. (Sacombank-SBJ) was listed at VND2.802 - VND2.874 million/tael (buy - sell); an increase of VND87,000/tael for buying and an increase of VND90,000/tael for selling compared to yesterday morning.

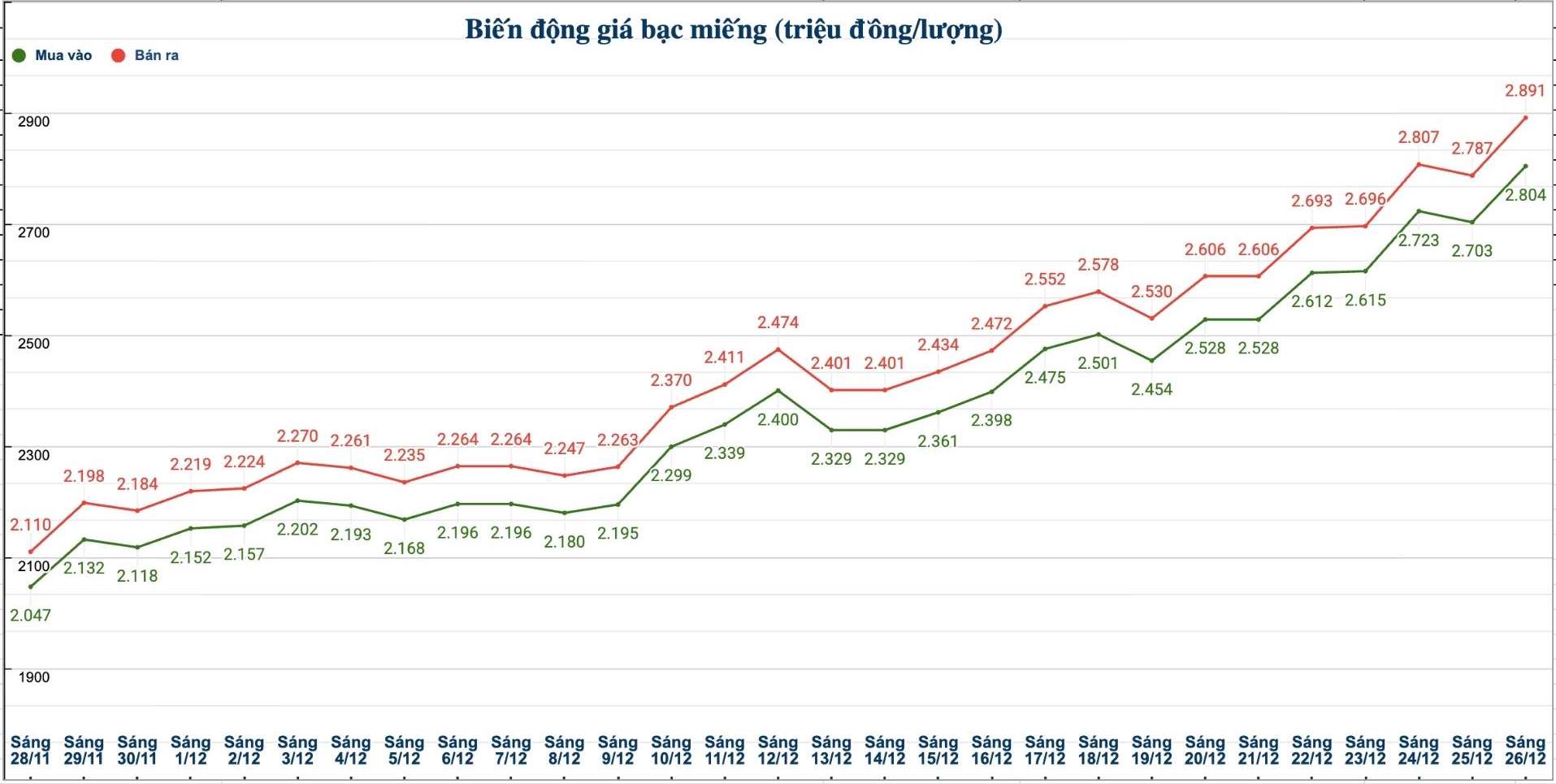

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 2.804 - 2.891 million VND/tael (buy - sell); an increase of 101,000 VND/tael for buying and an increase of 104,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 74.773 - 77.093 million VND/kg (buy - sell); an increase of 2.694 million VND/kg for buying and an increase of 2.774 million VND/kg for selling compared to yesterday morning.

World silver price

On the world market, as of 11:35 a.m. on December 26 (Vietnam time), the world silver price was listed at 74.69 USD/ounce; an increase of 2.88 USD compared to yesterday morning.

![]Dien bien gia bac the gioi nhung phien gan day. Bieu do: Phuong Anh](https://media-cdn-v2.laodong.vn/storage/newsportal/2025/12/25/1630923/Bac-1-14.jpg)

Causes and predictions

Silver prices continue to climb. According to international financial analyst Sagar Dua at FxStreet, the precious metal's rally was driven largely by expectations that the US Federal Reserve (Fed) will ease monetary policy in 2026, despite US economic data showing growth still quite positive.

According to the CME FedWatch tool, investors now rate a probability of up to 70.6% that the Fed will cut interest rates by at least 50 basis points in 2026.

"In theory, falling interest rates is often beneficial for non-yielding assets like silver, due to falling holding opportunity costs. This is a key factor that has helped silver prices maintain a strong upward trend in recent times," said Sagar Dua.

Notably, Sagar Dua said that the increase in silver will continue even as the US economy recorded growth exceeding expectations. Data released on Tuesday showed that US GDP in the third quarter increased by 4.3% compared to the same period last year, much higher than the forecast of 3.3% and also far exceeding the 3.8% of the second quarter.

Regarding the short-term outlook, Mr. Sagar Dua emphasized that if the increase temporarily slows down, the corrections could find support around the threshold of 63.07 USD/ounce.

"Siliver prices remaining firmly above this support zone will help the uptrend continue to be maintained, while the above-mentioned milestone breaking scenario could open up a deeper correction as the overbought state is gradually released," he said.

See more news related to silver prices HERE...