Domestic silver price

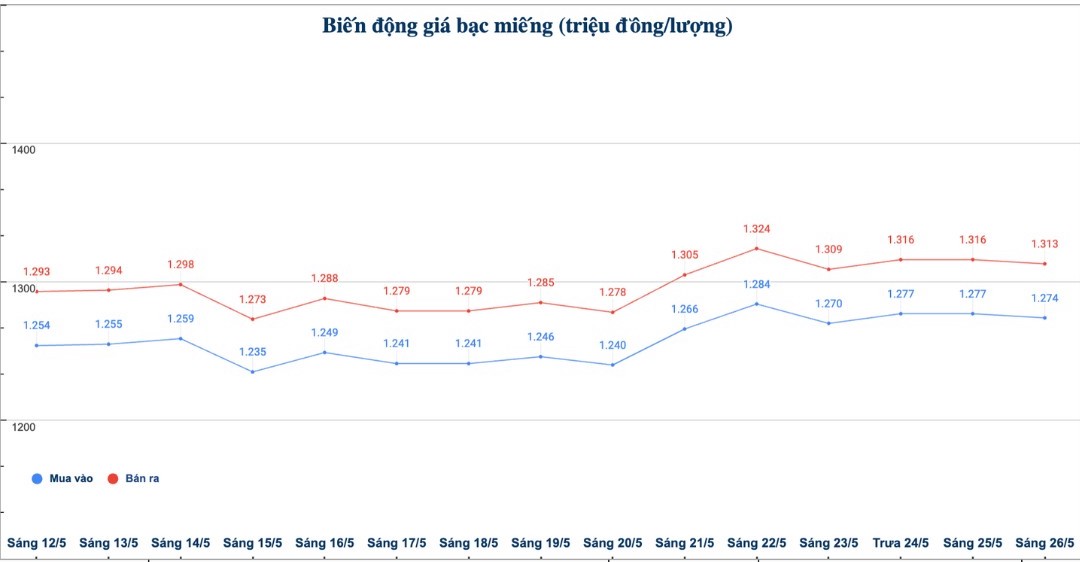

As of 9:17 a.m. on May 26, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.274 - 1.313 million/tael (buy - sell); down VND3,000/tael for both buying and selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.274 - 1.313 million VND/tael (buy - sell); down 3,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 (1kilo) taels at Phu Quy Jewelry Group was listed at 33.973 - 35.013 million VND/kg (buy - sell); down 80,000 VND/kg in both buying and selling directions compared to early this morning.

World silver price

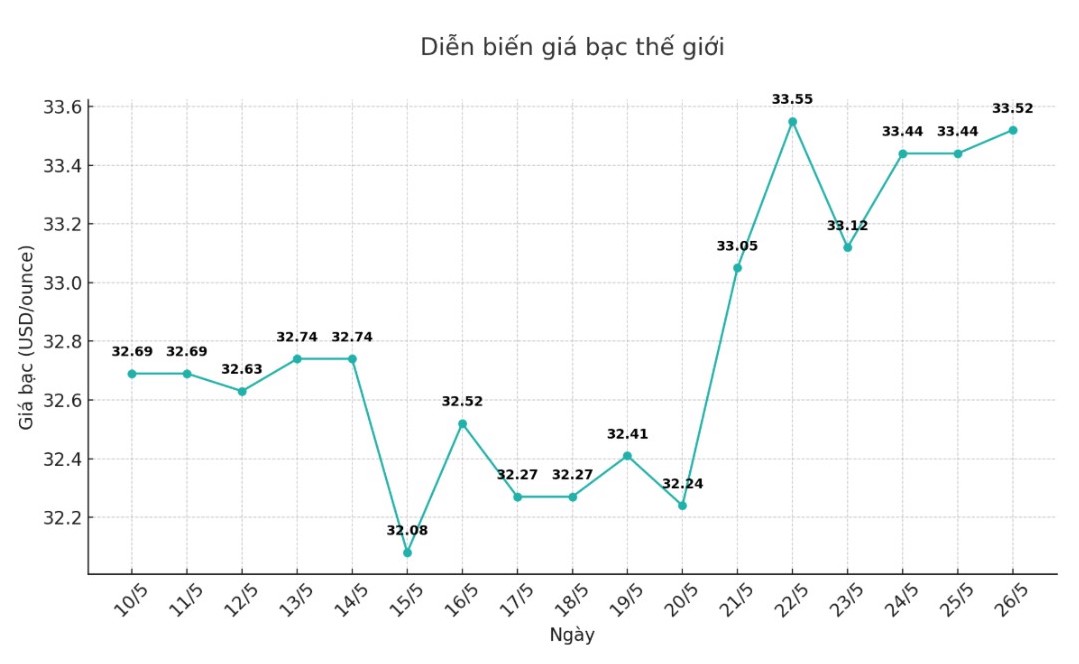

On the world market, as of 9:18 a.m. on May 26 (Vietnam time), the world silver price listed on Goldprice.org was at 33.52 USD/ounce; up 0.08 USD compared to early this morning.

Causes and predictions

According to FX Empire, silver is benefiting from macroeconomic disadvantages, a weakening USD and increased financial concerns from Washington (USA).

In addition, the psychology of favoring safe-haven assets such as precious metals continues to be consolidated - in the context of increasingly many doubts about the credit rating of the United States. This makes precious metals such as silver a safe alternative.

James Hyerczyk - market analyst at FX Empire - commented: "The sharp decline of the USD is the main factor driving up silver prices. skepticism about the US financial reputation is spreading, as USD selling positions skyrocketed to $17.3 billion and international investors began to gradually withdraw from US assets.

The decline in the US dollar despite rising bond yields shows growing concerns about the long-term appeal of US financial assets - which is boosting demand for precious metals."

The expert added that traders should continue to closely monitor macro factors, especially developments in the US bond market and statements from central banks, to grasp short-term trends.

Economic data to watch this week:

Tuesday: US durable goods orders, US consumer confidence, New Zealand Reserve monetary policy decision.

Wednesday: Minutes of the May monetary policy meeting of the US Federal Reserve (FED) - FOMC.

Thursday: US weekly jobless claims, US Q1 preliminary GDP, home sales pending processing.

Friday: US core PCE - the Fed's preferred inflation measure.

See more news related to silver prices HERE...