Domestic silver price

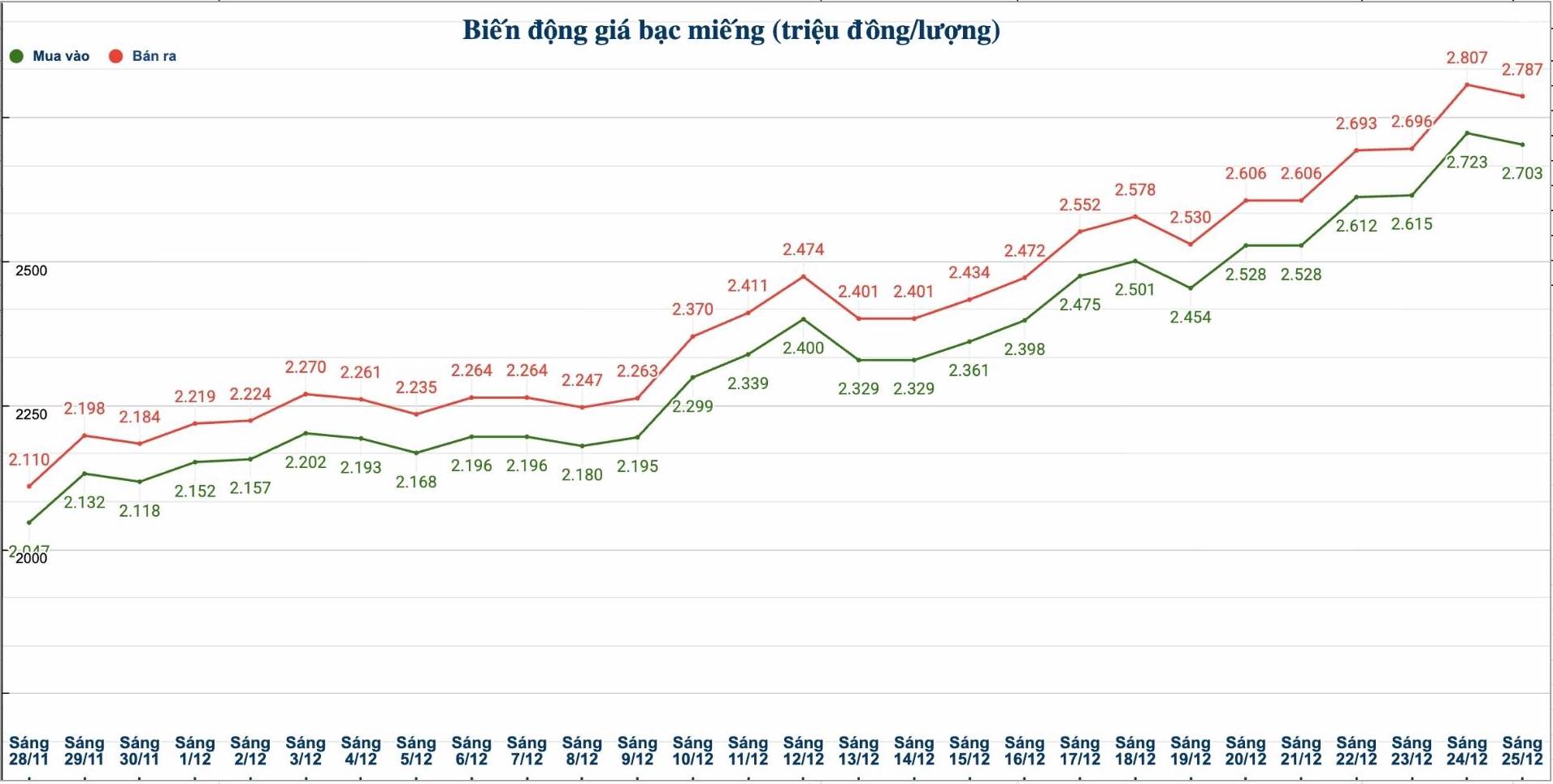

As of 11:35 a.m. on December 25, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND2.701 - 2.767 million/tael (buy - sell); down VND20,000/tael for buying and down VND21,000/tael for selling compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 71.126 - 73.286 million VND/kg (buy - sell); down 540,000 VND/kg for buying and down 560,000 VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of the Golden Rooster Bank of Saigon - SBJ (Sacombank-SBJ) is listed at 2.715 - 2.784 million VND/tael (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND2.703 - VND2.787 million/tael (buy - sell); down VND20,000/tael in both directions compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 72.079 - 74.319 million VND/kg (buy - sell); down 534,000 VND/kg in both directions compared to yesterday morning.

