Domestic silver price

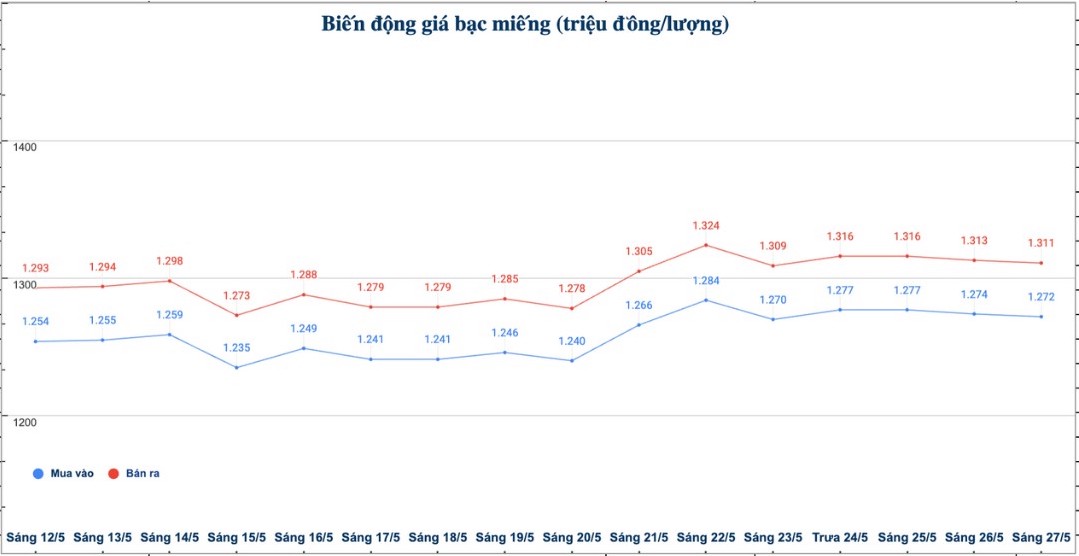

As of 9:17 a.m. on May 27, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.272 - 1.311 million/tael (buy - sell); down VND2,000/tael for both buying and selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.272 - 1.311 million VND/tael (buy - sell); down 2,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 (1kilo) taels at Phu Quy Jewelry Group was listed at 33.919 - 34.959 million VND/kg (buy - sell); down 54,000 VND/kg in both buying and selling directions compared to early this morning.

World silver price

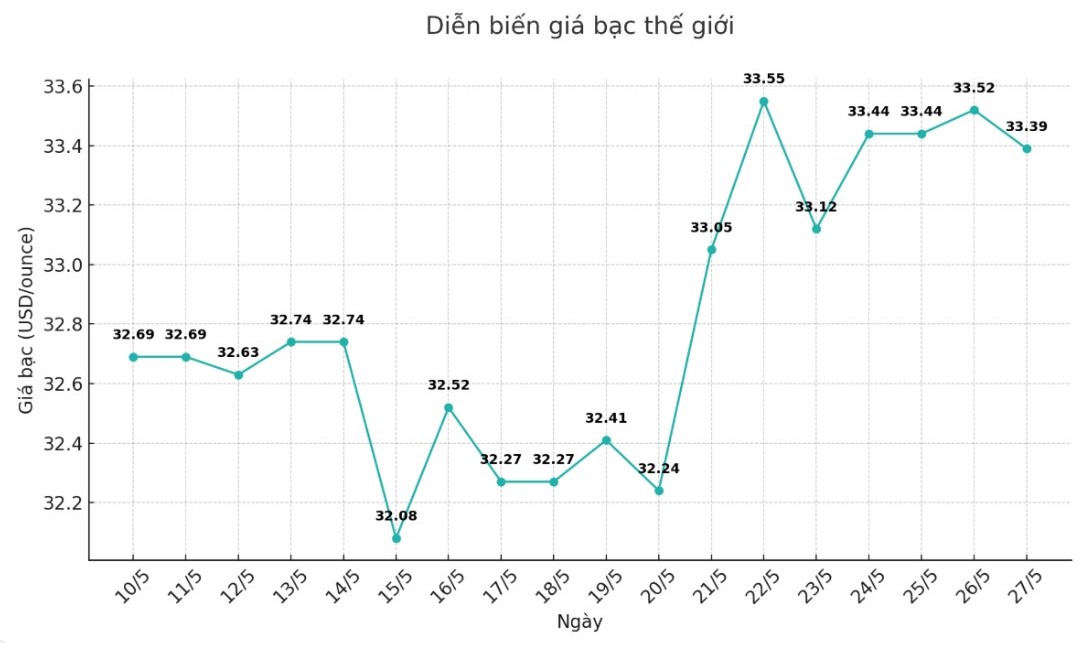

On the world market, as of 9:18 a.m. on May 27 (Vietnam time), the world silver price listed on Goldprice.org was at 33.39 USD/ounce; down 0.13 USD compared to early this morning.

Causes and predictions

According to FX Empire, one of the reasons for the sluggish silver market at the beginning of the week was due to changing expectations for trade policy.

US President Donald Trump has just announced a delay of the 50% tax on goods from the EU to July 9, after a phone call with President of the European Commission (EC) Ursula von der Leyen.

Previously, the US Presidents tough tax statements prompted investors to rush to gold and silver as a safe haven, said James Hyerczyk, a market analyst at FX Empire. However, the delay in the tax application deadline will immediately cool down investment pressure".

Although the market started the week quite quietly, James Hyerczyk still maintained an optimistic view on the long-term outlook for silver.

"Last week's rally was driven by concerns about the US financial situation, as the new tax and spending bill is expected to increase the federal budget deficit by $4,000 billion. Along with that, Moody's downgrading of US credit ratings has boosted demand for safe-haven assets," he said.

James Hyerczyk emphasized that in the context of concerns about inflation returning, silver is increasingly popular because of its dual role as both an industrial metal and a means of preserving value.

"Although gold often reacts more slowly during times of crisis, factors such as trade policy, USD risks and public debt issues are expanding the attractiveness of this precious metal," James Hyerczyk said.

See more news related to silver prices HERE...