World silver price

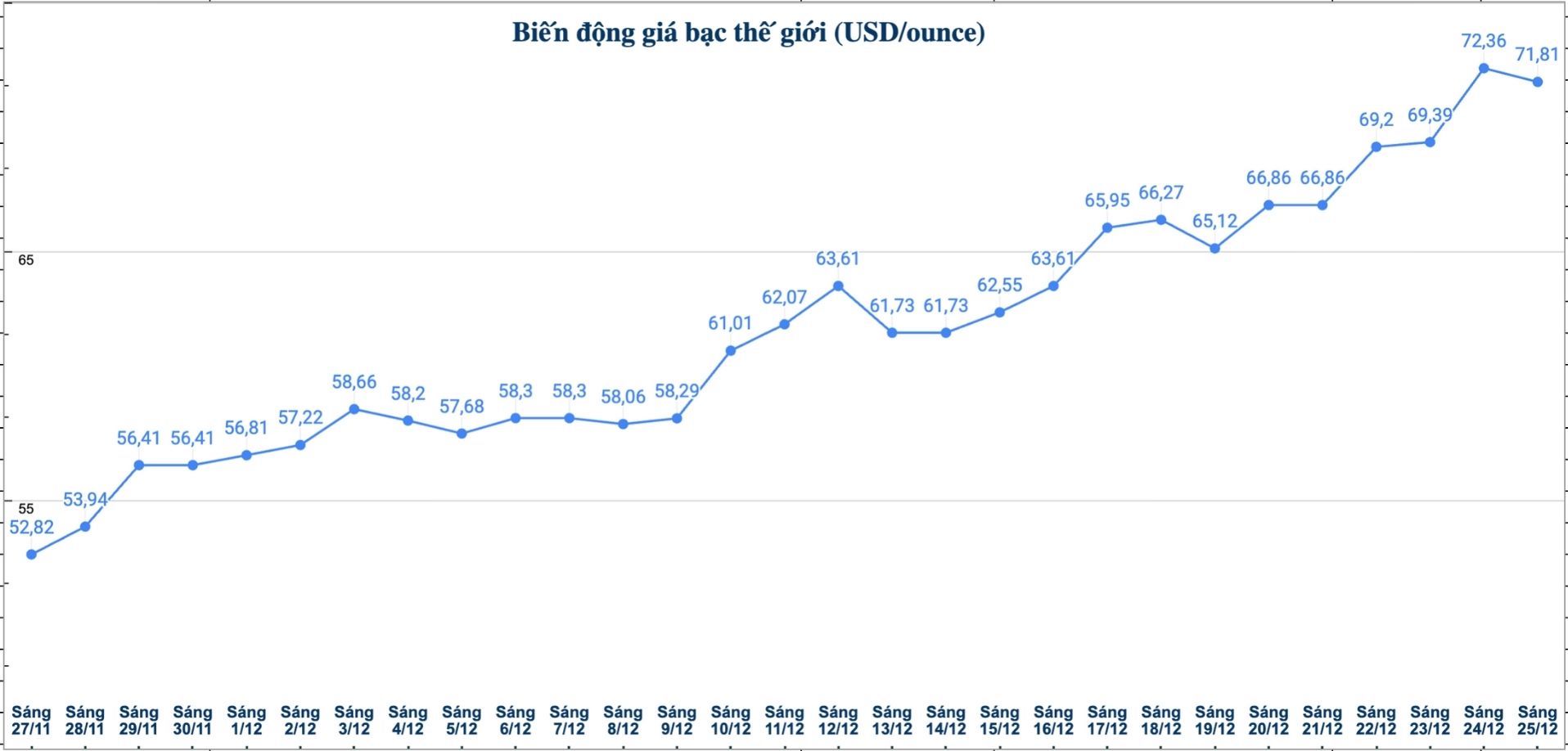

On the world market, as of 11:35 a.m. on December 25 (Vietnam time), the world silver price was listed at 71.81 USD/ounce; down 0.55 USD compared to yesterday morning.

Causes and predictions

According to precious metals analyst James Hyerczyk at FX Empire, the correction in prices after a series of strong increases is a normal development, reflecting investors' cautious sentiment after the almost vertical increase of the market.

"Although slightly reduced, buying power in the market is still clearly present. In the context of no significant technical resistance level, traders are closely monitoring signals from the price model, especially the possibility of reversal in low liquidity sessions" - James Hyerczyk said.

The expert said that compared to other metals, silver shows better durability. According to James Hyerczyk, since the beginning of the year, silver prices have increased by about 148%, far exceeding the increase of more than 70% of gold, reflecting the positive sentiment of investors towards this metal.

James Hyerczyk added that the prospect of a rate cut continues to be an important supporting factor for the precious metals group.

"The market is currently predicting that the US Federal Reserve (Fed) may cut interest rates twice next year, thereby encouraging investors to maintain their buying strategy when prices adjust. In addition, some geopolitical tensions have contributed to maintaining the appeal of the precious metals market," said James Hyerczyk.

See more news related to silver prices HERE...